Press Release

UberJeets Innovates with New Online Business Model: Virtual Equity Communities (VECs)

United States, 21st Aug 2024 – Imagine the internet as a vast ocean. Traditional businesses are like giant cruise ships – impressive and comfortable, but with limited access and control for most passengers. Social media platforms are bustling ports where people gather to trade stories and ideas, but rarely see direct profits from their activities. Now, picture a new type of vessel emerging on this digital sea: a community-owned sailing ship where everyone on board is both crew and shareholder.

This is the essence of Virtual Equity Communities (VECs). They’re collaborative enterprises where ideas can set sail, where participants can contribute their talents and resources, and where the spoils of success are shared among all who help steer the ship.

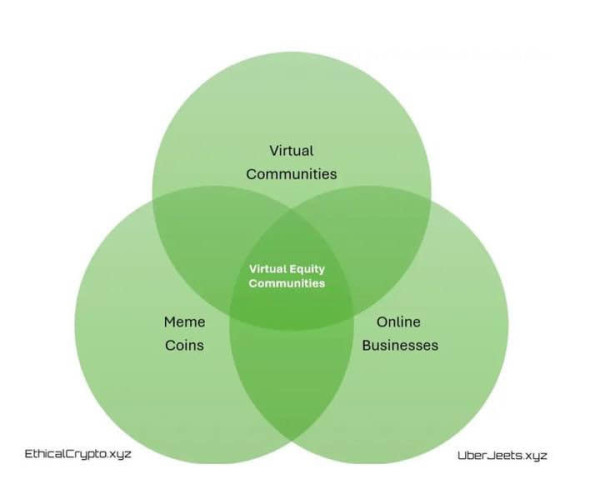

Virtual Equity Communities (VECs) are decentralized online ecosystems that bridge traditional business models with cryptocurrency markets. They leverage blockchain technology, particularly meme coins, to create a pathway for global, fractional ownership in digital enterprises. VECs tie the success of real-world business operations to the growth and value of their associated cryptocurrency, enabling a new form of collaborative entrepreneurship and investment.

In this article, we’ll explore the key components of VECs, how UberJeets is leading this revolution, what makes them unique, and why they could represent the future of online business. Understanding VECs will be crucial for anyone looking to participate in the next wave of online entrepreneurship and investment.

Meme Culture and Meme Coins

Memes are like the language of the internet. They are a way for like-minded individuals to connect with each other using this shared language. If memes are the language of the internet, meme coins are its currency.

Meme coins leverage the power of viral internet culture to gain traction and attract attention from crypto enthusiasts and investors.

Thanks to the speed, security, and low cost of certain blockchain protocols, particularly Solana, it’s never been easier to buy or create a meme coin. But that does not mean all meme coins are created equal. Very few meme coin projects are approaching their coins like UberJeets does: A real business!

Utility & Innovation – It All Starts Here

The vision of UberJeets is to combine real-world business principles with meme coins, transforming the crypto market from a ‘get rich quick’ mentality to a place where investments can be made and grown through the power of community and innovation. This is the foundation of the VEC concept.

The VEC business model starts with a monetizable product or service, usually within the crypto ecosystem, but expanding beyond that ecosystem to grow investment and the addressable market size.

Meme coins, with rare exception, do not survive in the long-term. Without a real product or service, your VEC will die alongside these meme coins, whether all at once or a slow bleed.

Many meme coins have “utility.” They have merchandise, NFTs and elaborate digital stories. Some capture the zeitgeist of a moment and go viral on social media.

While this can be considered a business in the sense of generating some revenue, the addressable market is self-referential. You only appeal to coin holders and onlookers. Move outside that window and, without an of-the-moment meme, no one cares about what you’re offering.

Other meme coins are crypto constrained. They provide some product within the crypto ecosystem. Some bridge chains, but these products are focused on the crypto market and are thus limited in their appeal to a broader audience.

VECs don’t limit product development to the crypto markets. They offer something that has an audience outside of crypto. Whether this is a niche content site, or an e-commerce shop for outdoor apparel, or SEO services for plumbers. The business purposely seeks markets outside of crypto, not just to have a larger audience to market to, but also to attract new investors to the coin.

By focusing on genuine utility and continuous innovation, VECs can establish a sustainable foundation for long-term growth and relevance. UberJeets is laser-focused on utility – through the Jeet Receipt, a unique Volume Bot using a SaaS model, and other revenue generating projects in development.

The VEC Fly Wheel

The connection between the meme coin and a real business ensures that as the business grows, so does the value of the token. This approach encourages holders to think long-term, moving away from the “pump and dump” mentality often associated with meme coins.

Revenue generation is the catalyst that ignites the VEC flywheel. This self-reinforcing cycle begins with the VEC generating revenue through its core business activities. Profits are then strategically allocated through token burning, liquidity pool enhancement, marketing initiatives, and dividend payouts to token holders. This distribution enhances the token’s value and stability while rewarding participants.

As the token appreciates, it attracts more investors and participants. Increased community engagement drives business growth through product improvements, operational efficiencies, new partnerships, and expanded marketing efforts. This expansion generates more revenue, feeding back into the first stage and perpetuating the cycle.

Tokenomics & Value Distribution

VECs directly link business performance to token value through several mechanisms: automated revenue-to-token conversion, strategic token burning, liquidity pool enhancement, and dividend distribution. Smart contracts and multi-signature wallets ensure transparent and secure financial management.

UberJeets exemplifies this approach, using generated revenue for marketing, token burning, increasing liquidity, and other community-beneficial activities. This system builds trust and attracts long-term investors by providing clear, tangible benefits tied to the project’s success.

Charity & Social Impact – A Primary Focus of UberJeets

VECs incorporate social impact initiatives, allocating tokens or revenue to charitable causes. This is not an afterthought, but a core component of a successful VEC. Charity strengthens community bonds, attracts new members, and creates a shared sense of purpose beyond profit. UberJeets is directly supporting an orphanage in Mexico with essential food and health supplies. Such efforts contribute to societal good while enhancing the VEC’s appeal and sustainability.

VECs vs. Traditional Financial Markets

VECs represent a novel approach to investment and business ownership that differs significantly from traditional financial markets. While stocks and bonds derive value from company fundamentals, VECs’ value stems from a combination of social connection, innovation, charity, and community engagement.

Traditional markets often suffer from issues like artificial stock price inflation through buybacks and questionable financial engineering that benefits a select few. In contrast, VECs aim to create a more equitable system where value is distributed more broadly among community members.

VECs offer unique advantages:

Accessibility: Anyone with an internet connection can participate, regardless of geographical location or financial status.

Community Influence: Token holders in VECs have a more direct say in the project’s direction through governance mechanisms.

Transparency: Blockchain technology enables a level of transparency rarely seen in traditional markets.

Rapid Innovation: The decentralized nature of VECs allows for quicker decision-making and implementation of new ideas, potentially leading to faster growth and adaptation.

While traditional markets offer more established regulatory frameworks and historical performance data, VECs like UberJeets provide a new paradigm of investment that aligns with the digital age’s collaborative and decentralized ethos. As the crypto ecosystem matures, VECs have the potential to become a significant part of the future financial landscape, offering a bridge between traditional investment models and the innovative world of decentralized finance.

Building and Scaling an Ethical VEC – The UberJeets Method

Launching a VEC can follow two main paths: creating a new project from scratch or reviving a “dead” or abandoned coin through a community takeover (CTO).

Starting from scratch allows for more control over the project’s vision but requires building trust from the ground up. This often involves the founders revealing their identities to establish credibility. Recruiting a diverse team of contributors, each bringing unique skills and perspectives, is crucial for a well-rounded project.

The CTO approach, exemplified by UberJeets, involves a core group of holders taking over a project that has been abandoned or “rugged” by its original developer. This method can leverage existing community interest and technical infrastructure but requires swift action and clear communication to rebuild trust.

Regardless of the launch method, scaling a VEC involves several key strategies:

• Attracting and retaining members

• Balancing growth with ethical considerations

• Navigating regulatory challenges

• Education and Transparency

Ultimately, successful scaling of a VEC relies on maintaining a delicate balance between community engagement, business development, and adherence to ethical principles.

Conclusion: The Future of VECs

Virtual Equity Communities represent a significant evolution in the cryptocurrency landscape, and UberJeets is leading the way. VECs blend the viral appeal of meme coins with sustainable business practices, charitable giving, and community-driven governance. As shown by projects like UberJeets, VECs have the potential to transform the crypto market from a ‘get rich quick’ mentality to a space where long-term investments can thrive through community collaboration and innovation.

The success of ethical VECs could mark a new era in digital entrepreneurship. As this model evolves, it has the potential to reshape not just the crypto market, but our broader understanding of online business and investment.

Media Contact

Organization: UberJeets

Contact Person: UberJeets

Website: https://uberjeets.xyz/

Email: Send Email

Country: United States

Release Id: 21082415975

The post UberJeets Innovates with New Online Business Model: Virtual Equity Communities (VECs) appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Your Funds, Your Security – Trade with Confidence on BitDelta

Bucharest, Romania, 24th February 2025, ZEX PR WIRE, Exchange hacks are on the rise, putting millions of dollars at risk every day. The question isn’t if another attack will happen—it’s when. With security breaches exposing vulnerabilities in even the biggest platforms, traders need a safer alternative.

At BitDelta, security isn’t just a promise—it’s built into our DNA. Ranked among the top 10 most secure exchanges on CER.live, externally audited by Hacken, and fortified with Fireblocks’ industry-leading security, BitDelta ensures your assets are always protected.

Plus, trade now and win up to $1,000 daily*—no hidden conditions!

*The terms and conditions are listed below.

How BitDelta’s Robust Security Protects Your Assets

Distributed MPC Wallets: Unlike traditional multi-signature wallets, BitDelta’s Fireblocks-powered MPC (Multi-Party Computation) wallets reduce single points of failure.

Distributed MPC Wallets: Unlike traditional multi-signature wallets, BitDelta’s Fireblocks-powered MPC (Multi-Party Computation) wallets reduce single points of failure.

Secure Hardware Key Management: Private keys are stored in secure enclaves, preventing unauthorised access and drastically reducing breach risks.

Secure Hardware Key Management: Private keys are stored in secure enclaves, preventing unauthorised access and drastically reducing breach risks.

Institution-Grade Policy & Governance Engine: Automated approval flow and strict access controls prevent fraudulent transactions and unauthorised withdrawals.

Institution-Grade Policy & Governance Engine: Automated approval flow and strict access controls prevent fraudulent transactions and unauthorised withdrawals.

DeFi Threat Detection & Transaction Clarity: Real-time monitoring detects suspicious activities to ensure transactions remain safe and transparent.

DeFi Threat Detection & Transaction Clarity: Real-time monitoring detects suspicious activities to ensure transactions remain safe and transparent.

Fireblocks Network Security: Eliminates deposit address risks, minimising exposure to external threats.

Fireblocks Network Security: Eliminates deposit address risks, minimising exposure to external threats.

Zero Counterparty Risk – Fireblocks’ Off Exchange Solution ensures asset control, segregated storage, and 1:1 mirroring for ultimate protection.

Zero Counterparty Risk – Fireblocks’ Off Exchange Solution ensures asset control, segregated storage, and 1:1 mirroring for ultimate protection.

BitDelta’s $1 Million Bug Bounty Program – Security Never Sleeps

At BitDelta, security isn’t just a priority—it’s a necessity. We take security so seriously that we’re offering up to $1 million to security researchers and ethical hackers to proactively identify and report potential vulnerabilities. This helps us stay ahead of threats.

Up to $1 Million in rewards** for critical discoveries

Up to $1 Million in rewards** for critical discoveries

Continuous monitoring and rapid patching of vulnerabilities

Continuous monitoring and rapid patching of vulnerabilities

Global collaboration with top security experts

Global collaboration with top security experts

Join One of the Top Secure Exchanges – Win Up to $1,000 Daily!

To celebrate our unwavering commitment to security, BitDelta is launching the SecureCEX campaign, giving users a chance to win up to $1,000 daily until March 1, 2025.

How to participate:

How to participate:

1⃣ Sign up with code: SecureCEX

2⃣ Deposit a minimum of USD $100

3⃣ Complete 3-4 trades within 24 hours

One lucky trader wins up to $1,000 every day!

One lucky trader wins up to $1,000 every day!

Learn more: https://bitdelta.com/en/register?referralcode=securecex&utm_source=campaign&utm_medium=socialmedia&utm_campaign=pr (Compliance with the Terms and Conditions of BitDelta is required.)

Learn more: https://bitdelta.com/en/register?referralcode=securecex&utm_source=campaign&utm_medium=socialmedia&utm_campaign=pr (Compliance with the Terms and Conditions of BitDelta is required.)

Security is Not an Option – It’s the Foundation of Trust

Every hack is a reminder of why security should never be an afterthought. At BitDelta, we stay ahead of threats and cybersecurity innovation, so you never have to worry about your funds. Trade with confidence, security, and total peace of mind—because when it comes to protecting your assets, there are no second chances.

Trade with confidence, trade with BitDelta!

**Please visit the complete Terms and Conditions for the Bug Bounty Program on https://bitdelta.com/en.

About BitDelta

BitDelta is a versatile trading platform for retail and institutional traders that offers a comprehensive trading experience by enabling users to trade digital assets. With a focus on security, BitDelta offers robust encryption and institutional-grade protection to safeguard user transactions and data. The platform is designed to provide a seamless trading experience, support cross-asset trading, and offer features like buying cryptocurrency with a card, algo trading, token launchpad services, SafePass, and more. BitDelta is dedicated to improving user engagement and investment capabilities across multiple financial markets.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Forxl Markets: Driving Innovation to Open a New Chapter in Global Financial Trading

In the increasingly complex and competitive global financial market, Forxl Markets has rapidly emerged as a leader in the financial services industry, driven by its advanced technological advantages and precise market insights.

As the demand for high-quality financial services continues to grow, Forxl Markets remains keenly aware of future market trends, dedicated to creating a more intelligent and personalized investment environment for traders. Through continuous technological optimization and service upgrades, Forxl Markets has not only made significant strides in its trading platform but has also secured a prominent position in the global financial services sector.

Innovative Platform: Providing Comprehensive Services to Global Traders

The technological innovation of Forxl Markets is the core driver of its success. Through ongoing research and development, the company has created a powerful and responsive trading platform that enables global users to trade various financial assets at any time. Whether it’s forex, commodities, stocks, or cryptocurrency and futures markets, Forxl Markets’s platform offers an exceptional trading experience, ensuring users can execute every trade quickly and accurately.

In terms of platform design, Forxl Markets uses the most advanced algorithms and real-time data streams to ensure the efficiency and low latency of trades, allowing users to stay ahead in a fast-moving market. Additionally, the platform provides a wide range of tools and features, including smart analysis, real-time price tracking, and decision support systems, helping traders make more precise investment decisions.

Diversified Financial Products: Meeting Diverse Investment Needs

One of the highlights of Forxl Markets is its diversified product line. The company offers clients a wide range of asset classes, including forex, commodities, stocks, bonds, cryptocurrencies, and more. Whether for professional investors or beginners, users can find financial products on the platform that meet their needs and help them achieve effective asset allocation and value growth.

Through detailed asset allocation services, Forxl Markets’s clients can flexibly choose the most suitable financial products based on their risk preferences, investment horizons, and return expectations to optimize their portfolios. To assist clients with asset management, Forxl Markets also regularly publishes market analysis reports and investment recommendations, providing timely market insights and investment guidance.

Security Assurance: World-Leading Fund Security System

As a leader in the financial industry, Forxl Markets understands the importance of fund security for traders. The company strictly adheres to international financial regulatory requirements and uses world-class security technologies to ensure a safe trading environment. The platform’s fund storage follows a strict deposit strategy, isolating client funds from company funds, and collaborating with top global banks to provide multiple layers of security for customer funds.

Furthermore, Forxl Markets strengthens its monitoring of the trading process to ensure that client funds are safeguarded against external threats. To combat potential cybersecurity risks, the platform employs the latest encryption technology, two-factor authentication, and firewall protection, ensuring that each client’s account information remains secure.

Transparency and Compliance: Building a Trust Foundation for Clients

Forxl Markets is committed to transparent operations, ensuring that clients are always aware of the platform’s operational status. The company regularly discloses fund usage and financial reports, ensuring all traders can clearly understand the platform’s financial flows and operational transparency. Additionally, Forxl Markets is authorized by regulatory agencies in multiple countries and regions, strictly adhering to the laws and regulations of the jurisdictions in which it operates, ensuring that every action on the platform complies with global financial compliance standards.

To further enhance customer trust, Forxl Markets has established strict internal auditing and monitoring mechanisms to ensure the fairness and transparency of platform operations. The company believes that through stringent compliance management and continuous transparency efforts, it can earn long-term trust and support from its customers.

Future Development: Continuous Innovation and Global Expansion

As the global financial market continues to evolve, Forxl Markets is actively preparing for the future, planning to further consolidate its leadership position through continuous technological innovation and global market expansion. The company will focus its efforts in the following areas to drive ongoing growth:

Smart Trading and AI Application: The company will increase its investment in artificial intelligence and big data to launch more intelligent trading tools and services, offering clients more personalized investment advice and risk management solutions.

Green Finance and Sustainable Development: Forxl Markets plans to actively participate in global green finance and sustainable development projects, promoting environmentally friendly financial products and supporting the global economic transition to a greener future.

Global Education Program: The company will expand its educational services, offering a broader range of financial training courses to help traders improve their investment skills and financial literacy. Whether new to trading or an experienced investor, users will have access to the latest market analysis techniques and investment strategies.

Global Strategic Partnerships: Forxl Markets will continue to strengthen its strategic cooperation with global financial institutions, advancing the construction of a global financial network and enhancing the platform’s ability to serve clients worldwide.

With its powerful technological support, diverse product offerings, and excellent security management, Forxl Markets has become a key player in the global financial market. Looking ahead, Forxl Markets will continue to uphold the principles of innovation and customer-centricity, constantly optimizing its technology and services to drive the full upgrade of global financial trading platforms. The company aims not only to provide users worldwide with a superior trading experience but also to contribute to the healthy development of the global financial market.

Through continuous innovation and global expansion, Forxl Markets will continue to play a significant role in the new era of financial services, creating greater value for clients and helping global traders seize opportunities and achieve wealth growth in an ever-changing market.

Contact:Seraphina Grace

Company:Forxl Markets

Email: Grace@forxlmarkets.com

Website: https://forxlmarkets.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Bitomato Reaches 1 Million Monthly Visitors, Marking a Significant Growth Milestone

London, United Kingdom—Bitomato, a centralized cryptocurrency exchange, has officially surpassed 1,000,000 monthly visitors. This milestone reflects the platform’s expanding user base and growing presence in the digital asset market, and it underscores its increasing adoption among crypto traders and projects.

Over recent months, Bitomato has experienced steady growth, driven by an expanding range of token listings, user-friendly trading tools, and a strong global community. The exchange has gained traction among users exploring emerging digital assets, particularly within the meme token sector.

“Reaching one million monthly visitors is an important milestone for our platform,” said a Bitomato representative. “It highlights the increasing engagement from the crypto community and reinforces our focus on delivering a secure and accessible trading experience.”

Key Drivers of Growth

Several factors have contributed to Bitomato’s rising user activity:

- Expanding Token Offerings – The exchange consistently lists new and trending digital assets, catering to traders looking for early-stage market opportunities.

- Enhanced User Experience – Intuitive trading tools, referral programs, and interactive platform features contribute to an engaging trading environment.

- Security and Transparency – Bitomato prioritizes user protection through advanced security measures and operational transparency.

- Active Community Engagement – The platform supports international user communities, fostering direct interaction and market insights.

Future Developments

Building on this momentum, Bitomato is preparing to roll out new trading features, enhanced security measures, and strategic partnerships to support the next phase of its growth.

“This achievement reflects our platform’s progress, but we see it as just the beginning. We are committed to continuous improvement and innovation to serve our growing global user base,” added the Bitomato representative.

About Bitomato

Bitomato is a centralized cryptocurrency exchange specializing in meme tokens and emerging digital assets. Headquartered in London, United Kingdom, the platform is designed to provide a seamless and secure trading experience for both new and experienced traders.

For more information, visit https://bitomato.com

Media Contact

Organization: Bitomato

Contact Person: William Smith

Website: https://bitomato.com/

Email: Send Email

Country: United Kingdom

Release Id: 24022523550

The post Bitomato Reaches 1 Million Monthly Visitors, Marking a Significant Growth Milestone appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release6 days ago

Dynamic Team of Students Launches Revolutionary AI Monster 3D Platform

-

Press Release6 days ago

KODDPA to Go Public on NASDAQ

-

Press Release6 days ago

HIPPO, a meme coin, will be listed on CoinW Exchange

-

Press Release6 days ago

ForU AI Pioneers the Future of Real-World AI Agents through the Community AI-DiD Initiative

-

Press Release1 week ago

Sitngo Accepts Car Rental Payments in USDT Cryptocurrency

-

Press Release4 days ago

Twings Supply Enhances Logistics with Seamless Door-to-Door Shipping Solutions

-

Press Release4 days ago

Twings Supply Strengthens Global Trade with Reliable Freight Forwarding Services

-

Press Release4 days ago

Global Publicist 24 Unveils Special Edition: Her Vision, Her Legacy: A Tribute to Women Business Leaders