Press Release

Brighty App Launches AI-Powered Investment Platform Reinventing How People Trade

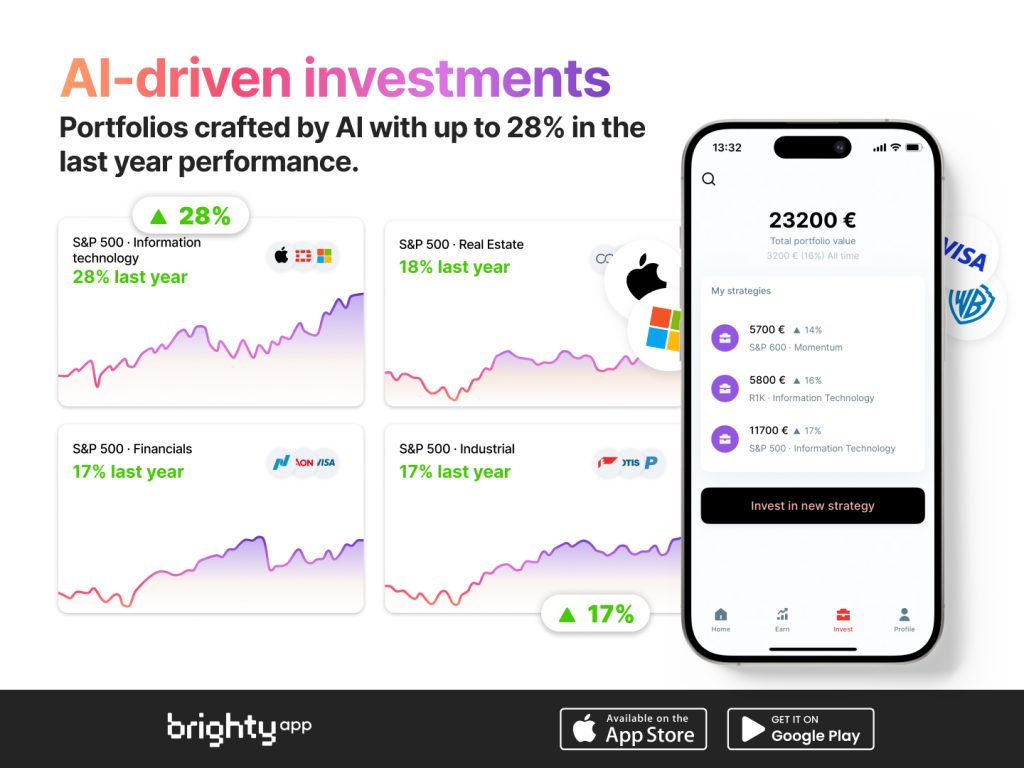

Baar, Switzerland, 9th October 2024, ZEX PR WIRE, Brighty App has recently presented its AI-powered investment platform to the trading community. The announcement marks yet another step forward in the way artificial intelligence is transforming the asset management sector.

With tailored portfolios, data-driven strategies, and continuous monitoring, Brighty App is reinventing how people trade in the digital age. Investors can now easily access diverse sectors such as Momentum, Industrial, and more.

A New Entrance in the AI Investment Field

AI for trading is no longer a science fiction dream preserved for advanced quant firms. Brighty’s AI-powered investment platform opens the door for anyone to enjoy advanced strategies. This new trading ecosystem also comes with diversified portfolios and a zero-commission environment.

On Brighty App, users can invest in sectors such as real estate or industrial and let AI drive the strategies. These tailor-made portfolios have hit yearly returns as high as 21%. This target was possible thanks to sophisticated algorithms working day and night with the analyses of market data. In this way, these different systems evolve with dynamic trends and investor behavior to achieve maximum returns.

The AI Investment management platform by Brighty App gives users an edge since its data-driven strategies change with market variables. This automates the approach to continuous monitoring and adjustment, thereby allowing investments that are continuously in tune with financial goals.

Instant deposits and withdrawals represent another major selling point of this technology. These operations generally take several business days to be completed with a broker, but Brighty is using new technologies.

Investment Strategies and Portfolio Management

Brighty’s AI technology lets users invest in diverse and data-driven portfolios with a simple click.

Brighty is using AI to enable investment in diversified, data-driven portfolios with a single click. Trades continuously undergo analysis and rebalancing for market trends and news. Users can build valuable insight into the market by leveraging AI analysis of millions of data points.

This allows for investments across various sectors such as NASDAQ, S&P 500, momentum, industrial, dividends, real estate, energy, and more.

The idea of setting a continuous investment strategy aims to overperform the market and provide stable long-term investment returns. At the core of this technology stands the belief that AI-powered solutions can perform better than an average human approach.

Brighty App PRO offers a seamless investment experience, letting users invest in curated portfolios and strategies with a single click. This intuitive feature simplifies the process, enabling anyone to begin investing right away without dealing with complicated administrative tasks.

About Brighty App

Brighty App is a prime Swiss fiat & crypto platform with virtual and physical payment cards. The application is available both on the App Store and Google Play. Users have the ability to spend, transfer, and manage their assets in one place.

With up to 10% yearly interest on crypto deposits, the Brighty app is building something new for its online community. The project’s team is highly qualified, with seasoned bankers and experienced ex-Revolut software developers leading the way. Any users in EU and EEA countries can make the most out of this app by downloading it.

Any reader curious about the intersection of traditional banking and cryptocurrency will find more information on Brighty App’s official website. The social pages below will allow anyone to stay on top of news updates and join the Brighty’s community.

LinkedIn | Instagram | X (Twitter) | Telegram

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Understanding Bitcoin Mining with BSTR Miner Dark Pool Contracts

Cryptocurrency mining has evolved significantly, with cloud mining emerging as a game-changer for those looking to profit from Bitcoin without the need for expensive equipment or technical expertise. BSTR Miner, a leading cloud mining provider, has announced new BTC Cloud Mining Contracts for users to earn up to $9,999 daily profits.

The Rise of Bitcoin Cloud Mining

The traditional barriers to Bitcoin mining—such as high initial investment, complex technical setups, and significant electricity costs—have deterred many potential participants. However, BSTR Miner aims to bridge this gap by offering BTC cloud mining services that allow users to rent mining power and earn passive income without the associated complexities.

The company emphasizes the numerous advantages of BTC cloud mining, including:

- Accessibility: Users worldwide can participate via an internet connection.

- Cost-effectiveness: No need for expensive hardware or electricity bills.

- Ease of use: No technical expertise required.

- Scalability: Flexible contract plans cater to different investment budgets.

- Environmental responsibility: Utilization of renewable energy sources like wind and solar power.

- Quick returns: Profits start accumulating within 24 hours of contract activation.

How to Start Mining Bitcoin with BSTR Miner

BSTR Miner, established in 2019, has built a reputation over eight years with more than 60 large-scale mining data centers worldwide. The company has amassed a user base of over 5 million crypto enthusiasts and investors.

To get started with BSTR Miner’s cloud mining platform, users must follow a simple four-step process:

- Choose a Mining Provider

BSTR Miner allows users to rent computing power without the need for physical hardware.

- Create an Account

Signing up with an email address grants users an immediate $10 bonus, along with daily login rewards of $0.6.

- Select a Mining Contract

BSTR Miner offers various investment plans based on different budget levels, including:

- Experience computing power: $100 investment for 2 days, yielding $107 in total profit.

- Classic hashrate: $1800 investment for 15 days, yielding $2172.6 in total profit.

- Classic hashrate: $3000 investment for 20 days, yielding $3846 in total profit.

- Advanced computing power: $5000 investment for 30 days, yielding $72250 in total profit.

- Advanced computing power: $10,000 investment for 45 days, yielding $17,560 in total profit.

- Advanced Cloud Computing Power: $28,000 investment for 50 days, yielding $52,780 in total profit.

Users can choose a contract that aligns with their financial goals and risk appetite.

- Activate the Account and Earn

Once a contract is activated, users begin accumulating mining profits, which can be tracked via the platform’s dashboard and withdrawn when ready.

Key Features of BSTR Miner

BSTR Miner distinguishes itself with several unique features that enhance user experience and profitability:

- Global accessibility – Available to users worldwide.

- User-friendly interface – Designed for both beginners and experienced investors.

- 24/7 customer support – A dedicated team assists users at all times.

- Top-tier mining equipment – Uses hardware from industry leaders like Bitmain and Canaan Creative.

- No hardware maintenance required – BSTR Miner handles all technical aspects.

- Green energy commitment – Mines powered by renewable sources.

- Multi-crypto support –USDT-TRC20、BTC、ETH、LTC、USDC、BNB、USDT-ERC20、BCH、DOGE、SOL(Solana), and more.

- Affiliate reward program – Users can earn referral bonuses of up to 4.5%, with top partners eligible for a $22,000 monthly salary bonus.

Start Mining, Start Earning with BSTR Miner

For those eager to explore cloud mining, BSTR Miner offers a promising entry point with its structured investment plans and eco-friendly approach.

To learn more, visit the official website at https://www.bstrminer.com/ or download the mobile app at https://www.bstrminer.com/download/.

Summary

The advantages of BSTR Miner are significant and diverse. They provide an attractive entry point for cryptocurrency mining through cost-effectiveness and accessibility. Let more people benefit from mining cryptocurrency. Whether you are a mining novice or an experienced investor, BSTR Miner‘s platform allows you to easily maximize your profits.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

FXSpire Debuts in Dubai as Forex Traders Seek Smarter Tools Amid Global Uncertainty

Dubai, UAE – 18/04/2025 – (SeaPRwire) – With market volatility on the rise, Avenix Fzco has introduced FXSpire, an expert advisor built to enhance forex trading precision and filter out false breakouts. Market volatility presents both opportunities and challenges. In forex trading, one misstep can mean the difference between a smart entry and a costly mistake. That’s why the ability to spot false breakouts has become essential, and why tools like FXSpire, developed by Avenix Fzco, are helping traders better navigate today’s fast-moving markets.

Understanding False Breakouts and Why They Matter

False breakouts happen when price briefly breaks a support or resistance level before reversing course, often luring traders in and flipping direction. These traps can lead to losses and disrupt overall strategy. Identifying and avoiding them is key to staying consistent, especially in uncertain economic conditions.

Why False Breakout Detection Matters in 2025

As global economic uncertainty increases, detecting false breakouts is more crucial than ever. FXSpire’s technology helps traders filter misleading signals, focus on high-probability setups, and strengthen risk management, all essential for capital preservation and long-term profitability.

Smarter Detection in 2025

With global markets facing heightened unpredictability, distinguishing between real and false signals is more important than ever. FXSpire’s false breakout detection helps traders filter out the noise and zero in on setups that align with momentum, trend, and structure. The result? A more focused strategy with improved decision-making and stronger capital protection.

How FXSpire Works

FXSpire is an Expert Advisor (EA) for MetaTrader 4, tailored specifically for trading the EURUSD currency pair on the M30 chart. At its core, it combines pattern recognition, including formations like the Three White Soldiers and Three Black Crows, with algorithms designed to catch false breakouts before they turn into real losses.

It’s not just about automation, it’s about precision. By identifying high-probability entries and layering on risk safeguards, FXSpire aims to deliver more control and fewer surprises.

Core Features

FXSpire’s approach to trading includes a well-rounded toolset:

- Pattern Recognition Engine: Detects chart formations and filters out false breakouts to highlight better trade opportunities.

- Risk Protection Tools: Uses trend filters, RSI indicators, trailing stops, and filters for spread/slippage to reduce unwanted exposure.

- Flexible Position Management: Offers auto-lot sizing, fixed stop-loss and take-profit levels, and supports up to four simultaneous positions.

In 2025’s forex environment, it’s not enough to automate, you need tools that think ahead. FXSpire offers traders a methodical, data-driven way to tackle volatility while keeping risk in check. Prioritizing precision and adaptability, it helps traders stay focused, confident, and in control of their next move.

About FXSpire

FXSpire is a precision-driven Expert Advisor for MetaTrader 4, optimized for EURUSD trading on the M30 timeframe. Using advanced pattern recognition, false breakout detection, and robust risk management, it helps traders achieve consistent results while minimizing unnecessary risks. Learn more at https://fxspire.com/.

Media contact

Brand: FXSpire

Contact: Media tem

Email: support@fxspire.com

Website: https://fxspire.com/

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Set Sail with Confidence: Miami Sailing School Offers Premier Sailing Education in Biscayne Bay

Miami Sailing School, led by USCG-licensed and ASA-certified Captain Russ Beyer, offers immersive, hands-on sailing instruction on beautiful Biscayne Bay. With beginner to advanced courses taught aboard a 42-foot Catalina 400 MKII, the school provides a premier learning environment for those looking to gain confidence, earn certifications, and embrace the freedom of sailing. Now enrolling students for ASA-certified training and personal sailing experiences.

Miami, Florida, United States, 18th Apr 2025 — Miami Sailing School, led by U.S. Coast Guard-licensed Captain Russ Beyer, is redefining hands-on sailing education in South Florida. Nestled in the turquoise waters of scenic Biscayne Bay, the school provides world-class instruction to aspiring sailors of all skill levels, from total beginners to advanced mariners seeking certification and refinement.

Captain Russ Beyer, owner and head instructor of Miami Sailing School, brings over 15 years of maritime experience and seven years of instructional expertise to the helm. As a certified American Sailing Association (ASA) instructor, he is committed to delivering a high-impact learning experience that blends technical training with a deep appreciation for life on the water.

“Sailing isn’t just a sport—it’s a gateway to freedom, confidence, and adventure,” says Captain Russ. “Our mission is to make sailing accessible and unforgettable for everyone who steps aboard.”

A Premier Location: Learning on Biscayne Bay

Biscayne Bay offers 240 square miles of protected waters, making it one of the most sought-after training grounds in the world. Students enjoy safe, stable learning conditions that accommodate a full range of skills—from basic maneuvers to open-water navigation. The bay’s natural beauty, wildlife sightings, and variable winds provide an enriching, real-world classroom.

Training Vessel: The 42-Foot Catalina 400 MKII

Instruction takes place aboard the state-of-the-art Catalina 400 MKII—a spacious and responsive vessel equipped with modern navigation tools and premium rigging. Ideal for both beginners and experienced sailors, the Catalina 400 MKII offers the comfort of a luxury yacht and the functionality required for top-tier training.

Courses Offered

Miami Sailing School provides a progressive curriculum that meets the needs of recreational sailors and future professionals alike:

Beginner Courses: Focus on sailboat components, docking, sail trimming, and safety.

Advanced Navigation: Covers coastal and offshore navigation, anchoring, emergency procedures, and liveaboard training.

ASA Certification: Official ASA courses that pave the way to chartering or professional opportunities.

Each course emphasizes hands-on learning, allowing students to gain real-world experience in seamanship, navigation, and boat handling.

More Than a Lesson—A Lifestyle

Miami Sailing School is more than an educational program—it’s a transformational experience. Students consistently report increased self-confidence, a stronger sense of independence, and a lasting love for exploration and challenge.

From the thrill of trimming sails in the open breeze to the quiet awe of a Biscayne Bay sunset, each lesson becomes a cherished memory.

Now Enrolling – Your Journey Starts Here

Whether you’re preparing for your first sailing adventure, planning to charter your own boat, or seeking to upgrade your existing skills, Miami Sailing School is your trusted partner on the water.

Why Choose Miami Sailing School?

Expert instruction from a USCG-licensed, ASA-certified captain

Ideal training grounds in one of the world’s best sailing locations

High-performance, luxury training vessel

Courses tailored to all levels

A learning experience that combines education with adventure

Take the Helm Today

Enrollment is now open. Contact Miami Sailing School and discover how you can set sail with confidence under the guidance of Captain Russ Beyer.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release4 days ago

From $10K to a Global Action Trilogy: Maria Tran’s Echo 8 Saga Redefines Indie Cinema

-

Press Release7 days ago

FXSentry New Trading Strategy Launching: The Guardian Forex Robot Designed for Capital Protection

-

Press Release6 days ago

BLENIX TECHNOLOGY Launches BLENIX CHAIN: A Purpose-Driven Blockchain for Real-World Sustainability

-

Press Release5 days ago

Meana Raptor Announces Presale with Real-World Utility, NFT Integration, and Anti-Whale Protections

-

Press Release6 days ago

We Row For William: Family of 6-Year-Old Boy with Terminal Illness Launches Urgent Campaign to Fund Life-Saving Gene Therapy

-

Press Release7 days ago

Bali Harmony Rehab Adopts Trauma-Informed, Holistic Model for Addiction and Mental Health Recovery

-

Press Release5 days ago

PU Prime And Argentine Football Association Unite to Elevate Skills On and Off the Field

-

Press Release6 days ago

Teen Sisters Code Website to Give Everyone A Voice