Press Release

Scientific Advancements in Hair Wellness and the Emerging Role of Spermidine

People often wonder how some are able to maintain thicker, stronger strands as they age—while others struggle with breakage, dullness, and increased shedding. The latest science is turning attention to spermidine, a naturally occurring compound linked to hair vitality and healthy aging. This article explores how cellular wellness and hair health are connected, and why more people are looking to nutritional support for stronger, fuller-looking hair—backed by clinical insights and scientific research.

Irvine, CA, United States, 17th Mar 2025 – Hair vitality continues to be a central focus in the evolving conversation around wellness and healthy aging. Recent scientific developments have brought attention to naturally occurring compounds that may support internal hair and scalp health. Among them, spermidine has emerged as a topic of interest due to its connection with cellular renewal and hair follicle function (Ramot et al., 2015; Rinaldi et al., 2017).

Yuth , a patent-pending spermidine-based polyamine, is gaining recognition as an advanced ingredient. Known for supporting healthy aging and cellular renewal, Yuth

, a patent-pending spermidine-based polyamine, is gaining recognition as an advanced ingredient. Known for supporting healthy aging and cellular renewal, Yuth reflects a growing interest in integrative wellness approaches that prioritize both inner vitality and external appearance (BIGVITA, 2024).

reflects a growing interest in integrative wellness approaches that prioritize both inner vitality and external appearance (BIGVITA, 2024).

How Spermidine Supports Hair and Scalp Wellness

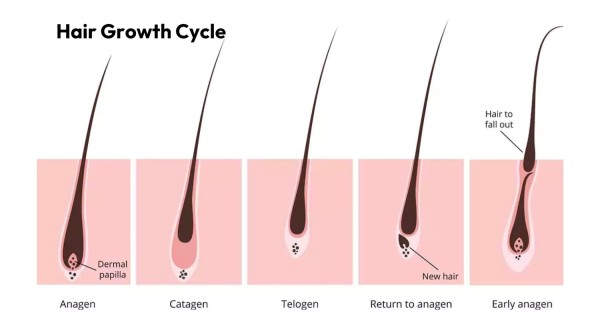

Spermidine plays a key role in cellular regeneration and autophagy, two essential processes that help maintain scalp balance and hair follicle activity. Studies published in respected scientific journals such as PLOS One and Dermatology Practical & Conceptual have shown that spermidine may support the anagen, also known as the growth phase of the hair cycle (Rinaldi et al., 2017; Ramot et al., 2015). This phase is known for contributing to visibly fuller and stronger hair strands over time.

By encouraging the activity of hair growth-associated genes and enhancing the body’s production of keratin, spermidine contributes to a stronger hair structure and a healthier scalp environment (Compound Solutions Inc., 2025). Its antioxidant properties also support the body’s defenses against oxidative stress, which is often linked to premature follicle aging.

Understanding the Science Behind Hair Support

Scientific research has long examined the biological processes that influence hair follicle health and growth cycles. Among these, scalp stimulation and enhanced blood flow have been widely recognized for their supportive role in maintaining hair vitality. Whether achieved through physical techniques like massaging or through select topical ingredients, this increased circulation is believed to help nourish follicles and sustain the growth phase, known as the anagen phase. Extending this phase is considered a valuable outcome, as it allows hair more time to grow—naturally contributing to greater length, density, and overall volume.

Emerging research in the wellness space has highlighted that spermidine also plays a role in supporting the anagen phase and hair follicle vitality. Acting through internal biological pathways, spermidine has been shown to influence gene expression and cellular renewal processes linked to healthy hair function (BIGVITA, 2025; Compound Solutions Inc., 2025). These findings continue to elevate the conversation around internal wellness as an essential foundation for lasting hair health.

Why Some Individuals Explore Internal Wellness Strategies

As the focus on whole-body wellness grows, many individuals are turning to natural, internal approaches that align with their lifestyle and long-term self-care goals. Factors such as sensitivity to application methods, time-consuming routines, or a desire to support beauty from within often drive this shift. While topical treatments can deliver benefits, they frequently require strict consistency, and concerns about noticeable changes in hair appearance following discontinuation remain common. This has led to growing interest in natural strategies that work in harmony with the body’s own biology.

New Insights from Yuth Clinical Research

Clinical Research

Recent clinical evaluations have reinforced the interest in spermidine as a valuable contributor to hair appearance and scalp health. In a study involving Yuth , participants reported noticeable improvements in multiple subjective measures after consistent use. By week sixteen of use, more than 78% of participants reported that their hair seemed to grow faster, while 76.7% noted their hair felt stronger. Over 70% shared that they experienced less hair loss and observed enhanced overall hair appearance. Most significantly, over 86% felt their scalp health had improved during the period of use (Compound Solutions Inc., 2025).

, participants reported noticeable improvements in multiple subjective measures after consistent use. By week sixteen of use, more than 78% of participants reported that their hair seemed to grow faster, while 76.7% noted their hair felt stronger. Over 70% shared that they experienced less hair loss and observed enhanced overall hair appearance. Most significantly, over 86% felt their scalp health had improved during the period of use (Compound Solutions Inc., 2025).

At the cellular level, Yuth was observed to support the expression of the HR gene, commonly associated with hair growth. Scientific data show that spermidine, along with other polyamines, upregulated this gene during controlled laboratory trials, mirroring mechanisms also associated with other well-known hair wellness pathways (Compound Solutions Inc., 2025).

was observed to support the expression of the HR gene, commonly associated with hair growth. Scientific data show that spermidine, along with other polyamines, upregulated this gene during controlled laboratory trials, mirroring mechanisms also associated with other well-known hair wellness pathways (Compound Solutions Inc., 2025).

A Broader View on Hair Wellness and Longevity

Spermidine’s benefits extend beyond scalp wellness. It is also associated with support for healthy nails and overall skin vitality, further reinforcing its relevance in beauty and aging conversations that emphasize internal nourishment (BIGVITA, 2024).

As the wellness industry continues to evolve, ingredients like spermidine are emerging as cornerstones in the next generation of hair care innovation. With its unique ability to support cellular renewal and biological function from within, Yuth represents a breakthrough in beauty-from-within science—offering a modern approach to hair vitality that aligns with holistic, health-conscious lifestyles.

represents a breakthrough in beauty-from-within science—offering a modern approach to hair vitality that aligns with holistic, health-conscious lifestyles.

References

BIGVITA. “Yuth Sets the Standard for Spermidine.” BIGVITA, https://bigvita.com/yuth-sets-the-standard-for-spermidine/. October 2, 2024.

Compound Solutions Inc. “Yuth Clinical Research, Rev II.” Compound Solutions Inc. Internal Clinical Research Summary Report. 2025.

Rinaldi F, Marzani B, Pinto D, Ramot Y. A spermidine-based nutritional supplement prolongs the anagen phase of hair follicles in humans: a randomized, placebo-controlled, double-blind study. Dermatol Pract Concept. 2017 Oct 31;7(4):17-21. doi: 10.5826/dpc.0704a05. PMID: 29214104; PMCID: PMC5718121.

Ramot Y, Marzani B, Pinto D, Kloepper JE, Paus R. N(1)-methylspermidine, a stable spermidine analog, prolongs anagen and regulates epithelial stem cell functions in human hair follicles. Arch Dermatol Res. 2015 Nov;307(9):841-7. doi: 10.1007/s00403-015-1592-9. Epub 2015 Jul 28. PMID: 26216444.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Allergen-Free Compounding: An Innovative Approach by My Compounding Pharmacy of Roseland Australia

New South Wales, Australia, 20th April 2025, ZEX PR WIRE, Healthcare continues to evolve, and with it, the need for tailored treatment options grows. For many individuals, standard medications are not always the perfect fit due to allergies, sensitivities, dietary restrictions, or specific health needs. Recognizing these unique challenges, My Compounding Pharmacy of Roseland Australia, a trailblazer in personalized medicine, has introduced allergen-free compounding as a solution to bridge the gap in modern healthcare.

The Role of My Compounding Pharmacy in Personalized Healthcare

The team behind My Compounding Pharmacy is a trusted name in crafting customized pharmaceutical solutions. Their commitment lies in offering tailored treatments to meet the health challenges of every individual. This goes beyond simply combining ingredients. It’s about identifying specific patient needs and creating medications that are not only effective but also safe for those with particular sensitivities or allergies.

My Compounding Pharmacy’s approach is built on the belief that no two patients are the same. Whether it’s an adult with dietary restrictions, a child struggling to take a traditional medication form, or an individual looking to avoid allergies like gluten or lactose, the pharmacy can provide a bespoke solution. Their dedication to inclusivity and quality makes them the go-to choice for patients seeking personalized care.

What is Allergen-Free Compounding?

At the heart of My Compounding Pharmacy’s innovation is allergen-free compounding. This specialized service allows for the preparation of medications, skincare products, and other treatments that are completely free of common allergens and irritants. These unwanted ingredients can include preservatives, dyes, gluten, lactose, or artificial fragrances—components that can cause adverse reactions for sensitive patients.

The process ensures that every aspect of the medication is tailored to the individual. These personalized formulations not only reduce the chances of side effects but also provide effective treatments for those who have struggled with standard, off-the-shelf medications. Whether it comes in the form of a capsule, cream, liquid, or even a gummy, allergen-free compounding opens the door to safer and more comfortable options for patients of all ages.

The Benefits of Allergen-Free Medicines

Choosing allergen-free medications carries a range of benefits that go beyond addressing immediate sensitivities. Here are some of the key advantages:

-

Safety and Peace of Mind: Compounded medications are carefully prepared to exclude any ingredients that can trigger reactions. This ensures that patients can take their prescribed medicines without fear of exposure to irritants like preservatives or food-related allergens.

-

Improved Tolerance: Many patients experience unnecessary discomfort due to inactive components in their medications. Allergen-free compounding eliminates these risks, making treatments easier to tolerate and more effective overall.

-

Personalized Care: Every patient has distinct needs, and My Compounding Pharmacy works with healthcare providers to craft medications that meet individual requirements. Whether someone needs a lactose-free formulation or a vegetarian-friendly option, the pharmacy has a tailored solution.

-

Creative Dosage Forms: Medications are not one-size-fits-all. For children or adults with swallowing difficulties, My Compounding can reimagine how medications are delivered—whether in liquid form, a topical ointment, or other custom alternatives.

Addressing Specific Allergies and Sensitivities

My Compounding Pharmacy is equipped to respond to a variety of allergies and sensitivities, ensuring that no patient feels left behind in their healthcare needs. Some common solutions include:

-

Preservative-Free Medications: Many patients find themselves sensitive to preservatives used in commercial medicines. My Compounding creates preservative-free alternatives that are just as effective, without the added irritants.

-

Medication Revamps: Allergies to inactive ingredients like dyes or binders often pose significant challenges. The pharmacy can reformulate medications, replacing problematic components with safer options. This also includes altering medication forms—turning pills into creams, for instance, for patients with unique requirements.

-

Custom Skincare for Skin Allergies: Patients with dermatological sensitivities can benefit from hypoallergenic solutions tailored to their needs. From fragrance-free moisturizers to personalized cleansers, these products are designed to minimize skin reactions while delivering results.

-

Children’s Allergies: Medication for children can be particularly tricky when allergies are involved. My Compounding Pharmacy offers solutions like allergen-free antihistamines and corticosteroids, ensuring that younger patients have access to safe and effective treatments.

An Inclusive Approach to Healthcare

One of the standout elements of My Compounding Pharmacy’s service is its inclusivity. Their process begins with a thorough consultation, during which the patient’s specific allergies, sensitivities, and other needs are carefully assessed. This collaborative approach, involving the patient, healthcare provider, and compounding pharmacist, ensures that every treatment plan is precisely aligned with the individual’s circumstances.

Additionally, My Compounding Pharmacy accommodates dietary and cultural preferences, offering options like Halal, Kosher, vegetarian, and vegan formulations. This thoughtful consideration underscores their commitment to delivering accessible care to all members of the community.

Allergen-Free Options for Common Medications

Some of the most commonly requested allergen-free medications include:

-

Custom Antihistamines: For allergies that cause itching, hives, or nasal congestion, these formulations are tailored to avoid ingredients that can exacerbate sensitivities.

-

Corticosteroids: Used to manage severe allergic reactions, these are compounded to reduce inflammation without including potential allergens.

-

Topical Formulations: For individuals who need transdermal solutions, My Compounding can prepare custom creams, gels, or ointments that bypass allergens while maintaining efficacy.

Redefining Health Journeys with Allergen-Free Solutions

Allergen-free compounding represents a new frontier in personalized medicine, where patients with unique needs are no longer constrained by the limitations of standard treatments. By offering these services, My Compounding Pharmacy of Roseland Australia empowers individuals to take control of their health with solutions that are as unique as they are.

My Compounding Pharmacy has stood as a reliable partner in healthcare innovation. Now, with allergen-free compounding, they’re raising the bar once more—introducing a compassionate, inclusive, and patient-focused approach to modern medicine. Experience the difference today through tailored treatments that prioritize your safety and well-being.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Jaime Bejar Shares Expert Insights on Ecommerce Trends for 2025: How Brands Can Stay Ahead of the Curve in a Rapidly Evolving Industry

Los Angeles, CA, 20th April 2025, ZEX PR WIRE, Jaime Bejar, a visionary entrepreneur and industry expert, will be offering valuable insights into the future of ecommerce at the upcoming Ecommerce Innovations Summit 2025. With global ecommerce sales reaching over $4.1 trillion in 2024 and projected to surpass $6.4 trillion by 2029, the ecommerce industry is entering a new era of growth and transformation. As technology continues to advance and consumer expectations evolve, brands must be prepared to adapt or risk falling behind. Bejar’s expertise in ecommerce automation, business management, and entrepreneurship will help businesses navigate the challenges of the year ahead.

Jaime Bejar is a respected leader in the ecommerce space, known for his work as the founder of Automate My Cash Flow and creator of Online Empire University. Through these initiatives, Bejar has empowered countless entrepreneurs to achieve financial independence while avoiding the common pitfalls and scams that plague the ecommerce industry. As an expert in automation and business management, Bejar’s insights are invaluable for businesses aiming to stay ahead of the curve in the competitive world of online retail.

As we enter 2025, brands must embrace the latest technologies and strategies that will define the future of ecommerce. From augmented reality (AR) and artificial intelligence (AI) to personalized shopping experiences and blockchain for enhanced security, staying competitive requires a proactive approach. In his upcoming presentation at the Ecommerce Innovations Summit, Bejar will explore the key trends shaping ecommerce and provide actionable strategies to help businesses thrive in a rapidly changing landscape.

The Rise of Blockchain: Security and Transparency in Ecommerce

One of the most significant shifts occurring in ecommerce is the rise of blockchain technology. As online shopping continues to grow, so do concerns about data security, fraud, and trust between buyers and sellers. Blockchain technology offers a solution by providing a decentralized and tamper-proof ledger that enhances transaction security, prevents fraud, and improves transparency in online shopping.

According to Statista, the global blockchain technology market is projected to grow from $17 billion in 2023 to over $943 billion by 2032, signaling its rapid adoption across industries, including ecommerce. Bejar will highlight the critical role blockchain will play in the future of ecommerce, as businesses increasingly use it for secure payments, supply chain tracking, and smart contracts. By leveraging blockchain, retailers can offer a safer, more trustworthy shopping experience, helping to build customer confidence in an age where data privacy and security are paramount.

Livestream Shopping: A New Era of Interactive Ecommerce

Another trend that Bejar will discuss at the summit is the rise of livestream shopping. Livestream commerce is rapidly redefining the way consumers discover and purchase products online, blending entertainment with real-time shopping experiences. What was once a niche trend is now becoming a mainstream sales channel, with platforms like TikTok Live, eBay Live, and Whatnot leading the charge.

In 2023, US livestream ecommerce sales reached $50 billion, and this figure is expected to grow to $68 billion by 2026. Retailers are increasingly using livestream shopping to engage audiences, showcase products in action, and drive instant sales. Bejar will discuss how brands can leverage this trend by hosting interactive product demos, exclusive drops, and influencer-led shopping events to encourage real-time engagement. With consumers craving more immersive and authentic shopping experiences, livestream commerce is set to become a major revenue driver in 2025.

Augmented Reality (AR): Bridging the Gap Between Physical and Digital Shopping

One of the greatest challenges of online shopping has always been the inability to see and experience products in-person before making a purchase. Augmented reality (AR) technology is helping bridge that gap by allowing consumers to virtually try on products or view them in 3D before making a decision.

According to eMarketer, the number of AR users in the US is expected to exceed 100 million by the end of 2025, making up 32% of the population. Bejar will explore how AR is revolutionizing ecommerce by enhancing the online shopping experience, reducing return rates, and increasing buyer confidence. Retailers are already using AR for virtual try-ons, interactive 3D product views, and real-world visualization of products, allowing shoppers to engage with products in a way that was previously impossible in the digital space.

Voice Search: Optimizing for the Future of Shopping

As voice assistants like Amazon Alexa and Google Assistant become increasingly integrated into daily life, voice search is becoming an important trend in ecommerce. With 75% of US households expected to own a smart speaker in 2025, Bejar will explain how ecommerce businesses can optimize their platforms for voice search.

Voice search allows consumers to shop hands-free, making the shopping experience more convenient and efficient. As voice technology continues to innovate, Bejar will offer insights into how brands can leverage voice search to enhance customer convenience, improve user experience, and drive significant growth in online sales. Ecommerce platforms like BigCommerce and Shopify are already making strides in optimizing for voice queries, and this trend is set to reshape the way consumers interact with online retail.

Artificial Intelligence: Revolutionizing Customer Experience

Artificial intelligence (AI) and machine learning algorithms have become integral parts of the ecommerce landscape. From chatbots and customer service automation to personalized product recommendations, AI is transforming how businesses interact with consumers and streamline operations.

Bejar will delve into how AI-powered tools are solving customer pain points and improving the overall shopping experience. AI-driven personalization helps brands deliver tailored recommendations based on a customer’s browsing history, preferences, and purchase behavior. Moreover, AI is enhancing inventory management, optimizing supply chains, and even generating custom product images, allowing businesses to operate more efficiently and cost-effectively.

With AI’s role in ecommerce continuing to expand, Bejar will highlight its potential to revolutionize the industry in 2025, improving customer engagement, driving sales, and increasing operational efficiency.

Personalization: Creating Seamless, Omnichannel Shopping Experiences

Personalization has become a crucial factor in driving customer loyalty. Research shows that 72% of consumers are more likely to stay loyal to brands that offer personalized experiences. However, personalization goes beyond simply addressing customers by their first names. It involves delivering a tailored shopping experience across all touchpoints, from personalized product recommendations to dynamic pricing and targeted advertising.

Bejar will discuss how businesses can use customer data to create seamless, omnichannel shopping experiences that engage customers at every step of the journey. He will also address the growing importance of data privacy and security, emphasizing the need for transparency and trust in the personalization process. As more consumers become aware of how their data is being used, retailers must provide clear options for opting into personalized experiences while ensuring compliance with consumer privacy laws such as GDPR and the California Consumer Privacy Act (CCPA).

About Jaime Bejar

Jaime Bejar is a highly regarded entrepreneur, educator, and thought leader in the ecommerce space. As the founder of Automate My Cash Flow and creator of Online Empire University, Bejar has dedicated his career to helping others achieve financial independence by building successful ecommerce businesses. Through his work, Bejar has empowered countless individuals to avoid the scams and inefficiencies that often plague the ecommerce industry, providing them with the tools and strategies needed to build sustainable businesses.

Bejar’s expertise spans ecommerce automation, wholesaling, logistics, and business management. His mission is to mentor the next generation of entrepreneurs, guiding them to success in the ever-changing world of online retail.

About Online Empire University

Online Empire University, founded by Jaime Bejar, is an educational platform designed to help aspiring entrepreneurs master Amazon Online Arbitrage while avoiding common industry scams. With a structured curriculum and hands-on coaching, the university provides students with the knowledge and support they need to build successful ecommerce businesses.

About Automate My Cash Flow

Automate My Cash Flow specializes in managing ecommerce cash flow, wholesaling, and logistics solutions. Led by Jaime Bejar, the company offers innovative services designed to protect clients from cash flow inefficiencies and scams. With a focus on automation and business management, Automate My Cash Flow helps ecommerce businesses achieve sustainable growth.

For media inquiries, please contact:

Press Contact:

Jaime Bejar

Founder/CEO, Automate My Cash Flow

Los Angeles Metropolitan Area

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Meet Augustus Kirby of NYC: The Marketing Visionary Redefining Digital Engagement

New York, US, 20th April 2025, ZEX PR WIRE, As digital marketing continues to evolve, businesses are searching for leaders who can blend innovation with ethics. Augustus Kirby of NYC is among the marketing experts who are leading the way in innovation. Kirby is a strategist known for helping brands harness data-driven marketing and emerging technology to drive measurable growth. With a proven track record in high-level marketing leadership and consulting, Augustus Kirby is at the forefront of reshaping how companies connect with their audiences in an era of rapid change.

A Leader in Data-Driven Marketing

NYC Augustus Kirby champions a data-first approach, empowering businesses with hyper-personalized campaigns, real-time performance optimization, and predictive analytics. “Data-driven marketing isn’t just about numbers – it’s about unlocking deeper customer insights and delivering content that resonates,” Kirby explains. “The companies that leverage these strategies effectively will lead their industries.”

Augustus Kirby stresses that automation plays a crucial role in modern marketing. AI-powered chatbots and automated content creation help brands engage with their audience at scale, ensuring personalized experiences without sacrificing efficiency. “Automation doesn’t replace creativity – it enhances it by freeing marketers to focus on strategy and storytelling,” he adds.

Innovative Strategies That Drive Results

Augustus Kirby’s expertise has helped businesses across industries achieve breakthrough success. Recently, an e-commerce company saw a 35% sales increase after implementing his recommended data-driven recommendation engines. A B2B SaaS firm, meanwhile, optimized its ad placements and automated its content strategy under Kirby’s guidance, leading to a 50% boost in lead generation while cutting acquisition costs. “Smart marketing isn’t about spending more – optimizing every move,” he notes.

He emphasizes the power of data analytics in shaping effective campaigns. Through advanced audience segmentation and machine learning models, brands can predict consumer behavior and adjust their strategies accordingly. “Marketing should no longer be based on guesswork,” says New York’s Augustus Kirby. “Every decision should be backed by data, ensuring brands reach the right people with the right message at the right time.”

Championing Ethical Marketing and Consumer Trust

As data privacy concerns grow, Augustus Kirby emphasizes responsible marketing practices. He advises brands to adopt transparent data usage policies, prioritize authenticity, and embrace ethical personalization. “Trust is the currency of modern marketing,” he says. “Brands that operate with integrity will build lasting customer relationships and stronger market positions.”

He believes that brands that fail to address privacy concerns will struggle to maintain customer loyalty. With global regulations tightening around data collection and usage, businesses must proactively secure consumer trust. “Transparency isn’t optional – it’s a requirement,” he insists. “Customers need to know how their data is being used and have the power to control it.”

The Power of Strong Marketing Leadership

Successful marketing extends beyond campaigns – it requires leadership that unites vision with execution. Kirby believes that today’s top marketing leaders must anticipate industry shifts and foster collaboration within their organizations. “The best marketing leaders don’t just follow trends – they set them,” he explains. “They align business objectives with innovative marketing efforts to create lasting impact.”

Strong leadership also means investing in team development. Augustus Kirby encourages companies to cultivate a culture of continuous learning, where employees are empowered to experiment with new technologies and approaches. “The most successful teams are those that adapt quickly and embrace change,” he notes. “Marketing is evolving too fast for businesses to remain stagnant.”

The Future of Digital Advertising

With digital marketing evolving rapidly, New York’s Augustus Kirby predicts significant shifts in the industry, from voice search optimization to AI-generated video content and advanced sentiment analysis. “The brands that succeed will be those that balance technology with a human touch,” he remarks. His ability to integrate emerging trends with ethical best practices keeps his clients ahead of the curve.

He highlights interactive email marketing as a growing trend. Consumers demand more engaging content, and brands incorporating dynamic elements – such as embedded videos, live polls, and gamification – will stand out in crowded inboxes. “Static emails are a thing of the past,” he says. “Marketing is becoming more immersive, and companies must adapt.”

Additionally, Kirby sees programmatic advertising and real-time bidding (RTB) as key drivers of efficiency in digital campaigns. By leveraging automation, brands can optimize ad placements, reduce costs, and precisely reach highly targeted audiences. “Smart ad placement is the future,” he states. “It’s not just about visibility – it’s about reaching the right audience at the right moment.”

Beyond Marketing: Passion and Purpose

When he’s not advising brands, Augustus Kirby can often be found on the water, kayaking across the U.S. and beyond. His adventurous spirit extends to philanthropy, where he actively supports charities that assist underprivileged children. “Success isn’t just about business,” he says. “It’s about making a difference where it matters.”

Kirby’s philanthropic efforts include donations to educational programs and sponsorship of initiatives providing resources to needy children. “Education and opportunity should not be limited by geography or circumstances,” he asserts. “Giving back is a responsibility, not an option.”

What’s Next for Augustus Kirby?

As businesses navigate an increasingly complex digital landscape, Augustus Kirby remains a go-to expert for those looking to merge data-driven strategy with ethical marketing. His focus is shifting toward helping brands build resilient marketing infrastructures that can withstand industry disruptions. “Marketing is about evolution,” he concludes. “Companies that innovate while staying true to their values will not just survive – they’ll thrive.”

Looking ahead, New York’s Augustus Kirby is exploring new AI and machine learning applications in marketing automation, aiming to streamline workflows and improve conversion rates even further. His consulting firm continues to work with brands ready to embrace change and build future-proof marketing strategies. “The future belongs to those who innovate fearlessly,” he states. And I plan to help brands lead that charge.”

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release6 days ago

From $10K to a Global Action Trilogy: Maria Tran’s Echo 8 Saga Redefines Indie Cinema

-

Press Release1 week ago

BLENIX TECHNOLOGY Launches BLENIX CHAIN: A Purpose-Driven Blockchain for Real-World Sustainability

-

Press Release7 days ago

Meana Raptor Announces Presale with Real-World Utility, NFT Integration, and Anti-Whale Protections

-

Press Release1 week ago

We Row For William: Family of 6-Year-Old Boy with Terminal Illness Launches Urgent Campaign to Fund Life-Saving Gene Therapy

-

Press Release7 days ago

PU Prime And Argentine Football Association Unite to Elevate Skills On and Off the Field

-

Press Release1 week ago

CoinW Will Launch Solana-based Meme Coin Retard Finder Coin (RFC)

-

Press Release1 week ago

Teen Sisters Code Website to Give Everyone A Voice

-

Press Release3 days ago

Six Years In: Matrixport’s Ascent from Crypto Asset Manager to Web3 Super Account