Press Release

White Label SEO Services celebrates its launch and ongoing impact since 2019

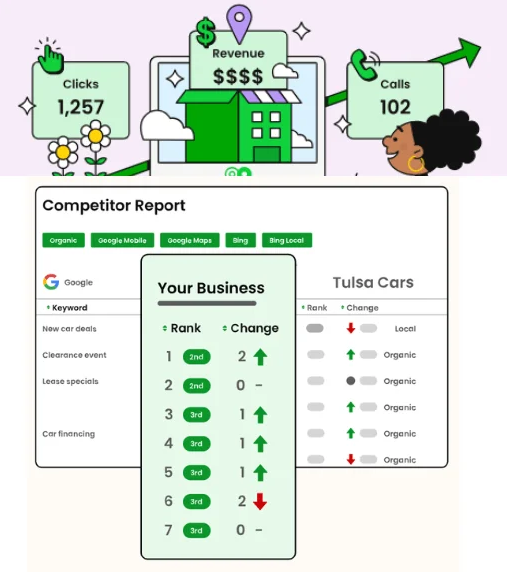

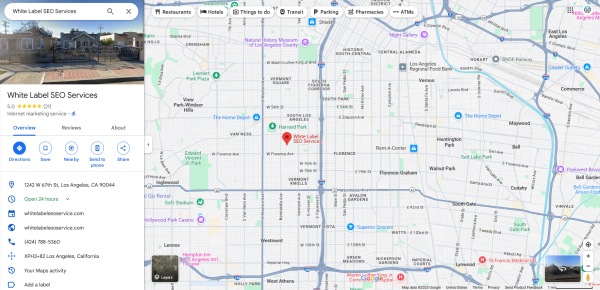

Since its official opening in 2019, White Label SEO Services, a digital powerhouse based in Los Angeles, has been helping businesses dominate search engine rankings and scale their digital presence through a full suite of high-performance SEO and marketing services.

Founded to empower agencies and business owners with scalable, behind-the-scenes marketing support, White Label SEO Services quickly became a go-to partner for brands seeking results-driven strategies without the overhead of in-house teams.

Over the past few years, the company has built a strong reputation offering specialized services including:

- SEO Services (Los Angeles-based and Nationwide)

- Local SEO Services

- Google My Business (GMB) Optimization

- Ecommerce SEO & Technical SEO

- Link Building Services

- Content Writing & Web Design Services

- Social Media Marketing & Facebook Ads Management

- PPC Services & Web Analytics

- Free SEO Audits and “Free Until You Rank” SEO Programs

- Local Citation Services & Press Release Distribution

White Label SEO Services

Address:

1242 W 67th St, Los Angeles, CA 90044, United States

Phone NO:

(424) 788-5360

Website:

https://whitelabelseoservice.com/

With a commitment to transparency, long-term results, and client-first service, White Label SEO Services has helped countless businesses grow their online visibility and revenue through ethical, white-hat strategies.

“We started with one goal: to make world-class SEO and digital marketing accessible to every brand,” said the company’s founder. “Now, we’re proud to have partnered with agencies and businesses across industries who trust us to deliver.”

As search algorithms and marketing trends continue to evolve, White Label SEO Services remains at the forefront—offering agile, data-driven strategies that adapt to a competitive digital landscape.

Media Contact

Organization: White Label SEO Services

Contact Person: Sales Department

Website: https://whitelabelseoservice.com/

Email:

support@whitelabelseoservice.com

Address:1242 W 67th St, Los Angeles, CA 90044, United States

City: Los Angeles

Country:United States

Release id:26244

Disclaimer: The information provided in this press release is for general informational purposes only and does not constitute professional advice or an endorsement of any specific service or strategy. White Label SEO Services does not guarantee specific outcomes or ranking positions, as search engine algorithms and digital marketing results can vary. Any references to third-party platforms or services are for descriptive purposes only and do not imply affiliation or endorsement. Always conduct independent research before making business decisions related to digital marketing or SEO.

View source version on King Newswire:

White Label SEO Services celebrates its launch and ongoing impact since 2019

It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

ZainTECH secures commercial license in Saudi Arabia, paving the way to set up regional head offices in the Kingdom

- Attaining ‘national entity’ status empowers ZainTECH to scale its advanced solutions across key sectors of digital IoT, cybersecurity, drones, AI, and cloud services

- Reinforces company’s commitment to Vision 2030 of driving innovation, strategic partnerships, and investment in local talent and digital infrastructure

Riyadh, KSA, 17th April 2025, ZainTECH, the integrated digital solutions provider of Zain Group, has achieved a significant milestone in its regional expansion strategy by securing a commercial license in Saudi Arabia that will pave the way for the entity to set up its regional offices in the Kingdom. This transition from an investment license to a full national entity status cements ZainTECH’s long-term commitment to the Kingdom, allowing it to scale its advanced technology solutions across key sectors such as digital IoT, cybersecurity, drones, AI, and cloud services.

The strategic move underscores ZainTECH’s deep commitment to Saudi Arabia’s digital transformation ambitions, fully aligning with Vision 2030. By strengthening its local presence, the company is poised to forge stronger collaborations, drive meaningful innovation, and provide tailor-made solutions that address the evolving needs of businesses and government entities in the Kingdom.

Andrew Hanna, CEO of ZainTECH, said: “Saudi Arabia is a vital market for us, and securing national entity status marks a defining moment in our growth journey. This step facilitates the opening of our regional offices and will allow us to operate with greater agility, contribute to the Kingdom’s digital economy, and reinforce our mission to deliver world-class technology solutions that empower businesses and government bodies to better serve the dynamic and digitally savvy local community.”

As part of ZainTECH’s expansion to the Saudi market, the company is actively exploring strategic partnerships with both public and private sector organizations to accelerate the adoption of next-generation solutions that enhance efficiency, security, innovation and business resilience. This expansion is also set to create new opportunities for local talent, strengthen the Kingdom’s digital infrastructure, and accelerate the adoption of emerging technologies across industries.

The commercial license comes on the back of ZainTECH’s recent participation at LEAP 25 whereby the company announced a multitude of agreements with local entities including: King Khalid University that aims to revolutionize digital education in the Kingdom; with both Najm Insurance Group and Diamond Policy and its SHAHIN Platform to drive digital transformation, cybersecurity and technological advancements in KSA’s insurance sector; as well as with Leejam Sports to drive the future of digital fitness in the Kingdom and beyond.

By deepening its footprint in Saudi Arabia, ZainTECH is doubling down on its investment in cutting-edge digital services, reinforcing its role as a key player in the region’s technological evolution. With a focus on AI-driven solutions, cloud advancements, and enterprise security, the company is well-positioned to support the Kingdom’s vision for a sustainable, technology-driven economy.

About ZainTECH

ZainTECH is a regional integrated digital solutions provider, unifying Zain Group’s ICT assets to offer a unique value proposition of comprehensive digital solutions and services under one roof. The company is positioned to drive the transformation of enterprise and government customers in the MENA region by providing a center of excellence and managed solutions across the ICT stack, including cloud, cybersecurity, modern infrastructure, big data, IoT, AI, smart cities, drones and robotics, and emerging technologies.

ZainTECH leverages Zain’s global reach, unique regional footprint, and infrastructure across its operations in Kuwait, Saudi Arabia, Bahrain, Jordan, Iraq, and the United Arab Emirates, as well as in other key markets in the Middle East.

ZainTECH forms a key pillar in the evolution of Zain’s core telecom business to maximize value and build on the company’s many strengths to selectively create and invest in growth verticals beyond standard mobile services. This ultimately supports Zain’s vision of becoming a leading ICT and digital lifestyle provider.

For more information, please visit www.zaintech.com For more information, please visit www.zaintech.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Six Years In: Matrixport’s Ascent from Crypto Asset Manager to Web3 Super Account

Perhaps it’s the monotony of this cycle’s memecoin PvP battles—loud but hollow, all flash and no substance—that has left the market numb with aesthetic fatigue. More and more, people are yearning for crypto’s golden era: when ICOs minted overnight millionaires; when Bitcoin forks sparked brutal hash wars; when the “HBO”(Huobi, Binance, OKEx) exchange titans fought for dominance; and when the wild-haired SBF dazzled with his Wall Street pedigree and high-frequency trading prowess.

Many of the early crypto pioneers—once the architects of chaos and champions of bull runs—have drifted into parallel timelines, their stories now reduced to dinner-table anecdotes. Li Xiaolai has rebranded himself as a self-help author, with a new book on mental focus and brainpower. Wang Chun made headlines for spending $200 million on a commercial space ticket. Justin Sun and Li Lin toasted away tears of rivalry at a Hong Kong banquet. As for CZ, he made a light-hearted jab at Justin’s love life during the event. In smoky Hong Kong dining rooms, the old guards still gather—glasses clinking, laughter echoing, legends fading gently into the memories.

“Where is Jihan Wu?”Someone eventually asked.

The man who introduced the Bitcoin white paper to the Chinese-speaking world. An evangelist who helped ignite a movement, the builder behind the Bitman empire—had seemingly slipped out of the spotlight, becoming increasingly reserved and enigmatic. Most people knew that after the much-publicized split at Bitman, Wu had taken the overseas mining operations and founded Bitdeer.

What most missed was that he also brought along John Ge—Bitman’s Executive Director and Head of the Investment, then still in his twenties. Together, they quietly laid the groundwork for what would become Matrixport, a crypto asset management firm born not amid market frenzy, but from the aftershocks of a tectonic split.

Pictured: John Ge (left) and Jihan Wu (right)

The Prehistory of Matrixport

“My very first internship—Han (Jihan Wu) was an investment manager then, and also my mentor. He was the one who introduced me to Bitcoin and mining.” John Ge absentmindedly traced the texture of a throw pillow as he spoke to BlockBeats as if reaching back to 2013.

Rewind twelve years. It was a hot summer in Hangzhou. A 21-year-old Business graduate could hardly have imagined that an internship at a venture capital firm would alter the course of his life—just because he crossed paths with a Bitcoin evangelist.

Wu was already a prominent blockchain advocate. Together with Chang Jia and others, he co-founded 8btc—one of the earliest Chinese-language platforms dedicated to blockchain innovation. Ge, naturally drawn to computers and hardware since childhood, found himself captivated. One was an evangelist, the other an eager learner. What began as technical banter soon evolved into late-night conversations about Bitcoin, mining economics, and the transformative power of blockchain.

“So we did the math—and decided to start mining.” They pooled their funds to buy mining machines and built their first farms. But when ambition grew, they wanted to go deeper—designing their own chips. That’s when they brought in a technical co-founder, Micree Zhan. That decision marked the birth of Bitmain. Ge would go on to serve as Director and Head of Investments at Bitmain, witnessing firsthand a computing revolution driven by hash power.

Much of what followed is now an industry legend. After several years of quiet ascent, Bitmain rose to become a titan of the crypto industry. Its operations spanned the entire mining ecosystem—from hardware manufacturing and mining pools to large-scale farms and exchange services—and it drew the attention of major investors, including Sequoia Capital China. By early 2018, Bitmain was the largest crypto-mining hardware company in the world. At its peak, 70% of global Bitcoin mining machines were Bitmain-made, and over 50% of all newly minted BTC came from its farms.

These milestones were once badges of honour. But the shine faded as IPO setbacks, asset devaluation, and internal turbulence began to surface—etched scars that the company still carries. The crypto winter of late 2018 was especially brutal. As Bitcoin plunged below $4,000, the industry giant faced its darkest chapter: a failed IPO attempt in Hong Kong, a draining hash war over BCH, and a deepening ideological divide among its founding leaders.

After a series of long, searching conversations, Jihan Wu and John Ge made the decision to leave the old order—carrying with them the spark of something new. In February 2019, they launched Matrixport in Singapore as a digital asset management platform. Wu took the helm as Chairman, while Ge stepped into the role of CEO—tasked with building the next generation of crypto financial infrastructure.

After Bitmain: Jihan Wu and John Ge’s Second Venture

At the time, the crypto landscape revolved around just two main arenas: the roaring world of mining hardware and the high-stakes battleground of exchanges. Asset management, in any meaningful form, was virtually nonexistent—still viewed by most as a term reserved for traditional finance. Reflecting on those early days, John Ge noted, “We were among the first to explore asset management in this industry. Before us, the concept barely existed in crypto—it was a niche within a niche.”

In this sense, building Matrixport was like planting trees in a desert. There were no benchmarks to learn from. No maps to follow. “Industry awareness” is a vague term—until you find yourself carving out a new track. That’s when you realize how much it matters.

Pictured: John Ge (left) and Jihan Wu (right). Source: Matrixport

In John Ge’s strategic framework, wealth creation in the crypto world takes two distinct forms. The first is market beta returns—broad-based value appreciation. “For example,” he explains, “when Bitcoin rises from $40,000 to $120,000, everyone feels wealthier. Paper gains surge across the board, but there’s no real transfer of value.” The second is alpha returns—differential performance. “Here, one wins, and another loses. Wealth gets redistributed, and money actually moves. Essentially, it’s about taking profits from counterparties in the market.”

This understanding laid the foundation for Matrixport’s early business architecture—structured along two axes. On the beta side, the firm generates revenue through spot trading and custody services. On the alpha side, it captures the upside through revenue sharing from quantitative strategies and structured products.

More specifically, Matrixport launched its institutional-grade custodian, Cactus Custody, to support its beta business. Meanwhile, its alpha offerings evolved into a diverse suite of investment products—and later became a core focus of the platform’s strategic development.

The First Bull Run: Matrixport Built a Unicorn

Matrixport was born in a bear market. As crypto OGs who had weathered multiple cycles, John Ge and Jihan Wu had seen too many people go from being wealthy on paper to being broke overnight. They understood this deeply: in crypto, ten bets lose nine—or even all ten. What users needed wasn’t just another high-leverage casino. They needed a safety net—a way to protect assets from going to zero. That, to them, defined the very purpose of crypto wealth management.

“That’s why Matrixport commits to delivering alpha—sustainably and with risk controls built in,” Ge told BlockBeats.

Convincing users to move funds from self-custody to a centralized platform meant overcoming the first—and most crucial barrier: trust. Fortunately, their legacy from the Bitmain era offered more than credentials—it offered trust. Many of the earliest users were longtime friends—miners who had once spent sleepless nights tuning machines with them on the outskirts of Beijing.

No one understands what miners need better than miners themselves. As two of the earliest miners in China’s crypto scene, Ge and Wu knew exactly what that meant.

At the time, most miners lacked access to effective hedging tools.They wanted to hold onto their Bitcoin—but they also had to regularly sell coins to cover high electricity costs, all while worrying about how price swings would impact mining profits. To address this, Matrixport became the first to introduce the Dual Currency Investment (DCI) model—adapted from traditional finance—into crypto.

DCI, at its core, combines money market deposits with currency options to deliver above-market returns. In traditional FX markets, dual-currency products—say, involving the RMB and HKD—can offer 10% annualized yields while automatically managing exchange rate risks. In its crypto implementation, Matrixport’s product integrated fiat and digital currencies into structured fixed-income contracts.

For example, a miner needing to sell 100 BTC each month to cover $3 million in electricity costs could instead use a DCI product that sets a conversion price 5% below market. If Bitcoin goes up, it earns 8% APY. If it drops, the BTC is converted into USDT at the predetermined price to pay bills. The product’s payout structure—rate, maturity, settlement asset—is all fixed at the time of subscription. This format was later replicated by exchanges such as Binance and eventually became an industry standard.

Bull markets fuel the fastest growth. In the 2021 run-up, Matrixport hit a critical inflexion point—building a full-stack product matrix covering custody, trading, lending, and investment. Structured products evolved into a core offering. The team scaled from a few dozen to several hundred members, and its client base diversified, from early mining participants to family offices and hedge funds.

This infrastructure-plus-strategy ecosystem enabled Matrixport to secure Series C funding in August 2021—backed by DST Global, C Ventures, and K3 Ventures—at a $1 billion valuation, officially joining Singapore’s unicorn ranks.

Navigating the Crash: Matrixport’s Survival Philosophy

Every boom has its bust. The other side of crypto’s riches effect has always been the industry’s susceptibility to spectacular crashes and bankruptcies. Even FTX—the so-called golden child—collapsed overnight due to mismanaged risk, wiping out hundreds of billions in market value in a single day. Titans like Three Arrows Capital, BlockFi, and Celsius once symbolized crypto’s exuberance. Their downfall became cautionary tales of unchecked greed.

Since its inception, Matrixport has weathered two full market cycles. Looking back, John Ge identifies one thing that made all the difference: a deeply conservative operating philosophy.

“Our goal has always been to build a conservative asset management firm,” he said, “—not one that chases profits, but one that ensures every line of business has a margin of safety. That’s likely why Matrixport is still standing today.” It was a calm, steady tone—one shaped by a CEO who has lived through Bitcoin halving in price more than a dozen times.

Unlike firms that blew up while chasing one-sided directional bets, John barely remembers what he was doing on those meltdown days—and that’s the point. That’s the point: for Matrixport, shocks are inevitable, but the impact remains within controlled bounds. “Liquidity crunch? That doesn’t happen to us,” he explains. “We don’t use leverage. We’re not subject to margin calls. Even when the market crashes, the money is still there.”

Internally, Matrixport established a dedicated Risk Management Committee, supported by robust modelling and high-standard protocols. In times of panic or strategy shifts, when redemption requests surge, Matrixport doesn’t scramble—it activates prebuilt responses. The platform can accommodate both scenarios: clients who want to catch the bottom, and those who need to add collateral.

“That’s what typically happens in extreme markets,” John notes. “Clients redeem because they lack liquidity. Sometimes it’s to buy the dip. Sometimes, it’s to top up margin. We offer solutions for both. Not through slogans—but through system design.”

In crypto, everyone talks about safety and risk controls. But too often, that talk proves hollow. John sees it differently: security and risk are not selling points—they’re structural. Only on that foundation can you compete on product, on service, on anything else. When asked about Matrixport’s client acquisition strategy during downturns, John’s answer was unexpectedly simple: “We don’t do anything special to attract clients in a bear market.”

In John’s view, Matrixport’s asset scale doesn’t change dramatically—whether in bull or bear markets. That’s because price volatility mostly impacts the USD-denominated value of crypto holdings, not the underlying asset volumes. As a result, Matrixport rarely makes aggressive operational adjustments during market cycles, focusing instead on steady product iteration.

At its core, asset management is simple: help clients make money, then take a share of what they earn. Traditional firms often charge fixed management fees, even when clients are losing money. But in crypto—where volatility is the norm—this model doesn’t translate. Asset managers can’t just lift-and-shift legacy fee structures into this environment. Naturally, this places a ceiling on profits. In bear markets, few strategies deliver strong returns. Even in bull runs, upside is limited by how much clients actually realize. By nature, crypto asset management is a partnership model—incentive-aligned, outcome-dependent, and built on shared risk..

“Real demand for asset management has nothing to do with bull or bear cycles,” Ge adds. “Warren Buffett didn’t make money every year, but that didn’t stop him from becoming the richest man alive.”

Matrixport, in that spirit, pays closer attention to rate markets than price charts. When rates heat up, asset management businesses grow faster and earn more.

Much like other platforms, Matrixport senses that this bull cycle—running from last year through today—lacks the froth and intensity of the last.

“There was a short spike in November through early December last year, where rates hit their peak,” John recalls. “But they fell just as quickly. Compared to the last bull cycle, this one has been shorter and less aggressive overall.” The lending rates that long-position traders are willing to pay, he notes, are a direct reflection of market speculation and sentiment.

Two Cycles In: Matrixport’s Steady Ascent

After weathering two major crypto cycles, Matrixport has entered a new phase of measured growth and strategic maturity. Within its client landscape, crypto investors typically fall into two distinct camps. The first is risk-takers—hands-on traders who farm in DeFi protocols and chase the latest meme coins. They approach crypto like it’s a thrill ride or a high-stakes casino. The second is allocators—investors who treat crypto as just one component of a diversified portfolio, much like holding a gold ETF. For them, investing is about discipline, not adrenaline.

“Most of our clients belong to the second group,” John explains. “They’re comfortable with risk-adjusted returns and willing to entrust their capital to us.” What began with miners has now shifted to high-net-worth individuals and institutions. These clients aren’t focused on tomorrow’s Bitcoin price—they care more about annualized returns over time.

On the global strategy front, Matrixport follows a basic principle: “Go where the money is.” “Financial institutions are highly local,” John says. “A U.S.-based client will always prefer to keep their money in a nearby, familiar bank.” From its Singapore headquarters, Matrixport has expanded across Hong Kong, Bangkok, and Europe. Its compliance infrastructure now spans three continents, with licenses secured in key jurisdictions.

Asia: Hong Kong Trust Company license, Money Lender license; Singapore: Major Payment Institution license under MAS (secured in 2025 by subsidiary Fly Wing);

Europe: FCA registration in the UK, FINMA SRO-VFQ membership in Switzerland; in 2024, acquired Swiss CFAM license and upgraded it to Matrixport Asset Management AG (MAM);

Americas: MSB license in the United States.

When asked why Matrixport hasn’t expanded into the Middle East, John Ge gave a measured and pragmatic response: “The Middle East is a unique region. In practice, most of its wealth continues to be managed through Switzerland.”

For Matrixport, Asia remains a cornerstone—both as a vast addressable market and as a strategic base for global operations. Switzerland, via its regulatory framework, not only provides comprehensive access to Europe but also acts as a gateway to the Middle East, leveraging its long-established role as a global wealth custodian. As for the United States—where regulatory costs are steep and competition is fierce—Matrixport has taken a disciplined, step-by-step approach to market entry. This calibrated approach reflects Matrixport’s long-term commitment to sustainable, compliant growth across regions.

On the product side, Matrixport continues to build a comprehensive portfolio tailored to varying user-profiles and risk appetites. The platform has steadily launched a full suite of offerings designed to serve different users from individual investors to institutional allocators.

Comprehensive Asset Management Solutions:Matrixport offers a full suite of investment products designed to meet diverse client needs. For users seeking stability, the platform provides flexible savings plans, fixed-income products, and conservative wealth strategies. For those pursuing differentiated yield strategies, Matrixport offers structured products such as Dual Currency Product , SharkFin, Smart Trend, Seagull, Snowball, Buy Now Pay Later(BNPL), and Double No Touch(DNT). For users aiming to capture on-chain rewards, Matrixport supports ETH staking, restaking, and other blockchain-based yield solutions. For clients seeking diversified alpha through both private and public traffic channels, Matrixport delivers a range of strategy-backed investment products tailored to varying liquidity requirements and market access levels.

End-to-End Institutional Services: Matrixport also offers institutional-grade infrastructure, including OTC trading, custody via Cactus Custody, and prime brokerage services tailored for sophisticated players.

Tokenization of Real-World Assets (RWA): Through its dedicated RWA platform Matrixdock, it has introduced STBT (Short-Term Treasury Tokens) and XAUm (Gold Tokens), enabling investors to hold high-quality traditional financial assets—such as U.S. Treasuries and gold—directly on-chain. While other platforms, including FTX, have previously experimented with similar products, most competitors have largely overlooked this niche segment. In contrast, Matrixport has demonstrated clear foresight and strategic commitment in the RWA domain. This forward-looking approach positions Matrixport as a key innovator at the intersection of traditional finance and decentralized infrastructure.

Robust Trading Experience: Matrixport has enhanced its trading platform with smooth spot trading systems and deep, liquid derivatives markets that rival top-tier exchanges.

Professional Research Reports: Leveraging in-house analysts and industry expertise, Matrixport publishes high-quality research reports that decode market trends, price action, and emerging narratives. These insights have earned recognition across major crypto communities, often setting the tone for market discussions. Through the Matrixport App, users can access a fully integrated crypto finance experience—trading, investing, loans, custody, RWA, and research to manage their digital wealth with ease and confidence.

Though Matrixport began as a crypto asset management firm, it now aspires to become a Web3-era super app—a single entry point for digital asset services. By continuously expanding its product verticals, Matrixport lowers the barrier to Web3 participation while delivering comprehensive, secure, and intuitive crypto financial services. In doing so, Matrixport transforms complexity into clarity—creating layered value for a new generation of Web3 users.

According to recent disclosures by John Ge, Matrixport now manages and safeguards over $6 billion in assets, with a core balance sheet footprint of approximately $4 billion. These figures reflect strong market adoption and the discipline, trust, and long-term underpinning of Matrixport’s operating philosophy.

From Here, the Next Six Years Begin.

Six years have flown by. From long, cold nights at the mining farms—dreaming what Bitcoin might become—to today’s stage of global regulatory licensing and expanding financial infrastructure, Matrixport’s journey has quietly mirrored the evolution of the crypto industry.

“We hope to become fully compliant and one day stand as a listed company,” says John Ge. As Matrixport enters its sixth year, he speaks of the next six with clear conviction: Matrixport is not just building an authoritative gateway for crypto assets. It’s aiming to stretch beyond—into broader financial services, offering a one-stop platform that spans OTC trading, structured products, and multi-asset wealth management.

es reach a specific size in crypto, two paths often appear: a traditional IPO or the hype-driven IDO. Matrixport has chosen the former—not for liquidity, but for legitimacy. Going public isn’t just a capital event. It’s about lowering the cost of trust. Like how different banks offer different deposit rates based on perceived safety, public companies earn trust not just through words and regulation, transparency, and accountability. That’s what enables clients to entrust millions.

History moves in decisive moments. Some fade into footnotes. Others write the next chapter. As John Ge reflects: “Everything evolves according to its own internal logic. So does crypto. What we’re after isn’t novelty—it’s durability. And deep, enduring trust.”

Even Matrixport’s name carries this dual spirit. Inspired by Wu Jihan’s favourite film The Matrix, the word “Matrix” evokes complexity and infinite possibility. “Port” is an entryway—a gateway. It was never just a company. It was a door. A portal through which users could begin their journey into crypto, finance, and something new.

And when Three Arrows Capital sank under the weight of its leverage… When BlockFi unravelled in a liquidity crisis… And when trillions of “old money” began to enter through that very door—

One truth became clear: True asset management doesn’t depend on leverage. It doesn’t live for bull markets.

It’s built by those who stay, cycle after cycle. The quiet stewards. The ones who keep the light on.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Golden State Visions Raises the Bar for Professional Real Estate Photography in Northern California

United States, 17th Apr 2025 – In today’s fast-paced housing market, stunning visuals are no longer optional—they’re essential. That’s why Golden State Visions, a top-rated real estate media company based in Lincoln, California, is redefining expectations with their commitment to professional real estate photography that helps listings stand out and sell faster.

With over seven years of specialized experience, Golden State Visions offers a comprehensive suite of services including high-quality real estate photography, aerial drone imagery, video walkthroughs, twilight photography, and virtual staging. These services are designed specifically for real estate agents, homeowners, builders, and brokers seeking polished, on-brand visuals that leave a lasting impression.

“Professional real estate photography is more than taking pictures—it’s about creating a visual experience that attracts buyers, builds trust, and drives sales,” said the company’s founder. “We’re proud to offer a level of quality and service that’s unmatched in our region.”

Golden State Visions is fully owner-operated, ensuring every project receives hands-on attention and expert oversight. Their team uses advanced cameras, lighting techniques, and FAA-certified drones to deliver consistently stunning results.

Each listing shoot is carefully planned and executed with a focus on what today’s homebuyers expect: sharp, well-lit images, aerial perspectives that highlight the surrounding neighborhood, and walkthrough videos that provide a cinematic feel of the space.

Their professional real estate photography services are available throughout:

- Lincoln, CA

- Roseville, CA

- Rocklin, CA

- Sacramento, CA

- Folsom, CA

- Auburn, CA

- Granite Bay, CA

- Loomis, CA

- Newcastle, CA

- El Dorado County

- Placer County

- Greater Sacramento Area

Golden State Visions is trusted by agents and real estate professionals who want to elevate their listings with photography that is not only MLS-ready, but also perfect for social media, print marketing, and YouTube promotion.

Clients benefit from:

- Fast 24–48 hour turnaround times

- Same-day scheduling availability

- Drone photography and video from an FAA-certified remote pilot

- Fully edited, branded, and ready-to-use visual assets

- Virtual enhancements, including twilight edits and digital staging

Since relocating to Placer County from the Bay Area in 2024, Golden State Visions has quickly become a local leader in real estate media. The brand has built its reputation on personalized service, creative excellence, and a deep understanding of what sells homes in today’s digital marketplace.

“Every photo represents our client’s reputation—and ours,” the founder added. “That’s why we guarantee every shoot and treat each listing as if it were our own.”

In addition to real estate agents and homeowners, Golden State Visions regularly works with architects, interior designers, and developers looking to showcase their projects with professional real estate photography that tells a compelling story.

Contact Information:

Golden State Visions

Lincoln, CA

(916) 432-3373

info@gsvisions.co

www.gsvisions.co

Follow Golden State Visions on social media for real estate photography tips, behind-the-scenes content, and highlights from recent projects.

About Golden State Visions

Golden State Visions is a Northern California-based company offering professional real estate photography, drone videography, video walkthroughs, virtual staging, and 3D property scanning. Serving clients across Placer County and the Greater Sacramento area, the company is known for delivering fast, consistent, high-quality real estate media with a personalized touch.

Media Contact

Organization: Golden State Visions

Contact Person: Cory Beck

Website: https://www.gsvisions.co/

Email: Send Email

Address:757 Caber Dr, Lincoln, CA 95648

Country:United States

Release id:26621

View source version on King Newswire:

Golden State Visions Raises the Bar for Professional Real Estate Photography in Northern California

It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release4 days ago

From $10K to a Global Action Trilogy: Maria Tran’s Echo 8 Saga Redefines Indie Cinema

-

Press Release6 days ago

FXSentry New Trading Strategy Launching: The Guardian Forex Robot Designed for Capital Protection

-

Press Release1 week ago

Dr Hala Medical Aesthetics Introduces New Holistic Approach to Enhance Wellness and Beauty

-

Press Release5 days ago

Meana Raptor Announces Presale with Real-World Utility, NFT Integration, and Anti-Whale Protections

-

Press Release5 days ago

BLENIX TECHNOLOGY Launches BLENIX CHAIN: A Purpose-Driven Blockchain for Real-World Sustainability

-

Press Release1 week ago

Bit.com Exchange Ushers in a New Era of Cloud Mining – C2C Hashrate Trading Now Live

-

Press Release5 days ago

We Row For William: Family of 6-Year-Old Boy with Terminal Illness Launches Urgent Campaign to Fund Life-Saving Gene Therapy

-

Press Release6 days ago

Bali Harmony Rehab Adopts Trauma-Informed, Holistic Model for Addiction and Mental Health Recovery