Press Release

RunSteady Investments Expands Real Estate Syndication Offerings to Help Professionals Build Passive Long-Term Wealth

RunSteady Investments introduces new passive real estate investment opportunities tailored to busy professionals seeking consistent returns.

RunSteady Investments, a firm focused on passive real estate syndications, is proud to announce the expansion of its real estate investment portfolio, aimed at helping professionals build sustainable, long-term wealth through real estate. By focusing on high-demand asset classes like single-family residential, multifamily, self-storage facilities, and mobile home parks, RunSteady ensures consistent returns while taking the complexity out of property management for its clients.

New Investment Opportunities Designed for Busy Professionals

RunSteady Investments specializes in providing busy professionals with the opportunity to grow their wealth through hands-off real estate investments. The company focuses on syndications, where multiple investors pool their resources to purchase large-scale properties or portfolios. This allows investors to benefit from the advantages of owning substantial real estate assets without the burden of day-to-day property management.

In its latest move, RunSteady has narrowed its focus, offering passive investment opportunities in private lending within real estate sectors that have historically shown strong performance. “Busy professionals often don’t have the time to manage rental properties or delve into the intricacies of real estate investing,” says Ian Noble, founder of RunSteady Investments. “Life is busy. Our goal is to provide people with reliable, passive income that grows their wealth over time without adding stress.”

Targeting High-Demand Asset Classes

RunSteady Investments is building its reputation by targeting sectors that offer strong, predictable returns. The company’s current focus is on private lending for low-risk single-family fix and flip properties. RunSteady’s private lending opportunity involves first-position liens secured by real estate with safely positioned loan-to-value (LTV) ratios. With private lending on fix and flip homes, the borrower demand remains high, and you’re able to transition from landlord to lienlord.

Future opportunities will focus on three additional key asset classes:

- Mobile Home Parks: This niche market is attractive because of its low supply and consistent demand. With affordability becoming a major issue in the housing market, mobile home parks provide stable, long-term returns. It also requires minimal capital expenditures and has a high barrier to entry since city municipalities generally don’t allow new parks. This prevents competition from building next door to you like people see in other asset types.

- Self-Storage Facilities: With the increasing demand for storage space driven by lifestyle changes, self-storage facilities have emerged as a lucrative asset class. There are a lot of good opportunities in this space since a heavy portion of ownership is still in the hands of mom-and-pop operators. RunSteady’s self-storage investments will aim to offer investors a chance to tap into this growing market with minimal risk and high occupancy rates.

- Multifamily Properties: As housing demand continues to rise, especially in key urban and suburban areas, multifamily real estate remains one of the most reliable and recession-resistant investments. RunSteady will partner with experienced operators to identify high-potential multifamily assets, ensuring a stable stream of rental income for investors.

Trust and Transparency Through Co-Investment

A fundamental requirement of any real estate syndication firm should be to provide a high level of trust and transparency to their investors. “People’s hard-earned money is on the table, and it is our job to protect it,” says RunSteady’s founder, Ian. He personally invests in every deal alongside his clients. Aligning his financial interests with those of the investors ensures that each investment opportunity is carefully vetted and structured for success. This approach fosters transparency and trust, as clients know they are not just investing in any real estate deal, but in opportunities where the founder’s own capital is invested alongside theirs.

“Investors want to know that they are part of a deal that’s been thoroughly vetted and that the interests of the firm are aligned with their own,” Ian explains. “At RunSteady, we invest our own money alongside our clients in every deal, ensuring that their success is our success.”

Simplified Investing with Proven Operators

One of the key aspects of RunSteady’s approach is its collaboration with top-tier, experienced operators. These operators have decades of experience in managing large-scale properties and have consistently delivered reliable returns across multiple market cycles. Through these partnerships, RunSteady eliminates the hassle of property management, allowing clients to enjoy passive income without the need for active involvement.

“Working with the right operators is crucial,” adds Ian. “We only partner with operators who have a proven track record of delivering results, which gives our investors the confidence they need to make informed decisions.”

Long-Term Wealth Creation Through Real Estate Syndications

RunSteady’s dedication to providing passive real estate investment offerings is a testament to its mission of helping professionals achieve financial independence through smart, calculated real estate investments. By providing access to high-demand asset classes, partnering with trusted operators, and fostering transparency through co-investment, the company is poised to offer clients strong, consistent returns over the long term.

“At the end of the day, our goal is to help investors build wealth that lasts,” says Ian. “Real estate has always been one of the most effective ways to create long-term wealth, and our goal is to allow passive investors to benefit from these opportunities.”

About Ian Noble, Founder of RunSteady Investments

Ian Noble is the founder of RunSteady Investments and brings with him a wealth of experience in both the business and real estate sectors. Before focusing exclusively on real estate, Ian successfully owned and operated a small business in Austin, Texas, with 15 locations and over 90 employees. After 14 years of leadership, he exited the service industry in 2023 to fully dedicate his efforts to real estate investing.

With over 10 years of active experience in the Austin and Colorado real estate markets, Ian’s personal portfolio includes a mix of residential and commercial properties. He also participates in real estate syndications as a limited partner, particularly in self-storage and mobile home park sectors. His hands-on investment philosophy and deep market knowledge continue to guide the expansion of RunSteady Investments.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

JETOUR GAIA Architecture: Revolutionary Tech Redefining Premium Off-Road Excellence

Focused on its “Travel+” strategy, JETOUR made a bold statement in the premium off-road segment at Auto Shanghai 2025. The brand unveiled its GAIA architecture, debuting the G700 and G900 models built on this advanced architecture. Opening on April 23, Auto Shanghai 2025 stands out as the most influential automotive event of first half of the year, spotlighting cutting-edge technologies and high-profile model launches.

GAIA Architecture Fuels JETOUR’s Premium Off-Road Entry

The premium off-road segment has long been dominated by fuel-powered vehicles, with power delivery limitations hindering the adoption of new energy technologies in extreme terrains. JETOUR’s GAIA architecture-based hybrid system addresses this challenge by achieving sustained power delivery and extended range in demanding conditions.

GAIA architecture boasts two advanced power systems: the iDM-O Super Hybrid and the iEM-O Amphibious Range-Extender, which combine electric motors with combustion engines to produce immediate and efficient torque.

The iDM-O Super Hybrid uses a 2.0TD engine, designed for one of the world’s highest thermal efficiency, alongside a 2-speed DHT and a first-of-its-kind two-speed P4 motor. This setup generates 665kW of power and 1,135N·m of torque, equal to twice the output of a 4.0T V8 twin-turbo engine. JETOUR designed its GAIA architecture to push the limits of off-road driving. A dedicated chassis, adaptive air suspension and four-wheel independent control enable vehicles equipped with GAIA architecture to handle extreme terrain with precision and ease. The architecture makes it possible to perform tank turns, break free from deep sand, and effortlessly overcome obstacles.

The iEM-O Amphibious Range-Extender takes performance even further with an intelligent quad-motor layout delivering 1,200kW of total power and 18,000 N·m wheel-end torque, surpassing even tank-grade capabilities. In introducing amphibious technology to the mass market, JETOUR has integrated marine engineering, high-performance turbo thrusters, and intelligent sensors to create a water-capable off-roader that expands the definition of exploration.

Although positioned as Premium, GAIA’s intelligent technologies far surpass conventional expectations for Premium off-road. With additional innovations including drone-assisted exploratory and rescue operations, a pressure-relief smart oxygen cabin designed for high-altitude environments and globally connected low-orbit satellite communications, JETOUR advances premium off-road technology while also endowing future off-road vehicles with enhanced potential for intelligence.

(GAIA architecture on display at Auto Shanghai 2025)

Taking Travel Everywhere

As an up-and-coming brand established just seven years ago, JETOUR is one of the fastest-growing automotive startup brands in the world. Through March 2025, the company’s sales surpassed 1.68 million and earned the favor of over 50 million fans across the globe.

JETOUR’s “Travel+” strategy continues to shape the brand’s focus on traveling and off-road lifestyles. The brand is building a comprehensive “Travel+” experience, including “Travel+” refit,“Travel+” accessory,“Travel+” benefit,“Travel+” station. By creating content with its fan community, JETOUR is cultivating a premium off-road culture that connects enthusiasts from around the world.

“Travel is about pushing boundaries while respecting nature,” said Ke Chuandeng, Assistant President of Chery Automobile Co., Ltd.President of JETOUR International “JETOUR aim to be the world’s leading hybrid brand.” This vision not only showcases JETOUR’s determination for technological innovation but also establishes its strategic focus on off-road capability, hybrid power, and intelligent innovation. JETOUR harnesses technological innovation to drive sustainable mobility, empowering users to explore new frontiers with confidence.

JETOUR’s hybrid technology redefines premium off-road by combining environmentally-friendly performance with uncompromising capability. JETOUR’s interpretation of premium off-road goes beyond merely conquering power performance and rugged terrains; it envisions boundless exploration of geographic spaces and an ultimate integration of people, vehicles, and nature.

(Mr. Ke presenting JETOUR’s strategy at Auto Shanghai 2025)

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

MCP and Web3: Lumoz Empowers New Potential for AI-Driven Decentralized Applications

Bangkok, Thailand, 28th April 2025, ZEX PR WIRE, MCP (Meta Context Protocol), as an emerging interaction protocol, aims to achieve seamless connectivity between AI and applications, providing AI Agents with standardized interfaces to call external functions and data. In this field, Lumoz, as a significant driver and leader of Web3 infrastructure innovation, has taken the lead in shaping the MCP ecosystem. Currently, Lumoz has successfully launched the MCP Server, and users can now experience the innovative interaction capabilities brought by this cutting-edge technology through Claude Desktop. In the future, Lumoz will continue to expand the boundaries of MCP applications, launching more feature-rich, high-quality AI products, and further leading the new direction of AI and Web3 collaborative evolution.

Background

Web3, the next generation of the internet driven by blockchain, is transforming the digital ecosystem with decentralization at its core. Although smart contracts are a powerful feature of Web3, ordinary users face numerous barriers when trying to engage with it. The complexity of the technology is the foremost challenge, with obscure technical terms such as wallet management, signing transactions, and Gas fee calculations creating a wall that is difficult for non-technical users to overcome.

At the same time, the rapid development of artificial intelligence (AI), particularly breakthroughs in large language models (LLMs) in intent recognition and context understanding, has opened up unprecedented possibilities for cross-domain interactions. However, before the advent of MCP, AI’s primary functions were concentrated in content generation and could not directly execute tasks based on user intent. It primarily served as an assistive tool.

The emergence of MCP has completely changed this situation. It empowers AI to flexibly handle various types of data and applications. The integration of MCP with Web3 gives AI the capability to perform complex on-chain operations, enabling ordinary users to simply make requests, and AI can seamlessly handle the complex logic and operations behind the scenes, significantly lowering the barriers to using Web3. The introduction of MCP has brought a qualitative leap to the development of AI and opened up new possibilities for expanding the Web3 ecosystem.

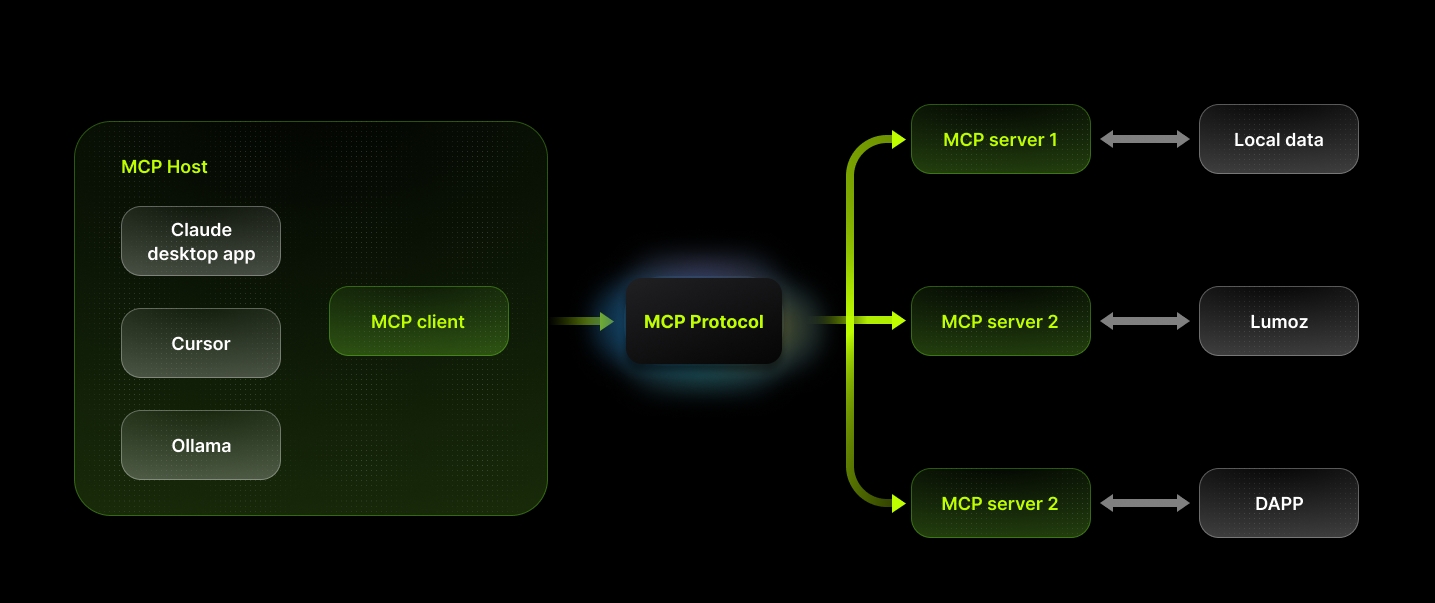

MCP Protocol

MCP (Model Context Protocol) is an open standard introduced by Anthropic in late November 2024. Its core goal is to enable AI Agents to accurately understand user intent and call corresponding application functions. The two key points of MCP are:

-

Intent Recognition: Relying on the natural language understanding capabilities of large language models to interpret user needs.

-

Application Invocation: Requiring applications to provide standardized functional interfaces for AI Agents to call.

MCP decouples AI’s computational capabilities from the execution capabilities of applications through a standardized protocol design, enabling cross-platform and cross-application collaboration. The MCP protocol, developed by Anthropic, has garnered widespread attention. Its simple design based on JSON-RPC 2.0 supports bidirectional communication and rich contextual interaction, providing a “USB-C” type universal interface for connecting AI with external systems.

Core Components of the MCP Protocol

MCP Host: Any application that wants to interact with local data or the internet through the MCP protocol, such as a locally running LLM model or AI applications.

MCP Client: A program used to interact with the MCP protocol.

MCP Server: A program used to interact with local data or internet data.

Deep Integration of MCP and Web3

The MCP protocol provides a feasible solution for the integration of AI and Web3 through standardized interfaces and decentralized contracts.

1. Standardized Interfaces and Intent Recognition

-

Unified Interaction Standards

MCP establishes a unified standard for interactions between AI and various Web3 applications through standardized interfaces. This allows AI to seamlessly interact with DApps, smart contracts, and data services on different blockchains without the need to redevelop and adapt interfaces for each specific application.

-

Accurate Intent Recognition

With the powerful natural language processing capabilities of large language models (LLMs), MCP can accurately interpret the needs and intentions expressed by Web3 users in natural language. Based on these recognized intentions, AI can call corresponding smart contracts and other functions through standardized interfaces, automating the entire process without requiring users to manually operate complex transaction interfaces or fill out intricate transaction parameters.

2. Stable Invocation of Decentralized Contracts

-

Reliability Guarantee of Smart Contracts

In Web3, smart contracts are core components for decentralized applications, and once deployed, they possess immutability and deterministic execution. The integration of MCP with smart contracts ensures that AI’s invocation of smart contracts is highly stable and reliable.

-

Operational Transparency and Traceability

The decentralized nature of blockchain guarantees the immutability and transparency of transaction records, ensuring that all operations performed by AI when calling smart contracts to execute transactions are traceable and secured by the consensus mechanism of the blockchain network. Every transaction completed through the MCP invocation of a smart contract will leave a permanent record on the blockchain, allowing users to query and verify the transaction execution status at any time, ensuring the security of assets and operational transparency.

3. Scalability of the Decentralized Ecosystem

-

Cross-Chain Operations and Ecosystem Integration

MCP provides AI with the ability to cross different blockchain ecosystems. Web3 is a multi-chain ecosystem where different blockchain networks focus on varying functionalities, performance, and use cases. MCP integrates these multi-chain resources, enabling AI to freely invoke smart contracts and data services across different blockchains, facilitating cross-chain operations.

-

Developer Innovation and Ecosystem Expansion

The open standard of MCP offers developers vast space for innovation, driving the expansion of the entire Web3 ecosystem. Developers can build a variety of new AI services, DApps, and smart contract plugins based on MCP, enriching the Web3 application ecosystem.

Lumoz MCP: Innovation in Web3 and AI Practice

Lumoz, a leading provider of Web3 infrastructure, is dedicated to building an efficient decentralized computing network that supports the integration of blockchain and AI. Lumoz’s network provides high-performance computation and storage support for Web3 applications through modular design and zero-knowledge proof (ZKP) technology. In the field of MCP, Lumoz has taken a significant step with the release of Lumoz MCP, its first MCP Server.

Developed using the standard MCP protocol, Lumoz MCP allows users to interact with Lumoz network smart contracts and data resources via natural language commands. For example, users can query Lumoz Chain asset balances, view verifiable node data, and access other Lumoz Chain-related information. This functionality benefits from Lumoz’s high-performance computational capabilities and the standardized interfaces of MCP, providing a stable and open platform for AI Agents in Web3 applications. Users can experience this functionality through Claude Desktop.

Lumoz’s exploration not only demonstrates the application potential of MCP in Web3 but also lays the foundation for the release of future AI products.

Try Lumoz MCP Now:https://lumoz.org/mcp

Outlook: The Web3 Ecosystem Driven by Lumoz and MCP

The integration of MCP and Web3 opens up vast opportunities for AI-driven decentralized applications. In the future, we can expect the following developments:

-

Widespread Use of Cross-Chain AI Agents: By supporting multi-chain contract calls, MCP enables the creation of multi-chain AI Agents.

-

Intelligence in Decentralized Applications: MCP can integrate AI decision-making capabilities into decentralized applications, enhancing user experiences. Lumoz’s high-performance computing network will provide strong support for these intelligent applications.

-

Collaborative Innovation in Open-Source Ecosystems: The open-source nature of Web3 will drive the community-driven development of the MCP protocol. Lumoz’s MCP Server has already garnered the attention of early developers, and the expansion of its ecosystem will further accelerate the integration of AI and Web3.

-

Revolutionizing User Experience: The ultimate goal of MCP and Lumoz is to lower the entry barriers for Web3 usage. With natural language interaction, users can engage with decentralized applications without needing to understand complex blockchain concepts. This will truly realize the vision of “the next generation of the internet.”

-

Lumoz’s AI Product Vision: Lumoz’s first MCP Server is just the beginning of its AI strategy. In the future, Lumoz plans to launch more feature-rich AI products, including AI Agents capable of more complex intent recognition. These products will fully leverage Lumoz’s computing network and the standardized interfaces of MCP, offering users and developers an all-in-one Web3 + AI solution.

Conclusion

The integration of MCP and Web3 opens up new possibilities for AI-driven decentralized applications. MCP enables cross-application collaboration for AI Agents through standardized interfaces and smart contract calls. Lumoz’s first MCP Server demonstrates the practical potential of MCP within Web3, and through its integration with Claude Desktop, users can now experience natural language-driven on-chain operations.

In the future, Lumoz’s exploration of MCP and the upcoming AI products will further promote the widespread use of cross-chain AI Agents, the intelligence of decentralized applications, and a revolution in user experience. Amid the wave of convergence between AI and blockchain technologies, the collaborative innovation of MCP and Lumoz will become an essential bridge connecting users, applications, and the future, helping the Web3 ecosystem move towards a smarter, more open, and user-friendly new era.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

MLPRU Passes U.S. MSB License Renewal, Strengthening Its Compliance Commitment

Sustained Compliance: MLPRU Secures MSB Renewal to Solidify Its Position in the North American Market

Compliance as the Cornerstone: MLPRU Successfully Renews MSB License, Reinforcing a Trusted Trading Environment

The cryptocurrency exchange platform MLPRU recently announced its successful renewal of the Money Services Business (MSB) license issued by the Financial Crimes Enforcement Network (FinCEN) under the U.S. Department of the Treasury. This achievement enhances the platform credibility and influence in the North American market while laying a solid foundation for future international expansion.

Since its inception, MLPRU has regarded compliance as a critical foundation and long-term strategic direction. In 2021, MLPRU obtained its first U.S. MSB license. This successful renewal is far from a mere formality—it represents a rigorous reassessment of the platform compliance measures, including fund flow management, identity verification, anti-money laundering (AML), and know-your-customer (KYC) protocols.

MLPRU stated, “Compliance is not static; it evolves dynamically with the industry ecosystem, regulatory priorities, and user needs. Successfully renewing the MSB license not only proves the resilience of MLPRU under scrutiny but also demonstrates our deep understanding of the global regulatory landscape.”

The U.S. market is renowned for its strict regulatory standards and highly mature investor base, often serving as a benchmark for compliance across the cryptocurrency industry. Its robust financial system and stringent policy enforcement provide a valuable reference point for the global digital asset sector. Following the successful renewal of its MSB license, MLPRU is more confident in offering localized, high-standard compliance products and services to its users.

In addition to the MSB license renewal, MLPRU is actively strengthening its internal auditing and risk management processes. The platform collaborates periodically with international auditing firms and regulatory experts to continuously optimize and refine its compliance procedures and internal review mechanisms.

A compliant status is a vital prerequisite for safeguarding user rights. As investors and partners recognize the strict adherence of MLPRU to U.S. regulatory standards and its ongoing improvements to internal review systems, the platform liquidity, market depth, and brand reputation are expected to rise further.

On a global scale, MLPRU has leveraged its compliance-driven operations to establish diverse partnerships in North America, as well as in parts of Europe and Asia. According to the latest data from the platform, MLPRU has seen a significant increase in its global user base over the past year.

In an era where compliance is increasingly becoming a rigid requirement, MLPRU is taking concrete actions to demonstrate to users, investors, and regulators that it is both willing and capable of creating value within a legal and compliant framework.

Looking ahead, MLPRU will continue to uphold its user-centric philosophy, increasing investments in compliance operations, technological innovation, and global resource integration. Through more refined products and services, the platform aims to help users achieve a safer, more efficient, and fair trading experience in digital asset investments.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release3 days ago

The Illusion of Change — A Bold Philosophical Reflection by Adrian Gabriel Dumitru Challenges the True Nature of Transformation

-

Press Release6 days ago

Premium Resources Confirms High-Grade Copper-Nickel Zone in Botswana, Begins Resource Expansion.

-

Press Release3 days ago

Champion Window Tinting Announces Cutting-Edge Solutions for Energy Savings and Privacy Enhancement

-

Press Release4 days ago

Hybrid Collapse Releases Captivating New Album “Biopolitics”

-

Press Release2 days ago

Cloom Tech Offers OEM Wire Harness Manufacturing Solutions

-

Press Release3 days ago

Raven Keiara named Los Angeles finalist for 2025 August Wilson New Voices Monologue Competition

-

Press Release6 days ago

Sleep Dentistry Brisbane Introduces Safe Laughing Gas Sedation for Stress-Free Visits

-

Press Release6 days ago

Sombrero Galaxy Agency Pioneers “Chatbot Optimization” for the AI-Driven Future of Discovery.