Press Release

Mike Pocrnich: A Seasoned Finance Professional Bringing 20 Years of Expertise to Financial Analysis

Minneapolis, MN, 28th June 2024, ZEX PR WIRE, Mike Pocrnich, a seasoned finance professional, leverages over 20 years of expertise in non-profit accounting, auditing, and financial analysis. With a Bachelor’s degree in Accounting from St. John’s University, he has built a career that blends technical prowess with strategic insight.

Residing in the Minneapolis metro area, Mike enjoys outdoor activities and spending time with his wife, daughters, and their family dog. His journey began at CliftonLarsonAllen as a Senior Auditor, where he managed non-profit audits, crafted internal controls, and mentored new auditors while also conveying complex financial data to organizational leaders.

As a Finance Manager at Element Financial Advisory, Mike excels in providing CFO and Controller services to a broad array of clients. He is adept at building financial forecasts, steering state and federal grant processes, and consulting on organizational financial strategies. His previous tenure as a Controller at Beltz, Kes, Darling & Associates required similar strategic oversight, with additional responsibilities like conducting annual audits and supporting client financing efforts.

With a comprehensive skill set in managing teams and nurturing client relationships, Mike’s leadership is underscored by his high emotional intelligence and communication skills. He manages financial operations, including accounts payable and payroll, with a keen eye for compliance and efficiency. Mike’s consistent application of accounting standards such as GAAP, FASB, and GASB over the past two decades cements his reputation as a detail-oriented and forward-thinking financial strategist. He is a dynamic asset for any entity aiming to refine their fiscal operations and pursue financial excellence.

What Is Financial Analysis?

Financial analysis is the process of evaluating businesses, projects, budgets, and other finance-related transactions to determine their performance and suitability. Typically, financial analysis is used to analyze whether an entity is stable, solvent, liquid, or profitable enough to warrant a monetary investment.

Key Takeaways:

- Internal Financial Analysis: Helps fund managers make future business decisions or review historical trends for past successes.

- External Financial Analysis: Assists investors in choosing the best possible investment opportunities.

- Types of Financial Analysis: Fundamental analysis uses ratios and financial statement data to determine the intrinsic value of a security. Technical analysis focuses on trends in value over time.

Understanding Financial Analysis: Financial analysis is used to evaluate economic trends, set financial policy, build long-term plans for business activity, and identify projects or companies for investment. This is done through the synthesis of financial numbers and data. A financial analyst will thoroughly examine a company’s financial statements—the income statement, balance sheet, and cash flow statement.

Corporate Financial Analysis: In corporate finance, the analysis is conducted internally by the accounting department and shared with management to improve business decision-making. This includes ratios such as net present value (NPV) and internal rate of return (IRR) to find projects worth executing. Tracking days sales outstanding (DSO) helps companies with large receivable balances identify the length of time it takes to turn a credit sale into cash.

Investment Financial Analysis: In investment finance, an external analyst conducts an analysis for investment purposes. Analysts can either conduct a top-down or bottom-up investment approach. A top-down approach looks for macroeconomic opportunities and then drills down to find the best companies within that sector. A bottom-up approach looks at a specific company’s financial health, analyzing financial statements, products, services, supply, and demand.

Financial analysis is only useful as a comparative tool. Calculating a single instance of data is usually worthless; comparing that data against prior periods, other general ledger accounts, or competitor financial information yields useful information.

Types of Financial Analysis

Financial analysis for equity investments can be categorized into two primary types: fundamental analysis and technical analysis.

Fundamental Analysis

Fundamental analysis involves evaluating financial statements to derive ratios, such as earnings per share (EPS), to assess a company’s value. By analyzing these ratios and considering the broader economic and financial context surrounding the company, analysts can determine the intrinsic value of a security. This intrinsic value is then compared with the security’s current market price to identify if it is undervalued or overvalued.

Technical Analysis

Technical analysis focuses on statistical trends derived from trading activities, like moving averages (MA). This method operates on the premise that a security’s price already reflects all publicly available information. Instead of examining a security’s fundamental attributes, technical analysis aims to predict market movements by identifying patterns and trends in stock prices and volumes.

Horizontal vs. Vertical Analysis

When analyzing a company’s financial statements, horizontal and vertical analysis are two prevalent methods. Both use the same dataset but approach it differently.

Horizontal Analysis

Horizontal analysis involves comparing financial data across several years. One year is designated as the baseline, usually the oldest, and subsequent years’ accounts are compared to this baseline. This method highlights which accounts are growing (e.g., revenue) and which are shrinking (e.g., expenses).

Vertical Analysis

Vertical analysis compares every line item on a financial statement to a specific benchmark, typically net sales. For instance, a company might compare the cost of goods sold, gross profit, operating profit, or net income as percentages of net sales. This analysis helps track how these percentages change over time.

Examples of Financial Analysis

In Q1 2024, Amazon.com reported a net income of $10.4 billion, a significant increase from $3.2 billion in Q1 2023. Analysts can use this data for corporate financial analysis. For example, Amazon’s operating profit margins can be calculated as follows:

- 2024: $15,307 million operating income / $143,313 million net sales = 10.7%

- 2023: $4,774 million operating income / $127,358 million net sales = 3.7%

From Q1 2023 to Q1 2024, Amazon’s operating margin increased, indicating the company earned more operating income per dollar of sales.

Why Is Financial Analysis Useful?

Financial analysis is crucial for determining whether an entity is stable, liquid, solvent, or profitable enough to justify investment. It helps evaluate economic trends, set financial policies, develop long-term business plans, and identify viable investment projects or companies.

How Is Financial Analysis Conducted?

Financial analysis is performed in both corporate and investment finance settings. Analysts meticulously review a company’s financial statements, including the income statement, balance sheet, and cash flow statement. A common method is calculating financial ratios to compare a company’s data with that of other companies or its historical performance. In corporate finance, this often involves projecting past performance metrics, like net earnings or profit margins, to estimate future performance.

About Mike Pocrnich: Mike Pocrnich is a finance professional with over 20 years of experience in non-profit accounting, auditing, and financial analysis. He holds a Bachelor’s degree in Accounting from St. John’s University and resides in the Minneapolis metro area.

For more information or to schedule an interview with Mike Pocrnich, please contact:

Mike Pocrnich

https://mikepocrnich.com/

http://www.elementfinancial.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

ABR Electric: Prevent Electrical Overloads with Safe EV Charger Installations in McKinney, TX

As the EV market expands and revolutionizes transportation, the demand for reliable home charging solutions is skyrocketing. ABR Electric recognizes that this growth highlights the critical need for technical expertise and cutting-edge infrastructure to deliver seamless charging experiences for EV owners.

McKinney, Texas, United States, 28th Nov 2024 – ABR Electric Highlights Nuisance Tripping Challenges in EV Charging Stations for McKinney, TX Homeowners. As the electric vehicle (EV) revolution accelerates with leading brands like Tesla, Rivian, Lucid, and Ford Mach-E, homeowners are increasingly looking for reliable solutions to support home charging needs. The transition to sustainable transportation is ushering in a new era of EV infrastructure development, but it also comes with challenges. A critical issue arising from updated electrical codes is the nuisance tripping of Ground Fault Circuit Interrupter (GFCI) breakers, disrupting the convenience of at-home EV charging.

ABR Electric, a trusted provider of residential electrical services in McKinney, TX, is stepping up to address these challenges, helping local residents adapt their home electrical systems to meet the demands of modern EV infrastructure. As the EV market continues to expand and transform how we power transportation, the demand for robust home charging solutions is surging. This growth underscores the need for both technical expertise and innovative infrastructure to ensure seamless charging experiences for EV owners.

Collin County’s Populated Areas: Ensuring Seamless EV Charging ABR Electric’s services extend across McKinney, Allen, Plano, Frisco, and surrounding communities in Collin County. Residents in zip codes such as 75071, 75070, 75072 (McKinney), 75013, 75002 (Allen), 75025, 75023, 75093 (Plano), and 75034, 75035 (Frisco) can count on ABR Electric to deliver tailored solutions that meet their specific EV charging needs. With a rapidly growing population in these areas, the demand for reliable EV infrastructure has surged. Homeowners are seeking expert services to upgrade electrical panels, install hardwired chargers, and address nuisance tripping issues caused by updated NEC codes. ABR Electric’s local expertise ensures that residents in these bustling communities can transition to EV ownership with confidence, knowing their charging systems are designed to meet both current and future requirements for sustainable living.

The Impact of NEC Code Changes on EV Charging The 2020 National Electrical Code (NEC) introduced a significant update with Article 625.54, mandating that all NEMA 14-50 receptacles used for EV charging stations must include Ground Fault Circuit Interrupter (GFCI) protection. This update reflects the NEC’s overarching commitment to enhancing safety standards as electric vehicle (EV) adoption continues to rise. By requiring GFCI protection, the code aims to prevent electric shocks and reduce the risk of fire hazards, cutting off power immediately if a ground fault is detected. This safeguard is particularly crucial for EV charging, given the higher electrical loads involved and the frequent use of outdoor or semi-exposed charging setups where moisture or other environmental factors can increase risk.

However, while this update underscores the NEC’s proactive approach to safety, it has introduced a layer of complexity for homeowners and electricians alike. Nuisance tripping—a phenomenon where the GFCI mechanism shuts off power unnecessarily—has become a common frustration during EV charging sessions. This issue is often attributed to the inherent electrical characteristics of some EV chargers, which can generate ground fault currents that are within safe operating levels but still trigger the GFCI’s sensitive protection mechanism.

The code’s intent aligns with the broader industry shift toward making homes and electrical systems safer, but it also highlights the need for education and adaptation. Electricians must now navigate the balance between compliance and functionality, often working closely with homeowners to troubleshoot and mitigate nuisance tripping issues. For instance, selecting the right combination of EV chargers and GFCI-protected outlets, ensuring proper grounding, and adhering to manufacturer guidelines can help reduce the likelihood of such interruptions.

As the EV market expands with models like Tesla, Rivian, Lucid, and Ford Mach-E leading the charge, the NEC’s guidelines will continue to evolve to accommodate new technologies and use cases. This evolution underscores the importance of staying current with code updates and collaborating with licensed electricians who are familiar with the latest standards. For homeowners, understanding these requirements and their implications not only ensures safety but also optimizes the charging experience for their electric vehicles.

.

Why Nuisance Tripping Happens Many Level 2 EV chargers, like the Tesla Wall Connector, already incorporate internal GFCI protection. When this is paired with the external GFCI protection mandated by the code, the overlapping systems can create unintended electrical interference. This redundancy often results in the circuit breaker tripping unnecessarily—even when no actual ground fault exists.

Homeowners may wake up to find their EV only partially charged, or worse, not charged at all, because the breaker tripped overnight. As James Adams, master electrician and owner of ABR Electric, points out: “Nobody wants to go to bed thinking their car will be ready in the morning, only to discover the breaker tripped at 11 PM. It’s a real problem.”

Challenges for Older Homes The issue becomes even more pronounced in older homes. Modern two-pole 50-amp GFCI breakers required for EV chargers are not always compatible with outdated electrical panels. “Some older panels don’t even support these breakers,” Adams explained. “So, if you’re living in a house with a 20-year-old panel, you’re going to face additional hurdles. Upgrading a panel isn’t a small task—it’s costly and requires professional expertise.”

ABR Electric’s Recommendations for Homeowners To address the challenges posed by nuisance tripping of GFCI breakers, ABR Electric offers the following expert solutions to ensure homeowners can maintain seamless and code-compliant EV charging setups:

- Hardwired EV Chargers: Opting for a hardwired EV charging station is one of the simplest ways to eliminate nuisance tripping. Unlike NEMA 14-50 outlets, which require GFCI breakers under the 2020 NEC guidelines, hardwired chargers come equipped with internal GFCI protection and bypass the need for external breakers. “This setup adheres to all NEC safety standards while reducing the risk of nuisance tripping,” explains Adams. Hardwired installations can also enhance the aesthetics of the garage by reducing visible cables and outlet wear, making it an excellent long-term investment for EV infrastructure.

- Breaker and Panel Upgrades: For homes with older electrical panels, upgrading to a modern panel that supports two-pole 50-amp GFCI breakers is essential to comply with NEC requirements. Many older panels are not compatible with these advanced breakers, making upgrades a necessity rather than an option. Adams notes: “If you live in an older home, this might be the most significant hurdle to overcome. While panel upgrades involve an upfront cost, they prepare your home for future electrical needs beyond EV charging, including potential solar or other energy-efficient systems.”

- Expert Consultation: Working with a licensed electrician is critical to navigating the complexities of EV infrastructure. An experienced professional can assess your home’s current electrical system, recommend the most cost-effective and efficient solutions, and ensure proper compliance with the 2020 NEC. Adams emphasizes: “A lot of people assume they can just buy an EV and plug it in, but that’s not always the case. EV owners need to think through the details—whether their car is compatible with the charging system, whether their panel supports the necessary breakers, and what additional work might be required.”

About ABR Electric

ABR Electric, based in McKinney, TX, is a trusted leader in residential electrical services. With expertise in EV charger installations, electrical panel upgrades, and home safety inspections, the company is dedicated to helping homeowners embrace the future of sustainable transportation. Their team prioritizes safety, efficiency, and long-term reliability, ensuring your EV infrastructure is built to last.

- Certified Expertise: ABR Electric’s electricians are highly trained to navigate the complexities of NEC code compliance, guaranteeing installations that meet the highest safety standards.

- Customized Planning: The team evaluates each homeowner’s electrical capacity, EV charging needs, and potential future upgrades to deliver tailored solutions.

- Customer-Centric Approach: With a focus on satisfaction and safety, ABR Electric provides end-to-end support, from consultation to final installation.

Schedule Your Consultation Today

As EVs become a cornerstone of sustainable living, ABR Electric is here to empower McKinney, TX residents with charging solutions that meet today’s needs while preparing for tomorrow’s advancements. Whether you’re a new EV owner or looking to optimize your current setup, we’re ready to help you take the next step confidently.

Media Contact

Organization: ABR Electric

Contact Person: James Adams

Website: https://abrelectric.com/

Email: Send Email

Contact Number: +12146901941

Address: 1971 Univ Business Dr #106, McKinney, TX 75071

City: McKinney

State: Texas

Country: United States

Release Id: 28112420043

The post ABR Electric: Prevent Electrical Overloads with Safe EV Charger Installations in McKinney, TX appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Soei – A Revolutionary Social Platform Empowering and Adding Value to the Global Community

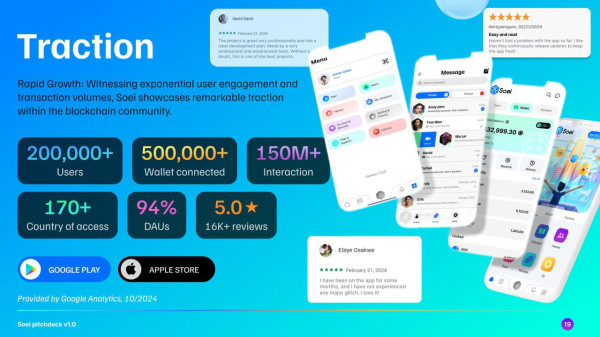

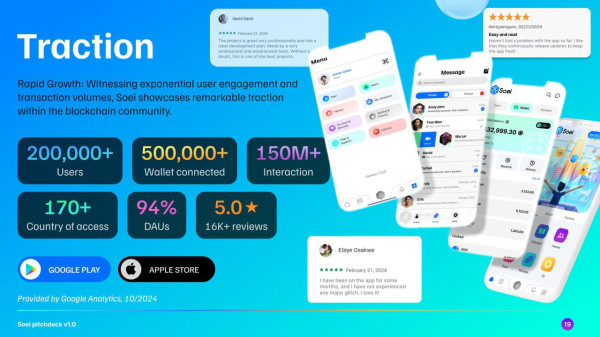

London, United Kingdom, 27th Nov 2024 – Soei, an emerging leader in digital technology, is transforming how the world connects and interacts. More than just a social networking app, Soei is a complete ecosystem integrating advanced Web2 and Web3 technologies. With over 200,000 users and an impressive 4.9-star rating across iOS and Android platforms, Soei is setting new standards in the social platform landscape.

Empowering Communities with Social Innovation

Soei, which stands for “Social Empowerment & Innovation,” is redefining how communities engage by integrating social networking with technological advancements. The platform provides secure, dynamic, and user-friendly features designed to foster connections, encourage creativity, and enhance user experiences.

Strategic partnerships with renowned organizations like CoinPost, Niza Global, and Psalms Capital further solidify Soei’s position as a sustainable and innovative digital hub.

A Multi-Faceted Ecosystem Tailored to User Needs

At its core, Soei offers a robust ecosystem designed to cater to diverse user demands:

- Soei Super App: A cutting-edge social networking platform enabling messaging, multimedia sharing, private group chats, and access to global news. With over 23,000 private chat groups as of October 2024, the platform continues to earn the trust of its growing community.

- Secure Digital Wallet: Integrated for seamless and safe transactions, offering top-tier encryption for user data protection.

- Soei Edu: An AI-driven online learning platform currently in development, aimed at delivering accessible and high-quality education.

- Gaming and NFT Marketplace: The Mystic Maze Game, set to launch in Q1 2025, will enable users to earn tokens while enjoying a unique gaming experience. The NFT trading platform is also in testing, promising an innovative marketplace for digital assets.

Socoin.io: A Gateway to Digital Innovation

Soei’s ecosystem extends to Socoin.io, a platform dedicated to maximizing the potential of SOI, the official token of the Soei ecosystem. Through Socoin.io, users can stake tokens, participate in community governance, and explore the gaming and NFT platforms within the Soei network.

Fostering a Community-Centric Approach

Soei’s commitment to its users is evident in its collaborative and inclusive model. By prioritizing community engagement and shared growth, Soei establishes itself as more than just a platform—it becomes a movement, bringing people together for mutual success.

Looking Ahead: AI and the Metaverse

Soei is gearing up to expand its horizons with cutting-edge AI and Metaverse technologies. These advancements aim to create an immersive digital environment where users can interact, work, and entertain themselves in unprecedented ways. This bold step underscores Soei’s dedication to building a future where technology meets human connectivity.

About Soei

Soei is a groundbreaking platform merging social networking, entertainment, and financial tools into a single, powerful ecosystem. With its strategic alliances and forward-thinking approach, Soei is setting the stage for a global digital revolution.

Contact Information

- Website: soei.social | soei.io | socoin.io

- Download the App: App Store | Google Play

- X: x.com/soei_io

- Telegram Channel: https://t.me/soei_ann

- Telegram Chat: https://t.me/soei_io

Join Soei today and experience the future of social innovation.

Media Contact

Organization: Soei

Contact Person: mathew_anthony

Website: https://soei.social

Email: mathew@soei.io

City: London

Country: United Kingdom

Release Id: 27112420393

The post Soei – A Revolutionary Social Platform Empowering and Adding Value to the Global Community appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Soei – A Revolutionary Social Platform Empowering and Adding Value to the Global Community

London, United Kingdom, 27th Nov 2024 – Soei, an emerging leader in digital technology, is transforming how the world connects and interacts. More than just a social networking app, Soei is a complete ecosystem integrating advanced Web2 and Web3 technologies. With over 200,000 users and an impressive 4.9-star rating across iOS and Android platforms, Soei is setting new standards in the social platform landscape.

Empowering Communities with Social Innovation

Soei, which stands for “Social Empowerment & Innovation,” is redefining how communities engage by integrating social networking with technological advancements. The platform provides secure, dynamic, and user-friendly features designed to foster connections, encourage creativity, and enhance user experiences.

Strategic partnerships with renowned organizations like CoinPost, Niza Global, and Psalms Capital further solidify Soei’s position as a sustainable and innovative digital hub.

A Multi-Faceted Ecosystem Tailored to User Needs

At its core, Soei offers a robust ecosystem designed to cater to diverse user demands:

- Soei Super App: A cutting-edge social networking platform enabling messaging, multimedia sharing, private group chats, and access to global news. With over 23,000 private chat groups as of October 2024, the platform continues to earn the trust of its growing community.

- Secure Digital Wallet: Integrated for seamless and safe transactions, offering top-tier encryption for user data protection.

- Soei Edu: An AI-driven online learning platform currently in development, aimed at delivering accessible and high-quality education.

- Gaming and NFT Marketplace: The Mystic Maze Game, set to launch in Q1 2025, will enable users to earn tokens while enjoying a unique gaming experience. The NFT trading platform is also in testing, promising an innovative marketplace for digital assets.

Socoin.io: A Gateway to Digital Innovation

Soei’s ecosystem extends to Socoin.io, a platform dedicated to maximizing the potential of SOI, the official token of the Soei ecosystem. Through Socoin.io, users can stake tokens, participate in community governance, and explore the gaming and NFT platforms within the Soei network.

Fostering a Community-Centric Approach

Soei’s commitment to its users is evident in its collaborative and inclusive model. By prioritizing community engagement and shared growth, Soei establishes itself as more than just a platform—it becomes a movement, bringing people together for mutual success.

Looking Ahead: AI and the Metaverse

Soei is gearing up to expand its horizons with cutting-edge AI and Metaverse technologies. These advancements aim to create an immersive digital environment where users can interact, work, and entertain themselves in unprecedented ways. This bold step underscores Soei’s dedication to building a future where technology meets human connectivity.

About Soei

Soei is a groundbreaking platform merging social networking, entertainment, and financial tools into a single, powerful ecosystem. With its strategic alliances and forward-thinking approach, Soei is setting the stage for a global digital revolution.

Contact Information

- Website: soei.social | soei.io | socoin.io

- Download the App: App Store | Google Play

- X: x.com/soei_io

- Telegram Channel: https://t.me/soei_ann

- Telegram Chat: https://t.me/soei_io

Join Soei today and experience the future of social innovation.

Media Contact

Organization: Soei

Contact Person: mathew_anthony

Website: https://soei.social

Email: mathew@soei.io

City: London

Country: United Kingdom

Release Id: 27112420393

The post Soei – A Revolutionary Social Platform Empowering and Adding Value to the Global Community appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release6 days ago

A Omega Fencing Company Launches New Eco-Friendly Fencing Options for Environmentally Conscious Homeowners

-

Press Release1 week ago

The Strategy for Avoiding Failures for High Performers with Leila Entezam’s ‘SET UP’ Method

-

Press Release6 days ago

Humera Tamboli elevates sustainable fashion with purpose: Embracing Supima cotton and Beechwood to create skin friendly capsule clothing

-

Press Release3 days ago

Saba Launches Saba PURE Colostrum and Biotin Complex™: A New Era in Foundational Wellness

-

Press Release23 hours ago

Prompt Passport Services Offers Expedited Passport Renewal Services for US Citizens in New Hampshire

-

Press Release6 days ago

Knowledge Is Power: Minority Class Registers With State

-

Press Release1 week ago

Aven Osborne Launches New Personal Website to Inspire and Connect Through Athletics, Academics, and Service

-

Press Release2 days ago

EnviFX.com Unveils an Innovative Trading Platform to Empower Investors with Advanced Tools