Press Release

Decentralized And Fully Open-Source Project PlatON Aims To Construct New Generation Financial Infrastructure

In recent years, with rapid development of 5G, Internet of Things, cloud computing and other technologies, the whole society has been evolving and upgrading on the road of informationization, digitization and intelligentization, and the data has become the key factor in the production process. As the value of data resources is gradually recognized, the demand for data circulation and sharing is increasing.

Although entities such as platform enterprises can set up algorithm analysis teams, use crawlers and terminal equipment and other technologies to obtain external data and process the same, provide relevant data to the outside world or provide data services, and overcome their own development problems in a centralized processing mode, from the perspective of the whole society, the data that can be acquired and processed by the centralized processing mode is still limited. The current digital infrastructure cannot meet the urgent needs for data transaction and sharing. Moreover, the inherent protection policy of trade secrets in the industry and the concerns of government departments on security interests restrict the maximum use of data value.

The emergence of blockchain and privacy computing technology provides guarantee and incentive for protecting data privacy and promoting data sharing transactions, and is gradually disrupting the traditional centralized governance model, creating the possibility for building a “decentralized” digital infrastructure.

“Decentralization” Reform And Development Trend In The Financial Field

The financial industry depends on big data, and its essence is in effective allocation of resources on the basis of mutual trust. As the traditional financial system is based on the centralized mode, it is highly dependent on intermediaries such as banks and arbitrators such as courts, which makes the market transaction cost high and the system efficiency low. It requires a lot of paperwork and it is difficult to manage vouchers. Introducing blockchain technology into the financial industry will break through the traditional centralized capital transaction mode and build a scattered and decentralized financial service system, which is called distributed finance (Defi).

Defi is not bound by central financial intermediaries such as banks, exchanges and brokerage companies, and uses blockchain intelligent contracts, which can specify in advance how to deal with all possible disputes and eliminate the necessity of third-party arbitrators, thereby reducing the provision and use of intermediary services and reducing transaction costs within the system. Compared with the traditional financial system, Defi transactions are smoother, and the financial services it provides will not be affected by a single point of failure.

Although Defi has many advantages in technology and business model, its development still faces many challenges. Security, as the first element of financial infrastructure, is also an unavoidable topic in Defi development. Within the financial system, the underlying network carries the transaction flow and payment settlement, while the vast amount of data flowing on nodes is related to customer privacy and trade secrets. In addition to that, whether it is institutional coordination and financial supervision in the short term or profit sharing in the future financial scenario, it is necessary to make a trade-off between data sharing and protection. All these cannot be separated from the escort of private computing technology.

Exploration Of PlatON In Constructing Financial Infrastructure

As a global leader in blockchain + privacy computing, PlatON will provide public infrastructure services under the open-source architecture for global AI and distributed application developers, data providers and various communities, institutions and individuals with computing needs through a new generation of private computing architecture consisting of verifiable computing, secure multi-party computing, zero-knowledge proof and homomorphic encryption.

At present, PlatON technology application scenarios have been extended to credit reporting, payment and clearing, key management and other fields. Facing the future all-digital era, one of PlatON’s core strategies is to explore possible paths for building a new generation of financial infrastructure by relying on privacy computing and its technical endowment, so as to promote large-scale transaction services and liquidity governance of data assets. To this end, PlatON officially launched the meta-network Alaya in October 2020. As the prototype network and “business sandbox” of PlatON’s new generation financial infrastructure, Alaya is committed to becoming the “pioneering demonstration area” of the next generation privacy computing and data asset computing infrastructure in the world.

PlatON is also a decentralized and fully open-source project, and anyone who is willing to support its development can contribute and get rewards. Recently, PlatON launched Hackathon activity on DoraHacks developer platform Hackerlink and set up a bonus pool of 170,000 US dollars, aiming at encouraging developers to emerge new inspiration and create new value, and further enriching the ecological application of PlatON and its meta-network Alaya around the private AI computing network. This activity was officially launched on July 21st and is expected to last until the end of September. The idea is tested on the Alaya development and test network or main network to continuously verify the completeness of the basic functions of the network. PlatON welcomes developers from all over the world to submit blockchain projects based on Alaya network to build a secure and credible digital infrastructure.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Avenix Fzco Introduces Avexbot: Data-Driven Precision for Forex Traders

Limassol, Cyprus – 03/04/2025 – (SeaPRwire) – Avenix Fzco announces the launch of Avexbot, an advanced algorithmic trading system leveraging high-quality tick data to enhance forex trading accuracy. In 2025, the trading world is buzzing about the importance of top-notch data, the quality of your data can make all the difference between success and failure. There’s a growing trend towards using top-notch data processing to supercharge trading strategies. Avexbot, developed by Avenix Fzco, is leading the charge by seamlessly integrating high-quality data into its algorithmic framework, giving traders a real edge in the competitive forex market.

Why Quality Data Matters More Than Ever

Good trading is all about timing and accuracy. But in fast-moving markets, relying on outdated or poor-quality data can skew analysis and lead to missed or misjudged trades. That’s why dependable, high-resolution tick data is essential. It enables trading systems to track market behavior with more clarity and accuracy, turning raw numbers into real insight.

Foundations Built on Precision

Avexbot has been built and refined using 100% quality tick data from Tick Data Suite (Thinkberry SRL). This long-term, high-resolution dataset gives Avexbot the foundation to interpret market conditions accurately, shape its strategies around reliable inputs, and minimize false signals or missed setups.

Practical Features for Informed Decisions

Avexbot’s design puts this data to work with a feature set geared toward clear, disciplined trading:

- Candlestick-Based Momentum Mapping: Avexbot calculates average candlestick values over specific periods based on its examination of daily chart data. This methodology serves as the foundation for identifying market trends and determining opportune moments to enter trades.

- Built for GBP/USD on M15: Focused on one of the most traded currency pairs, it balances opportunity and control with a 15-minute timeframe.

- Intelligent Risk Management: Includes automatic stop-loss settings and real-time position sizing adjustments, adapting to shifting market conditions to protect capital.

What’s Next for Algorithmic Trading

With algorithmic trading expected to grow from $19.95 billion in 2024 to over $22 billion in 2025, quality data and adaptable infrastructure are fast becoming the new standard. Traders using systems built on strong data foundations will be better equipped to handle volatility and evolve with the market.

Avexbot reflects this movement, where clean data meets careful execution. It’s not about chasing trends, but about building a trading system that holds up over time.

About Avexbot

Avexbot is dedicated to providing innovative trading solutions, combining advanced algorithms with expert market insights to enhance forex trading efficiency. Designed for both novice and experienced traders, its expert advisors (EAs) streamline decision-making and maximize profitability. Learn more at https://avexbot.com/.

Media contact

Brand: Avexbot

Contact: PR team

Email: support@avexbot.com

Website: https://avexbot.com/

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

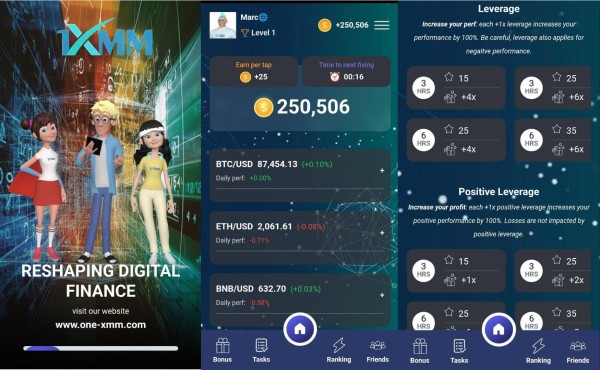

Asagaia Launches its Gamified App known as 1xMM for DeFi Education & Trading

1xMM is a gamified DeFi mini-app that educates users on finance, simplifies trading, and fosters engagement, paving the way for a Metabank.

London, United Kingdom, 1st Apr 2025 – Asagaia Europe Ltd officially announces the launch of 1xMM, on their X account, an innovative gamified DeFi mini-app designed to simplify trading, educate users on financial concepts, and introduce next-generation trading tools.

Set for release by the end of April 2025, this app working as an MVP for the coming exchange, aims to bridge the gap between traditional finance and decentralized markets, paving the way for a Decentralized Order Book Metabank that will redefine how users interact with decentralized markets and liquidity networks.

In addition, Asagaia, has launched its 1xMM Blockchain Token on Ethereum to support this new Ecosystem and is planning on a series of NFT’s by the end of the year.

Addressing the Complexity of DeFi

The decentralized finance (DeFi) market is experiencing rapid growth, with projections estimating an increase from $90 billion today to $350 billion by 2030.

However, many users face barriers to entry due to the complexity of DeFi platforms. 1xMM seeks to lower these barriers by providing an interactive and engaging educational environment for users to explore DeFi trading safely and effectively.

The app provides a structured onboarding process that allows users to familiarize themselves with DeFi mechanics before transitioning to real-world trading. 1xMM is the first project of Asagaia that will eventually create a real order book same as we find in traditional finance.

Key Features of the 1xMM game

Simulated Trading Platform: Users can trade assets in a safe, practice-based environment, gaining real-world trading experience and test strategies without financial risk.

Gamified Learning Experience: Interactive tutorials guide users through essential DeFi concepts like staking, liquidity provision, and decentralized exchanges. This simplifies DeFI’s concepts through those learning modules.

Reward-Based Progression: Completing trading challenges unlocks incentives, making learning both fun and rewarding while easing the onboarding process.

Integrated DeFi Tools: The app serves as an entry point for new users while also introducing experienced traders to innovative trading strategies and tools.

Beyond its educational and engagement functions, 1xMM serves as the foundation for future developments in decentralized finance. The platform aims to facilitate the evolution of decentralized order books and perpetual staking pools. As DeFi adoption continues to expand, Asagaia Europe Ltd anticipates that 1xMM will play a key role in shaping the next generation of decentralized trading platforms.

The platform aligns with a growing trend of bridging traditional financial tools with DeFi innovations, similar to developments seen with platforms such as dYdX and GMX. By integrating familiar trading mechanisms with blockchain technology, 1xMM seeks to make decentralized finance more accessible to a broader audience.

About Asagaia Europe Ltd

Asagaia Europe Ltd is a financial technology company dedicated to advancing decentralized financial solutions. With a mission to enhance accessibility and innovation in DeFi, Asagaia Europe Ltd develops products that empower users to engage with blockchain-based financial ecosystems.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Prestige Yacht Rentals Announces 2025 Summer Season Availability for Private Boat Rentals on Lake Michigan, Chicago IL

As summer kicks off in Chicago, Prestige Yacht Rentals invites locals and tourists to experience the city from the water. Operating out of Diversey Harbor, the company offers a fleet of 8 premium yachts ranging from 31′ to 46′. Ideal for events and leisure cruising, each charter includes top-tier amenities and flexible pricing starting at $150/hour. With demand rising for Chicago Playpen boat rentals and private yacht charters, early reservations are encouraged for peak weekends and holiday events.

Chicago, IL – March 2025 – Prestige Yacht Rentals, a private boat rental service based in Chicago, has officially opened bookings for the 2025 summer season. Operating from Diversey Harbor, the company offers a fleet of eight vessels ranging from 31 to 46 feet, providing charter options for a variety of group events including corporate outings, private celebrations, and lakefront cruises.

With convenient access to popular destinations such as the Chicago Playpen and the Chicago River, Prestige Yacht Rentals continues to serve both local residents and visitors seeking an unforgettable way to explore the city’s waterfront. The company emphasizes safe, private charters with weekday pricing starting at just $150 per hour.

“Chicago summers are all about making memories on the water,” said Nasco, owner of Prestige Yacht Rentals. “Our goal is to offer an elevated yet affordable boating experience for those looking to enjoy the city from a different perspective.”

What to Expect Onboard:

Each vessel comes equipped with Bluetooth sound systems, a floating lily pad for added fun, and spacious decks perfect for socializing—everything needed to create the ultimate summer experience on Lake Michigan.

Important Rental Information:

A USCG-licensed captain is required for every charter. Captains are not included in the rental price and are hired separately at an average rate of $100–$150 per hour.

The legal capacity is 12 guests per vessel, not including the captain.

Weekend charters follow a fixed schedule with limited availability due to high demand.

Advance reservations are highly recommended, especially for Memorial Day Weekend, Fourth of July, and the Chicago Air & Water Show.

Now Accepting 2025 Charter Bookings:

Whether you’re celebrating with friends or exploring the lakefront in style, Prestige Yacht Rentals makes luxury boating in Chicago easy and memorable.

For more information or to inquire about availability, visit www.prestigeyachtrentals.com or follow @PrestigeYachtRentals on Instagram and Facebook.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 week ago

Seospidy CEO Rahul Sharma Honored with Digital Excellence Award 2025 at Global Icon Awards Ceremony

-

Press Release1 week ago

NEKO Reborn: The Catcoin Slayer Unleashes Fun, Value, and Trust in a Community-Driven CryptoRevolution

-

Press Release1 week ago

SIX MINING Launches Remote Crypto Mining Contracts Amid Rising Demand for Accessible Investment Solutions

-

Press Release3 days ago

Digi-Peak: Empowering Users to Create a Safer Digital Cryptocurrency Environment

-

Press Release7 days ago

Dubai-Based Broker Kamil Magomedov Completes Record Sale of Three Entire Buildings in Under Seven Hours Amid Escalating Demand at Expo City

-

Press Release1 week ago

Trading Reimagined: KlasFX Upgrades User Experience with Investor-First Approach

-

Press Release7 days ago

Macmillan Lawyers and Advisors Specialises in Drone Law Services in Brisbane

-

Press Release1 week ago

Lilysuck: Where Genuine Pleasure Encounters Uncompromising Quality