Press Release

Nexys, LLC Launches to Transform the Mortgage Industry with Innovative Software Solutions

New York, NY, United States, 24th Aug 2024 – Nexys, LLC, https://www.nexys.com/, a pioneering software development company, is proud to announce its official launch, bringing cutting-edge technology to the mortgage industry. Led by Chief Technology Officer (CTO) Charles Park, Nexys, LLC is dedicated to revolutionizing the mortgage process with its suite of software solutions tailored for mortgage Customer Relationship Management (CRM), Loan Origination Systems (LOS), and Loan Servicing. With a vision to streamline operations and enhance customer experiences, Nexys, LLC is set to become a game-changer for lenders, brokers, and servicers across the nation.

A Comprehensive Suite of Mortgage Software Solutions

Nexys, LLC enters the market with a powerful portfolio designed to address the unique needs of the mortgage industry. The company’s offerings include:

- Mortgage CRM: An intelligent platform that optimizes customer engagement, retention, and sales conversions.

- Loan Origination Software (LOS): A sophisticated system that simplifies the loan origination process, ensuring compliance, accuracy, and efficiency.

- Loan Servicing Software: A robust solution that manages the entire lifecycle of a loan, from disbursement to payoff, with precision and transparency.

By providing an integrated approach, Nexys, LLC enables mortgage professionals to operate seamlessly, reduce operational costs, and deliver unparalleled service to their clients.

Meeting the Industry’s Evolving Needs

The mortgage industry is facing unprecedented changes, driven by technological advancements, regulatory pressures, and shifting consumer expectations. As a result, mortgage companies require tools that not only keep pace with these changes but also help them stay ahead of the competition. Nexys, LLC is uniquely positioned to meet these needs with software solutions that are both innovative and adaptable.

“Our goal at Nexys, LLC is to empower mortgage professionals with the technology they need to succeed in a rapidly evolving market,” said Charles Park, CTO of Nexys, LLC. “We understand the challenges faced by lenders, brokers, and servicers, and we’ve developed our software to address these challenges head-on. Our platforms are designed to enhance efficiency, ensure compliance, and, most importantly, improve the customer experience.”

Mortgage CRM: Transforming Customer Relationships

Nexys, LLC’s Mortgage CRM is more than just a tool for managing leads and contacts; it is a comprehensive platform that drives customer engagement and retention. The system leverages advanced analytics and automation to provide mortgage professionals with deep insights into customer behavior, enabling them to tailor their marketing and sales strategies effectively.

Key features of the Mortgage CRM include:

- Automated Lead Management: Automatically capture, score, and assign leads based on predefined criteria, ensuring that no opportunity is missed.

- Personalized Communication: Create and send targeted email campaigns, SMS messages, and social media outreach, all personalized to the individual needs and preferences of each customer.

- Pipeline Management: Track the progress of every deal in real-time, from initial contact to closing, with customizable dashboards and reporting.

- Customer Retention: Use data-driven insights to identify at-risk customers and implement strategies to retain them, improving lifetime value.

By integrating these features, Nexys, LLC’s Mortgage CRM ensures that mortgage professionals can build stronger, more profitable relationships with their clients.

Loan Origination Software (LOS): Streamlining the Loan Process

Loan origination is a complex, multi-step process that requires precision, compliance, and speed. Nexys, LLC’s Loan Origination Software (LOS) is designed to simplify this process, allowing mortgage lenders to process applications more efficiently while maintaining the highest levels of accuracy and regulatory compliance.

“In today’s fast-paced market, mortgage lenders need tools that can keep up with demand while ensuring that every loan meets the required standards,” said Charles Park. “Our LOS is designed to do just that, with features that automate key tasks, reduce errors, and improve overall efficiency.”

Key features of the Loan Origination Software include:

- Document Management: Securely upload, store, and manage all loan-related documents in a centralized repository, accessible from anywhere.

- Automated Compliance Checks: Ensure that every loan meets local, state, and federal regulations with built-in compliance monitoring and alerts.

- Underwriting Workflow: Streamline the underwriting process with automated workflows that reduce manual tasks and improve turnaround times.

- Integrated Communication: Keep all stakeholders informed with real-time updates and communication tools that facilitate collaboration between lenders, brokers, and borrowers.

Nexys, LLC’s LOS not only reduces the time and effort required to originate loans but also enhances the overall quality and consistency of the loan portfolio.

Loan Servicing Software: Managing the Full Loan Lifecycle

Once a loan is originated, it must be serviced effectively to ensure that it performs as expected. Nexys, LLC’s Loan Servicing Software is designed to manage the entire lifecycle of a loan, from initial disbursement to final payoff. The platform offers comprehensive tools for managing payments, escrow, customer inquiries, and more, all within a secure, user-friendly environment.

“Effective loan servicing is critical to the long-term success of any mortgage business,” said Charles Park. “Our Loan Servicing Software is built to provide mortgage servicers with the tools they need to manage their portfolios efficiently, reduce delinquencies, and enhance customer satisfaction.”

Key features of the Loan Servicing Software include:

- Payment Processing: Automate payment collection, posting, and reconciliation with support for multiple payment methods, including ACH, credit card, and wire transfer.

- Escrow Management: Accurately track and manage escrow accounts for taxes, insurance, and other obligations, with automated disbursements and reporting.

- Customer Service Tools: Empower customer service teams with a 360-degree view of each loan, enabling them to respond to inquiries quickly and effectively.

- Delinquency Management: Monitor and manage delinquent accounts with automated alerts, follow-up actions, and reporting to minimize losses.

Nexys, LLC’s Loan Servicing Software ensures that mortgage servicers can maintain control over their portfolios while providing a superior level of service to their customers.

Innovation and Adaptability at the Core

What sets Nexys, LLC apart in the crowded mortgage software market is its commitment to innovation and adaptability. The company’s platforms are built on a modern, cloud-based architecture that allows for seamless updates and integrations, ensuring that clients always have access to the latest features and capabilities.

“We believe that the future of the mortgage industry lies in technology that is not only powerful but also flexible,” said Charles Park. “Our software is designed to grow with our clients, adapting to their needs as their businesses evolve. Whether they are expanding their services, entering new markets, or adjusting to regulatory changes, Nexys, LLC is here to support them every step of the way.”

A Vision for the Future

Looking ahead, Nexys, LLC has ambitious plans to continue expanding its product offerings and enhancing its existing platforms. The company is actively investing in research and development to explore new technologies, such as artificial intelligence (AI) and machine learning, that have the potential to further transform the mortgage industry.

“Our journey is just beginning,” said Charles Park. “We are committed to staying at the forefront of technological innovation and delivering solutions that help our clients thrive in an increasingly competitive market. At Nexys, LLC, we see a future where mortgage processes are faster, simpler, and more transparent than ever before, and we are excited to be leading the way.”

About Nexys, LLC

Nexys, LLC is a forward-thinking software company dedicated to providing innovative solutions to the mortgage industry. Founded by a team of industry veterans and technology experts, Nexys, LLC offers a comprehensive suite of software products, including Mortgage CRM, Loan Origination Software (LOS), and Loan Servicing Software. With a focus on efficiency, compliance, and customer satisfaction, Nexys, LLC empowers mortgage professionals to achieve their business goals and deliver exceptional service to their clients.

Media Contact

Organization: Nexys, LLC

Contact Person: Charles Park

Website: https://www.nexys.com/home

Email: cpark@nexys.com

Contact Number: +19175971119

Address: 8206 Louisiana Blvd NE a 3583, Albuquerque, NM 87113

City: FLUSHING

State: NY

Country: United States

Release Id: 24082416027

The post Nexys, LLC Launches to Transform the Mortgage Industry with Innovative Software Solutions appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

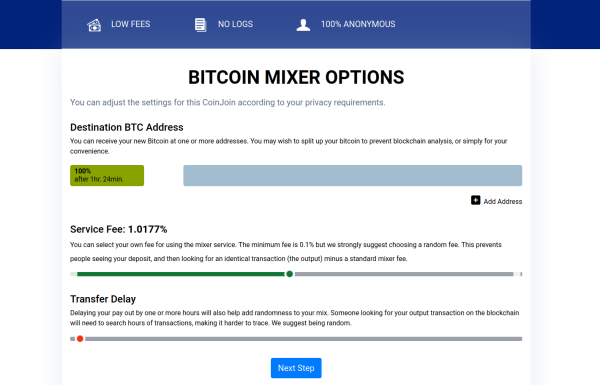

CoinJoin: Enhancing Bitcoin and Bitcoin Cash Privacy with Advanced Transaction Mixing

CoinJoin is a privacy-enhancing technique for Bitcoin and Bitcoin Cash transactions. By combining multiple transactions into a single transaction with multiple inputs and outputs, CoinJoin breaks the direct link between senders and recipients, making it harder to trace financial activities. This decentralized approach ensures enhanced privacy, lower transaction fees, and greater user control. As financial surveillance increases, CoinJoin remains a crucial tool for maintaining anonymity in the crypto space. Originally proposed by Gregory Maxwell in 2013, CoinJoin continues to be integrated into various privacy-focused wallets and services.

Texas, United States, 24th Feb 2025 – CoinJoin is revolutionizing the way users achieve financial privacy in Bitcoin and Bitcoin Cash transactions. By leveraging advanced cryptographic techniques, CoinJoin enables users to anonymize their transactions, making it nearly impossible for third parties to trace their financial activities.

How CoinJoin Works

CoinJoin is a privacy-enhancing technique that combines multiple transactions into a single, large transaction with multiple inputs and outputs. This process breaks the direct linkage between senders and recipients, making blockchain analysis significantly more difficult. By mixing transactions, CoinJoin enhances user privacy without altering the fundamental structure of the Bitcoin protocol.

Key Features

- Enhanced Privacy – Transactions are mixed in a way that prevents clear identification of the original sender and recipient.

- No Central Authority – CoinJoin is a decentralized approach to transaction anonymization, ensuring users retain full control over their funds.

- Lower Fees – By batching multiple transactions into one, CoinJoin helps reduce transaction costs while improving privacy.

- Open-Source and Transparent – CoinJoin technology is open-source, allowing developers and the community to audit and enhance its security.

The Importance of Privacy in Cryptocurrency

As financial surveillance increases, tools like CoinJoin play a critical role in preserving user autonomy and financial confidentiality. Bitcoin and Bitcoin Cash users seeking greater privacy can rely on CoinJoin to obscure their transaction histories and protect their digital assets from unwanted scrutiny.

For more information about CoinJoin and its implementation in various platforms, visit leading privacy-focused Bitcoin wallets and services that support CoinJoin technology.

About CoinJoin

CoinJoin is a Bitcoin privacy technique first proposed by Gregory Maxwell in 2013. By mixing multiple transactions into a single, indistinguishable transaction, CoinJoin enhances anonymity while maintaining the security and efficiency of blockchain networks.

Media Contact

Organization: CoinJoin Mixer

Contact Person: Victoriafromtexas

Website: https://coinjoin.cash/

Email: Send Email

City: Texas

Country: United States

Release Id: 24022524309

The post CoinJoin: Enhancing Bitcoin and Bitcoin Cash Privacy with Advanced Transaction Mixing appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

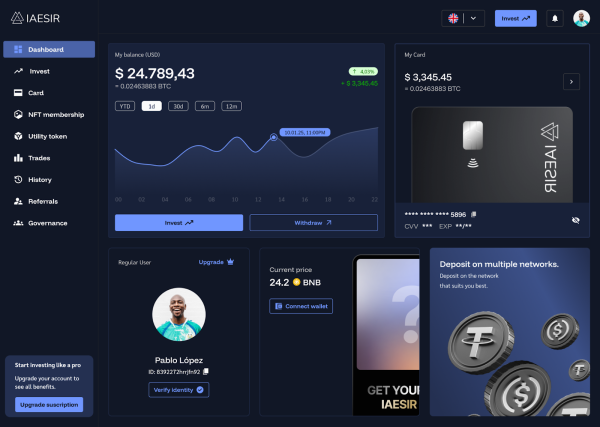

IAESIR Surpasses $200 Million in Assets Under Management, Expands Financial Solutions with IAESIR Debit Card

Dubai, United Arab Emirates, 24th Feb 2025 – IAESIR, a leader in AI-powered investment solutions, has officially surpassed $200 million in assets under management (AUM), reinforcing its position as a trusted investment platform for both institutional and retail investors.

In response to its growing ecosystem, IAESIR is now expanding its financial services, including the launch of the IAESIR Debit Card, designed to integrate digital asset management with everyday transactions.

A Growing AI-Powered Investment Platform

IAESIR’s continuous growth is driven by its proprietary algorithmic trading models, which leverage neural networks and real-time market analysis to execute high-efficiency trades while managing risk effectively.

The platform’s commitment to financial security and regulatory compliance has further fueled its adoption among investors worldwide.

Key Factors Behind IAESIR’s Growth

AI-Driven Algorithmic Trading: Proprietary technology that utilizes machine learning models and order book analysis to optimize decision-making.

Risk Management & Stability: IAESIR maintains a structured asset allocation strategy, ensuring at least 70% of assets are held in stablecoins to mitigate volatility.

Regulatory Compliance & Security: IAESIR is progressing toward VARA licensing in the UAE and SEC compliance in the United States, ensuring adherence to strict financial regulations.

Integration with Real-World Finance: The IAESIR Debit Card enables users to seamlessly convert digital assets into everyday payments, bridging the gap between crypto investments and traditional spending.

Institutional-Grade Transparency: Operating within Binance’s audited regulatory framework, IAESIR ensures top-tier security protocols and investor protections.

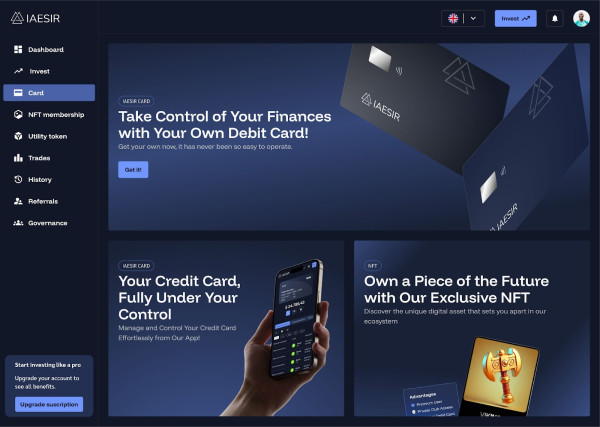

Introducing the IAESIR Debit Card

As part of its financial expansion, IAESIR is launching the IAESIR Debit Card, providing investors with a direct link between their digital assets and real-world transactions.

The card allows users to:

Convert crypto holdings into fiat for spending at any merchant accepting debit card payments.

Manage investments and liquidity on the go, integrating seamlessly with the IAESIR ecosystem.

Benefit from exclusive financial incentives tied to the IAESIR token (FEHU) and staking programs.

Future Expansion and Market Impact

IAESIR’s continued success signals a growing demand for AI-driven financial solutions. Looking ahead, the company is committed to:

Enhancing AI Trading Capabilities to further optimize investment performance.

Expanding Institutional Partnerships to increase accessibility to AI-powered financial tools.

Strengthening Compliance Measures to meet evolving global financial regulations.

About IAESIR

IAESIR is a financial technology company specializing in AI-powered trading and blockchain-based investment solutions.

The platform prioritizes regulatory compliance, security, and transparency, offering investors innovative tools for intelligent and risk-adjusted asset management.

For more details, visit IAESIR Finance.

Media Contact

Organization: IAESIR Finance

Contact Person: Whitley

Website: https://www.iaesirfinance.com/

Email: support@iaesirfinance.com

Country: United Arab Emirates

Release Id: 24022524210

The post IAESIR Surpasses $200 Million in Assets Under Management, Expands Financial Solutions with IAESIR Debit Card appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Benefits Of Video Marketing Boosts Engagement

Video marketing enhances audience connection through storytelling, leading to higher retention and emotional bonds. Studies show video can improve conversion rates by up to 80%, with tools like explainer videos and live streams increasing interaction.

Sacramento, California, United States, 24th Feb 2025 – Harnessing the power of dynamic visual content enables businesses to forge stronger connections with their viewers. Engagement flourishes as brands craft compelling narratives that resonate deeply with audiences. Through storytelling, video captivates and holds the viewer’s attention, leading to enhanced audience retention. This innovative approach not only personalizes the brand experience but also facilitates lasting emotional bonds. Statistics indicate that incorporating video can yield up to 80% higher conversion rates than traditional text formats. Tools like explainer videos and live streams significantly amplify interaction, further boosting engagement.

As organizations embrace these strategies, the myriad advantages of utilizing video marketing become increasingly clear.

Click here to learn more about: services

Click here to learn more about: services

Understanding Engagement Through Video Marketing

Leveraging captivating visuals can significantly enhance audience interest and interaction. Video marketing plays a strategic role in boosting online presence, ensuring content captures viewer attention effectively.

Engaging video ads create memorable experiences, prompting viewers to share and discuss.

Employing storytelling alongside humor enhances audience retention, which is vital for maintaining connection.

Platforms like Google Analytics facilitate tracking of interaction rates, offering insights for improving conversion rates. Actively gathering feedback from your audience leads to content that is relevant and targeted.

Each video must incorporate a clear call to action, guiding viewers towards specific outcomes while amplifying lead generation opportunities.

How Video Increases Brand Awareness

Utilizing engaging video content can significantly enhance the effectiveness of brand messaging. Dynamic visuals draw attention, promoting brand recall and awareness.

Customer testimonials crafted in video format can build viewer trust more effectively than text alone.

Shareable videos are instrumental in expanding your reach across social media platforms, effortlessly boosting visibility.

Incorporating user-generated content adds a layer of authenticity, creating stronger connections with diverse audiences. Companies leveraging product demonstrations through video often report increased interaction rates and conversions.

Mobile viewing facilitates real-time engagement, allowing brands to connect with potential customers wherever they are. Investing in targeted video marketing strategies can yield impressive returns in building brand recognition.

Video Marketing

- Video content is 1200% more likely to be shared than text and images combined.

- Including a video on a landing page can increase conversions by up to 80%.

- Over 50% of consumers prefer watching video content to reading text.

- Mobile video consumption rises by 100% every year, highlighting the importance of mobile-friendly content.

The Role Of Storytelling In Videos

Videos enhance engagement and foster connections through compelling narratives. Content marketing strategies that tap into emotions create memorable experiences, which promote brand loyalty.

Engaging narratives keep audiences invested, driving curiosity and interaction.

Successful video marketing integrates brand values, showcasing unique offerings that resonate with viewers.

- Brands harnessing storytelling often experience improved viewer retention rates.

- Analytics show that videos featuring captivating narratives are more likely to achieve viral marketing success.

Authenticity and trust established through storytelling foster credibility, cultivating lasting relationships with consumers.

Leveraging storytelling in video marketing strategies is a cornerstone for sustained audience engagement.

Enhancing Audience Retention With Visual Content

Engaging audiences effectively requires more than just traditional formats; utilizing video formats creates memorable interactions. Effective visuals can captivate viewers far longer than simple text or static images.

Research indicates that video elements significantly enhance retention rates, becoming indispensable for marketing strategies.

Incorporating interactive videos fosters deeper engagement, allowing audiences to participate actively in the narrative.

High-quality production techniques play a significant role in enhancing the viewer’s experience, allowing for stronger brand identity. To amplify customer reach, crafting creative campaigns around compelling visuals can drive interest and action.

Capturing attention early is paramount in a digital landscape characterized by fleeting moments, where concise formats can play a pivotal role in keeping audiences connected.

Engaging Audiences

- Video content can increase viewer retention rates by up to 95% compared to text alone.

- Interactive videos can lead to a 70% increase in engagement compared to traditional video formats.

- High-quality visuals enhance brand identity and can improve customer perception and loyalty.

- Short, captivating content is crucial for maintaining audience attention in a fast-paced digital environment.

Strategies For Effective Lead Generation

Generating new business opportunities remains a fundamental element of success for companies. Promotional content plays a pivotal role by effectively capturing the attention of potential customers.

Engaging video marketing strategies drive significant web traffic, as visually rich materials hold viewer interest longer.

Crafting compelling messages allows businesses to showcase their offerings and express their brand identity.

Utilizing demographic insights enhances targeting precision for video campaigns, ensuring the right audience is reached. Incorporating clear calls to action transforms passive viewers into active leads, making these components indispensable.

Therefore, educational videos must feature impactful CTAs encouraging direct responses from viewers. Integrating such strategies into a broader lead generation plan can greatly increase business growth and sustainability.

Why Video Ads Boost Conversion Rates

Engaging customers through dynamic visuals can transform marketing outcomes.

Statistics reveal live streaming techniques significantly enhance conversion effectiveness compared to traditional methods.

Case studies indicate brands leveraging email marketing with engaging videos see considerable increases in user interaction.

Emotional storytelling within brand messaging strengthens connections and resonates deeply with viewers.

Creative event coverage and well-produced video ads maximize audience engagement and retention.

Strong calls-to-action embedded in videos motivate consumers effectively, spurring them to take action.

Integrating video marketing strategies plays a pivotal role in achieving measurable business success.

Leveraging Social Media For Video Success

Effective engagement strategies can significantly enhance overall video production outcomes. Social media platforms create dynamic opportunities for video content’s shareability, which drives viewer interaction and retention.

Emphasizing compelling visuals and narratives tailored to specific audiences will help maximize reach.

Thoughtful platform integration, where content is customized for each network, plays a pivotal role in capturing attention.

Leveraging unique features such as stories and live streaming can further elevate interaction and engagement levels. Encouraging user-generated content nurtures authenticity, thereby strengthening brand perception and loyalty.

Including a strong call to action within each video not only improves clickthrough rates but also fosters deeper connections with viewers. Regularly analyzing viewer feedback is instrumental in refining approaches and maximizing overall effectiveness.

Analyzing Viewer Feedback For Improvements

Section>

Collecting and interpreting viewer feedback is essential for optimizing multimedia content. This process enhances user engagement, enabling brands to pinpoint audience preferences accurately.

Employing methods such as surveys and direct comments facilitates a deeper understanding of viewer sentiments.

Insights gleaned from this data empower marketers to tailor their video strategies effectively.

Utilizing platforms like Google Analytics provides vital metrics that can enhance marketing effectiveness. Having feedback mechanisms embedded within video hosting platforms secures real-time responses from audiences.

By refining video presentations based on insightful feedback, brands can fortify their connections and significantly enhance overall engagement.

Viewer Feedback in Multimedia Content

- Surveys can increase response rates by up to 30%, providing valuable insights into audience preferences.

- Brands that actively engage with viewer feedback see a 20% increase in user retention.

- Real-time feedback mechanisms can lead to a 15% improvement in viewer satisfaction and engagement metrics.

- Utilizing analytics tools can help marketers identify trends, leading to more effective content strategies and higher conversion rates.

Video Marketing For Small Businesses Boosts Engagement

Video Marketing Boosts Engagement

Video Marketing For Small Businesses Boosts Engagement

Video Marketing Boosts Engagement

Social Savvy

1401 21ST STREET SUITE R, SACRAMENTO, CA 95811

888-599-4312

Media Contact

Organization: Social Savvy

Contact Person: Social Savvy

Website: https://weresocialsavvy.com/

Email: Send Email

Contact Number: +18885994312

Address: 1401 21ST STREET SUITE R, SACRAMENTO, CA 95811

City: Sacramento

State: California

Country: United States

Release Id: 24022524301

The post Benefits Of Video Marketing Boosts Engagement appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release6 days ago

Dynamic Team of Students Launches Revolutionary AI Monster 3D Platform

-

Press Release6 days ago

KODDPA to Go Public on NASDAQ

-

Press Release6 days ago

ForU AI Pioneers the Future of Real-World AI Agents through the Community AI-DiD Initiative

-

Press Release6 days ago

HIPPO, a meme coin, will be listed on CoinW Exchange

-

Press Release7 days ago

Sitngo Accepts Car Rental Payments in USDT Cryptocurrency

-

Press Release4 days ago

Twings Supply Enhances Logistics with Seamless Door-to-Door Shipping Solutions

-

Press Release4 days ago

Twings Supply Strengthens Global Trade with Reliable Freight Forwarding Services

-

Press Release4 days ago

Global Publicist 24 Unveils Special Edition: Her Vision, Her Legacy: A Tribute to Women Business Leaders