Press Release

Navigating the Crypto Slump: 4E Exchange Offers Stability and Growth Amid Market Uncertainty

Malaysia, 30th Sep 2024 – The current crypto market continues to be sluggish, and a turnaround seems unlikely in the short term, leaving investors generally feeling lost. In this context, managing one’s funds has become a hot topic in the market.

The Crypto Market’s Persistent Decline

The cryptocurrency market in 2024 is markedly different from previous years. Although Bitcoin’s price surged from $26,000 to over $70,000, following a series of positive events, the crypto market has seen the most severe correction of this bull cycle, experiencing several significant declines, with panic spreading throughout the market.

Past bull markets were often accompanied by new concepts, such as the ICO craze of 2017 and DeFi and NFTs in 2021. However, this year’s market lacks new narratives. Most projects are merely replicating old models, and investors are losing interest, with many even doubting the potential of crypto projects to solve real-world problems and achieve widespread adoption.

After six months of decline, the current market resembles a frightened bird, with sentiment downcast and increasingly reliant on external macroeconomic factors. Although the Federal Reserve has initiated an interest rate-cutting cycle, which is favorable for risk assets in the long term, its focus on core inflation may lead to more cautious monetary policies, exacerbating short-term volatility. There are growing concerns that the U.S. economy is heading toward a recession.

Earn Products Are in High Demand

The complex market environment has led to a loss of confidence among investors. One of the most universal and practical strategies is reducing positions and increasing the proportion of holdings in USDT. Earning products that can generate extra income during this quiet market period have become highly sought after.

Unfortunately, the yields of most earning products offered by current platforms seem rather underwhelming. For example, in USDT savings accounts, the annualized yield from the three largest CEXs is around 1.8% at Binance, 2% at OKX, and Bybit, although claiming 7.23%, only offers this rate on amounts up to 500 USDT, with anything beyond that earning just 2.23%. For fixed-term products, annual yields are generally around 3%. While some platforms occasionally launch higher-yielding products, they are often in short supply and difficult for ordinary investors to grab. On-chain DeFi projects are similarly lackluster, with Curve offering an annualized yield of about 2.44% on stablecoins, and Aave and Compound at 1.5% and 2%, respectively.

The yields from earning products fail to meet investors’ asset growth needs, and the market is in urgent need of channels that can ensure both asset security and reasonable returns. Against this backdrop, 4E’s Earns have emerged as a standout option.

4E Earns: The Perfect Balance Between High Returns and Flexibility

4E, a platform that has quickly risen this year, launched a range of competitive products during its anniversary celebration, cleverly balancing high returns with liquidity, offering investors a highly attractive choice.

Flexible Earns: Compared to the approximately 2% annual yield offered by major platforms, 4E’s flexible savings accounts offer an annual yield of 2.5%. Unlike similar products on the market, this rate applies to all deposits without any tiered restrictions. The “deposit and withdraw anytime” feature of 4E’s flexible savings is a flexible and beneficial option for investors holding USDT and waiting to trade at any moment.

Fixed-term Earns: To meet the diverse needs of users, 4E offers three USDT fixed-term products, with annual yields of up to 5.5%, nearly double those of similar products on the market. Specifically, these include a 14-day term with a 5% yield, 30 days at 5.5%, and 90 days at 5.5%. For those who feel there are no immediate market opportunities, selecting a fixed-term savings product based on their liquidity needs can provide a relatively stable return.

Quantitative Earns: For investors seeking higher returns, 4E’s quantitative earnings offer an annualized return of 6%. These products utilize market data and algorithmic models for automated trading, generating high returns for investors in a short time.

On-chain Yield: Compared to the annual yield of around 2% offered by DeFi projects on USDT, 4E’s on-chain yield reaches an impressive 5%. Investors don’t need to manage on-chain wallets and smart contracts themselves, as the platform handles the investment into on-chain protocols, saving both time and effort.

Through its diverse range of earning products, 4E not only meets the demand for high returns but also ensures liquidity and safety, providing investors with a comprehensive earning solution.

In the current sluggish crypto market, frequent trading could increase the risk of losses, making prudent fund management more important than ever. A steady investment strategy and patiently waiting for a market turnaround might be the wisest course of action for now. With its diversified earning solutions, 4E allows investors to earn stable returns even during the market’s “off-season,” preparing them for the market’s eventual rebound.

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Media Contact

Organization: 4E Exchange

Contact Person: Rachel Soh

Website: https://www.eeee.com/

Email: Send Email

Country: Malaysia

Release Id: 30092417611

The post Navigating the Crypto Slump: 4E Exchange Offers Stability and Growth Amid Market Uncertainty appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Rat Corpse Discovered at the Resident’s Property by Abal Environmental Services Ltd Operative

Errol Baptiste the Northolt resident being visited by Abal Environmental Services Ltd Operative on February 19, 2025, also found evidence of rat corpse decomposing inside the property for 32 months since June 15, 2022, which explained the rancid odour. Rats has been accessing via hole in front way of the resident’s property and then accessing loft space via pipework in proximinty.

Access holes into the property have been blocked up with wire silicon solution and wire after more than 32 months which was reported to Ealing Council by Errol Baptiste the resident and his representative on June 15, 2022, on the rodent infestation. Ealing Council inadvertently failed by ignoring Mr Baptiste’s complaint on the rodent’s issue which was first reported to the Council confirmed evidence from Abel Environmental Services Ltd discovered a corpse of the dead rat on February 19, 2025.

Ealing Council ignored Errol Baptiste’s complaints for 32 months since June 15, 2022, about the rat infestation and he was abused by the Council which they never considered Mr Baptiste’s vulnerabilities on the comorbid and complex ill-health related to the resident’s disabilities breached the Data Protection Act 2018, Section 45, Section 94, and GDPR 2018, Article 15. Ealing Council inadvertently failed to do anything on the Rat Infestation until February 19, 2025, after 32 months delay never took Errol Baptiste’s complaints seriously and were very dismissive that was reported on June 15, 2022, breached the Prevention of Damage by Pests Act 1949.

https://www.ealingtoday.co.uk>page=ldrshousing016

https://harrowonline.org/2025/03/09/northolt-resident-says-council-don’t…

Media Contact:

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Choose YESMiner and move towards a future of daily stable income

YESMiner, a highly-watched blockchain mining platform, provides users with a low-cost entry point to Bitcoin mining. This move aims to lower the threshold for traditional mining and enable more users to participate in the digital currency ecosystem and benefit from it.

It is reported that one of YESMiner’s core services is cloud mining solutions. As a model that does not require users to directly purchase and maintain mining equipment, cloud mining has been favored by more and more investors in recent years. YESMiner predicts that by 2025, cloud mining will usher in rapid development and its market potential will be further released globally. The company said that it will provide users with a more efficient and sustainable mining experience through technical optimization and cost control.

In addition, YESMiner’s positioning in the blockchain economy has also attracted much attention. As a platform dedicated to promoting the popularization of blockchain technology, YESMiner is not only actively involved in the field of Bitcoin mining, but also exploring how to provide support for a wider range of blockchain application scenarios. This diversified development strategy helps to consolidate its competitive advantage in the industry.

It is worth mentioning that the YESMiner platform is strictly regulated by the UK Financial Conduct Authority (FCA). This compliance measure provides users with greater security and trust, and also reflects YESMiner’s commitment to industry standards and transparent operations.

Earn Profits with YESMiner Cloud Mining

1: Register now to get a $100 bonus ($1 for daily check-ins).

2: Choose a contract: After successfully registering, the next step is to choose a mining contract that suits your goals and budget. YESMiner offers a variety of contracts to meet different needs, whether you are a beginner or an experienced miner.

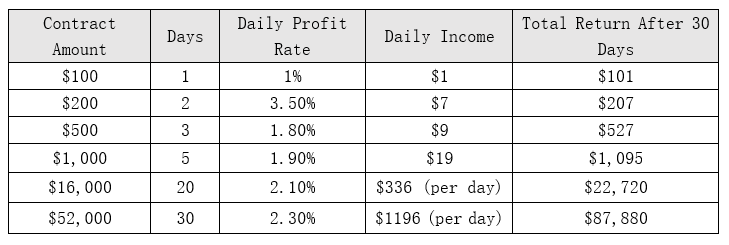

Choose the contract that suits your investment strategy:

3: Start making a profit: After selecting and activating a mining contract, you can sit back and let the system do the work for you. YESMiner’s advanced technology ensures that your mining operations run efficiently, thereby maximizing your potential earnings.

In the face of rapid changes in blockchain technology and the digital currency market, YESMiner said it will continue to uphold the concept of innovation and responsibility, provide users with high-quality services, and promote the healthy development of the entire industry.

About YESMiner:

YESMiner is an innovative company focusing on Bitcoin mining and blockchain technology applications, and is committed to providing users with efficient, secure, and low-cost digital asset management services. Through technological innovation and compliant operations, YESMiner has become one of the most trusted platforms in the industry.

Company name: YESMiner

Company website: https://yesminer.com/

Company email: cooperate@yes-miner.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Vtrading Releases Trading Ecosystem Whitepaper: Redefining the Cognitive Revolution of Wealth in the Digital Era

Amid a global cryptocurrency market with a daily trading volume exceeding $50 billion, 82% of retail investors continue to struggle with persistent losses. This structural contradiction has become the key entry point for the next-generation trading platform Vtrading to disrupt the status quo. Recently, Vtrading officially released its Trading Ecosystem Whitepaper, unveiling the world’s first “Cognition-Decision-Execution” tripartite trading operating system. The platform aims to redefine wealth creation paradigms in the digital age through technological innovation.

I. Scientific Revolution in Trading Paradigms: From Empiricism to Cognitive Industrialization

Traditional trading markets suffer from systemic cognitive gaps. CoinMarketCap data reveals that 73% of users mechanically apply RSI indicators without understanding their mathematical essence, while 97% of investors fail to distinguish between market beta returns and personal alpha returns. This cognitive divide directly triggers behavioral biases: during the 2023 Pepe coin surge, 63% of retail buy orders clustered within 1 hour of price peaks, only 11% set stop-loss instructions, and average holding periods lasted just 27 minutes—far below institutional averages of 83 hours.

Vtrading champions the core philosophy that “cognition is capital,” breaking down trading competence into a quantifiable, trainable industrial system. Its AI architecture integrates three engines:

– Intelligent Strategy Generator: Combines natural language interaction and genetic algorithms, enabling users to generate code frameworks via inputs like “BTC intraday volatility strategy, max drawdown 3%.”

– Decision Enhancement Network: Deploys a millisecond-response Trading Sentinel system, monitoring 100+ candlestick patterns and 60+ technical indicators across timeframes.

– Cognitive Evolution Workshop: Dynamically integrates 1,200+ trading concepts via knowledge graphs, with a 21-day cognitive restructuring program that boosted trainees’ average returns by 220%.

Early results are striking: users leveraging smart alerts saw trade opportunity capture rates rise by 73%, holding periods extend from 6.2 to 38.7 hours, and risk-adjusted returns reverse from -12.3% to +9.8%.

II. Building an Assembly Line for Cognitive Evolution

Vtrading’s product matrix targets three pain points in traditional trading ecosystems:

1.Cognitive Infrastructure Layer (VTrading Academy)

– Dynamic Knowledge Graph: Links candlestick patterns, technical indicators, and on-chain data, unlocking tool access as users master concepts like RSI.

– Live Simulation Sandbox: Tests strategies against historical data and stress models.

– Competency Assessment Model: Generates a Cognitive Index (formula: 0.4test scores + 0.6strategy returns).

2.Decision Enhancement Layer (Intelligent Trading Sentinel)

– Multi-Dimensional Signal Engine: Monitors 1-minute signals and 4-hour trends, triggering app/SMS alerts for critical events.

– Scenario-Based Strategy Templates: Prebuilt setups like “Meme Coin Sniper (500% social media spike + on-chain whale activity).”

– AI Alert Network: Detects anomalous trades with 95% interception accuracy.

3.Value Closure Layer (AI Strategy Workshop)

– Natural Language Programming: Converts strategy descriptions into executable code.

– Personalized Parameter Tuning: Dynamically optimizes indicators (e.g., adjusting RSI periods from 12 to 9 days for aggressive users).

– Strategy Monetization: Top strategies earn 39.7% average annual returns in copy-trading ecosystems.

III. World-Class Security Architecture

Vtrading safeguards both assets and cognition:

– Asset Security Triad:

MPC-TSS 2.0 protocol uses (3,5) threshold signatures, with private key shards stored across 5 geonodes (cracking cost >$1 billion).

Real-time risk control (e.g., AnomalyDetector class in code) blocks suspicious transactions with <0.3% false positives.

Daily Merkle Tree reserves with zk-SNARKs verification.

– Cognitive Security:

GAN-simulated 2008/2018-level crashes eliminate 89% of overfitted strategies.

Credibility models filter 92% of fake news across 50+ sources.

Bias correction systems halt “double-down” behaviors via risk circuit-breakers.

IV. Pioneering Web3 Collaboration Networks

Vtrading’s three-dimensional ecosystem includes:

– Developer Ecosystem: Open SDKs (backtesting frameworks), Data Lake APIs (10TB+ on-chain data), and Oracle networks (30+ data feeds), rewarding contributors via token incentives.

– Institutional Collaboration: Federated learning for private data sharing, cross-chain atomic settlement protocols (with MIT) reducing清算 latency to milliseconds.

– Community Governance: Token holders vote on 70% of product updates. An on-chain reputation system quantifies trading skills and contributions as NFT credentials, granting access to metaverse terminals.

V. Vision: Defining a New Trading Civilization

By 2030, Vtrading aims to:

– Establish global competency standards (L1-L4 certification).

– Launch next-gen OS integrating AI, cross-chain protocols, and metaverse terminals.

– Reduce irrational trading losses by $21 billion annually and nurture 380,000 digital nomad developers.

Early network effects are evident: users completing the 21-day program reduced trading frequency by 54% but improved risk-reward ratios by 220%. A viral referral model (R(inviter)=Σ(1/2^(k-1)*BaseReward) and 120,000+ NFT credentials underscore rapid adoption.

In this cognitive revolution, Vtrading poses a fundamental question: As trading competence becomes a core digital-age literacy, do we need a holistic upgrade—from tools to mental models? Let’s find out at Vtrading.com

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release7 days ago

Seospidy CEO Rahul Sharma Honored with Digital Excellence Award 2025 at Global Icon Awards Ceremony

-

Press Release6 days ago

NEKO Reborn: The Catcoin Slayer Unleashes Fun, Value, and Trust in a Community-Driven CryptoRevolution

-

Press Release1 week ago

Ace Comfort Air Conditioning and Heating Reaffirms Commitment to AC Repair and Installation in Houston Neighborhoods

-

Press Release6 days ago

SIX MINING Launches Remote Crypto Mining Contracts Amid Rising Demand for Accessible Investment Solutions

-

Press Release5 days ago

Dubai-Based Broker Kamil Magomedov Completes Record Sale of Three Entire Buildings in Under Seven Hours Amid Escalating Demand at Expo City

-

Press Release6 days ago

Trading Reimagined: KlasFX Upgrades User Experience with Investor-First Approach

-

Press Release5 days ago

Macmillan Lawyers and Advisors Specialises in Drone Law Services in Brisbane

-

Press Release6 days ago

Lilysuck: Where Genuine Pleasure Encounters Uncompromising Quality