Press Release

Interview with Prabhat Kumar: Decoding the potential and prospects of the Indian stock market

Preface

With widespread attention from global investors, the Indian stock market is attracting attention with its significant growth potential and unique investment opportunities. In order to explore the dynamics and future trends of this market more deeply, the Financial Times specially invited Mr. Prabhat Kumar, a well-known registered equity research analyst, to share his professional insights and investment suggestions.

Interview content

Reporter: Mr. Prabhat, thank you very much for taking the time to accept our exclusive interview. First of all, please talk about the current macroeconomic conditions of the Indian market.

Prabhat Kumar: India’s macroeconomic fundamentals are quite solid, thanks to a series of major reform measures implemented by the government in recent years. These reforms not only improve the market environment, but also enhance the operational efficiency of enterprises. For example, the implementation of the Goods and Services Tax (GST) has unified the national tax system, reduced the tax burden on enterprises, simplified tax procedures, and improved transparency. The revision of the Insolvency and Bankruptcy Code (IBC) has also significantly improved corporate bankruptcy procedures, accelerated the process of debt restructuring, and enhanced market vitality and creditworthiness.

In addition, the Indian government’s investment in infrastructure construction is also very significant. The large-scale construction of infrastructure projects such as roads, railways, ports and airports not only promotes economic development, but also creates more business opportunities for enterprises. The continuous advancement of rural development, through various poverty alleviation projects and agricultural modernization plans, has increased the income level of the rural population and expanded the domestic consumer market.

These measures have continuously improved India’s status in the global economy, attracted a large inflow of foreign investment, and further promoted economic growth. Overall, India’s economic prospects are very bright and its market potential is huge.

Reporter: How would you evaluate the performance of the Indian stock market over the past year?

Prabhat Kumar: The Indian stock market has experienced several fluctuations over the past year, mainly due to global economic uncertainty and geopolitical tensions. For example, global supply chain problems, inflationary pressures, and monetary policy adjustments in major economies have all had a certain impact on the market. However, despite these challenges, Indian equity markets have performed well.

Major indices like NIFTY 50 and BSE SENSEX are showing a steady upward trend, helped by strong performance across multiple sectors. The technology and pharmaceutical industries, in particular, have demonstrated strong competitiveness and growth potential globally. Indian IT companies, such as Tata Consultancy Services (TCS) and Infosys, continue to occupy an important position in the global software and service outsourcing market, attracting a large number of international orders and performing well.

The pharmaceutical industry is also performing well, with India being one of the world’s largest producers of generic drugs and its pharmaceutical companies occupying a significant share of the international market. During the epidemic, demand in the pharmaceutical industry increased significantly, driving the revenue and profit growth of related companies.

Overall, the performance of the Indian equity market is a testament to its inherent resilience and growth potential. Despite external challenges, market confidence remains strong, demonstrating investors’ long-term trust in the Indian economy.

Reporter: What investment areas do you think are worthy of attention currently?

Prabhat Kumar: There are currently several areas that deserve investors’ attention. The first is green energy and renewable energy. The Indian government’s efforts in sustainable development have created huge investment opportunities in this sector. For example, India is committed to achieving 450 GW of installed renewable energy capacity by 2030 and is actively promoting the construction of solar and wind energy projects. This provides relevant companies and investors with broad market prospects.

This is followed by e-commerce and digital payments. With the increase in Internet penetration, the online consumption and digital payment market has developed rapidly. India has a large young population that is highly receptive to digital technologies, driving the rapid growth of e-commerce and digital payments. Companies such as Flipkart and Paytm have made remarkable achievements in this field and have broad market prospects.

In addition, the real estate market, especially commercial real estate and logistics facilities, also shows great investment potential. As the economy gradually recovers, demand for commercial real estate increases, and the expansion of logistics facilities becomes increasingly important. Investment opportunities in these areas will continue to increase as the economy grows.

Reporter: What specific investment suggestions do you have for ordinary investors?

Prabhat Kumar: For ordinary investors, I have the following specific suggestions:

Focus on long-term trends: Investors should focus on long-term economic trends and industry prospects rather than short-term market fluctuations. For example, areas such as technology and renewable energy have long-term growth potential. Companies in these fields are not only performing well in the current market but are also expected to continue to grow in the future.

Diversified investment portfolio: Reasonably diversify investments to reduce the risk of a single market or individual stock. Investors can consider allocations across different industries and asset classes for better risk management. For example, you can invest in multiple sectors such as technology, finance, pharmaceuticals, and consumer goods, so that even if one sector fluctuates, the overall portfolio remains stable.

Maintain information sensitivity: Keep abreast of market dynamics and policy changes, especially government economic policies and industry regulations. These policy changes may bring new opportunities or risks to certain industries. Investors should remain sensitive to policy trends and adjust investment strategies in a timely manner to adapt to market changes.

Robust risk management: Set up reasonable stop loss points and exit strategies to avoid heavy losses when the market fluctuates violently. A sound risk management strategy can help investors protect capital and avoid excessive losses when markets go south.

Regularly evaluate the investment portfolio: Regularly review and adjust the investment portfolio to ensure that it is consistent with the current market environment and your own investment objectives. Investors should review investment performance regularly and make necessary adjustments based on market changes and adjustments to their own goals to optimize the performance of the investment portfolio.

Reporter: To summarize, what is your overall view on the Indian stock market?

Prabhat Kumar: Overall, I am optimistic about the Indian stock market. India’s large and young population, rapidly developing middle class and improving infrastructure provide strong growth drivers for the market. Through scientific investment strategies and adequate market research, investors are expected to obtain considerable returns in this market.

It is important to note that all investments come with risks. Investors should make prudent decisions based on their own risk tolerance and financial status, and avoid over-investing or over-concentrating investment in a single area. Through diversification and sound risk management strategies, investors can achieve stable growth and long-term returns in India’s dynamic market.

Conclusion

Through this interview, we learned that in the eyes of Mr. Prabhat Kumar, the Indian market is not only full of opportunities, but also faces challenges. It is hoped that his insights and suggestions will provide a useful reference for investors and help them achieve their investment goals in this dynamic market of India.

Media contact

Company Name:Dhruva Research

Email: dhruvaresearch.info@gmail.com

Country:India

Website:dhruvaresearch.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Structural Repetition: West Red Lake Gold’s New Ore Shoot is Similar to the High-Grade 8-Zone

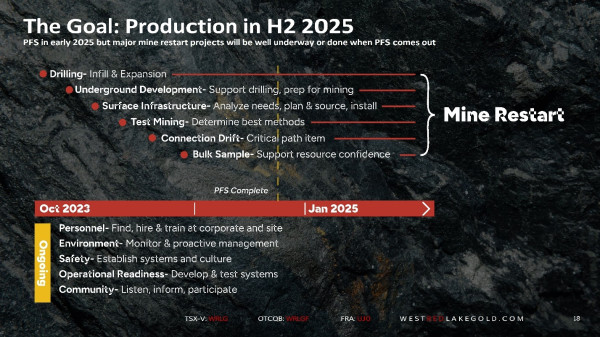

West Red Lake Gold Mines is currently working towards a restart at the Madsen Gold Mine in the Red Lake Gold District of Northwest Ontario, Canada. A Pre-Feasibility Study (PFS) for the Madsen Mine is targeted for release in early 2025. The WRLG management team projects a mine-restart date in 2025.

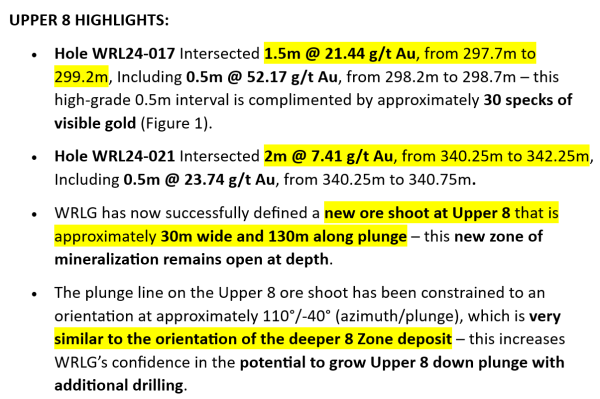

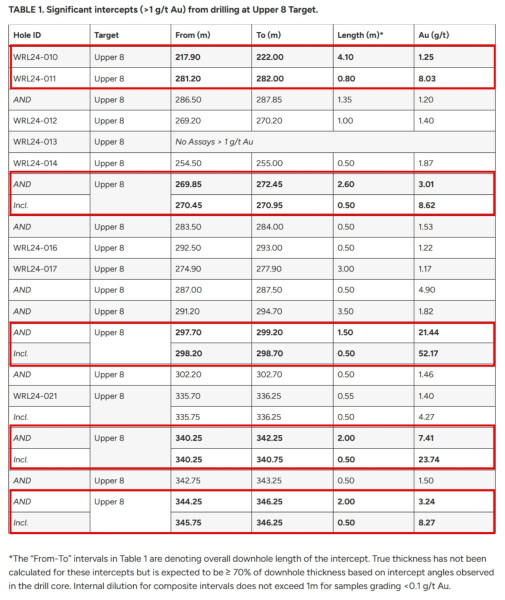

Vancouver, BC, Canada, 27th Nov 2024 – Sponsored content disseminated on behalf of West Red Lake Gold. On November 21, 2024 West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) reported additional drill results that define a new ore shoot at the Upper 8 Target following up on the October 2, 2024 intercepts of 44.17 g/t Au over 1.3 meters and 20.63 g/t Au over 0.5 meters.

West Red Lake Gold Mines is currently working towards a restart at the Madsen Gold Mine in the Red Lake Gold District of Northwest Ontario, Canada. A Pre-Feasibility Study (PFS) for the Madsen Mine is targeted for release in early 2025. The WRLG management team projects a mine-restart date in 2025.

“Our main objective this year with the surface drill program was to make new discoveries,” Will Robinson, VP of Exploration told Guy Bennett, CEO of Global Stocks News (GSN). “We have been focusing on drill targets generated from our conceptual modeling that possess the geologic potential to produce high grades.”

“The initial results we received from Upper 8 were very encouraging and motivated our team to add a second drill to focus solely on this new high-grade area,” stated Shane Williams, WRLG President and CEO in the November 21, 2024 press release.

“Upper 8 was already a shallow geologic analog to the deeper 8 Zone, but with the exceptional grades and visible gold showings we’re now encountering, this target is becoming truly reminiscent of the high-grade gold mineralization Red Lake is known for,” continued Williams.

“It’s still early days, but we believe the Upper 8 target has the potential to become the next new significant discovery in the Red Lake gold camp and supports the likelihood for the presence of more high-grade deposits like 8-Zone yet to be discovered across the Madsen property.”

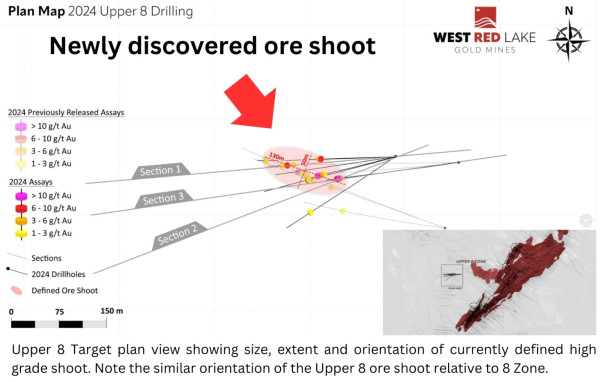

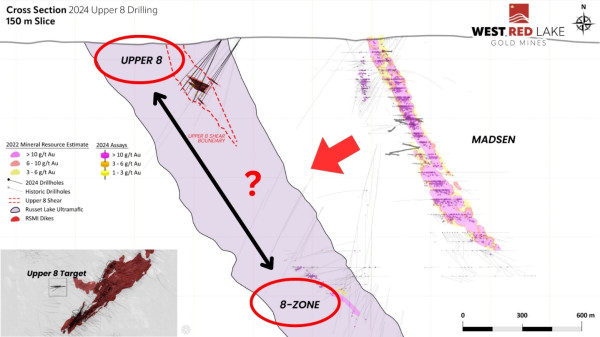

“If you compare 8-Zone with Upper 8, you’ll see the structural repetition in the way the mineralisation is oriented in these two shoots,” confirmed Robinson. “Our theory is that we may have one or two more of these zones stacked between Upper 8 and the deeper 8-Zone. Next year, we’ll get back in there with the drill, to test that theory.”

The Upper 8 target is hosted within the same lithologic unit (Russet Lake Ultramafic) approximately 750m up-plunge from the main 8-Zone deposit.

Its location in ultramafic rocks, its style of mineralization, and its exceptionally high grades make the 8 Zone geologically unique from the main Madsen deposit.

The 8 Zone currently contains an Indicated mineral resource of 87,700 ounces @ 18 grams/tonne gold, with an additional Inferred resource of 18,200 oz @ 14.6 grams/tonne gold.

“The size of the Upper 8 shoot that we’ve defined is similar in size and scale to the deeper high-grade 8 Zone,” Robinson told GSN. “The new shoot is 30 meters wide and 130 meters along plunge. We’ve only got 15 or 16 holes in the Upper 8. We are in an early stage of drilling on this target, but I’m encouraged by what we’re seeing. The geology is holding together.”

“The Pre-Feasibility Study (PFS) for the Madsen Mine is nearing completion,” stated WRLG in the November 21, 2024 press release. “The final phase of this study involves optimizing underground development and infrastructure sequencing and refining the associated operating and capital costs. West Red Lake Gold is working with SRK Consulting on these optimization opportunities, a process that is expected to take an additional few weeks to complete. As such the PFS is now targeted for release early in 2025”.

The WRLG Pre Feasibility study will be based on:

1. Real Costing: Operating underground at the Madsen Mine for the last year means West Red Lake Gold understands the real costs for blasting, mucking, and haulage of mined material.

2. Final Engineering: The Madsen Mine is essentially built. With the mine having operated as recently as 2022 and with West Red Lake Gold having studied and remedied many of the issues from that period over the last 18 months, there are very few unresolved engineering questions at Madsen.

3. Detailed Mine Plan: West Red Lake Gold has built a detailed mine design for the first 18 months of operation and intends to have 24 months of definition drilled in-situ mineral inventory defined prior to restart, which is targeted for mid-2025. This level of operational readiness far exceeds what is typical at the PFS stage in most development scenarios.

“Today, a tight labour market has made filling mining jobs harder than ever,” reports the Canadian Mining Journal. “Headhunting has become widespread, negotiations have gotten more complex, and as the industry is experiencing a wave of retirements.”

“Training is extremely important,” Robinson told GSN, acknowledging the challenge. “So are working conditions. We have a beautiful new camp at the mine site. Every room has its own restroom. That’s a perk usually reserved for top brass. A lot of the workforce live locally in Red Lake. But we have diesel mechanics, welders and pipe fitters flying in from other areas. In this tight labour market, the quality of the camp is an important part of worker retention.”

West Red Lake has partnered with Horizon North to provide the 114-person accommodations and mine dry facilities for the Madsen mine site.

Typical Horizon North Facility Built for Canadian Mining Camps

The Madsen Mine deposit presently hosts an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [1.] [2.] [3.]

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,500 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

References:

- SRK Consulting. (2021). Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada (West Red Lake Gold Mines, Ed.) [Review of Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada.

- Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the updated report. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country: Canada

Release Id: 27112420435

The post Structural Repetition: West Red Lake Gold’s New Ore Shoot is Similar to the High-Grade 8-Zone appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

GFH Launches OUTLIVE in City Scape: An innovative Real Estate Venture rooted in Health & Well-being

Manama, Bahrain, 27th Nov 2024- GFH Financial Group (“GFH”) today announced the launch of OUTLIVE in Cityscape, an innovative real estate developer and creator of master planned communities and mixed-use projects with a focus on health and well-being, which will operate across the MENA region and Europe.

OUTLIVE leverages the combined expertise and capabilities of the GFH Group and its management team with proven expertise in development, design and conceptualization of living communities. OUTLIVE will operate in Europe and the Mena region with a particular focus on the growing and attractive Saudi as well as the UAE markets where there is strong demand for such focus and need for communities that deliver well-being attributes in addition to physical appeal.

The venture addresses six key wellness dimensions: Social connection, Environmental stewardship, Physical health, Emotional awareness, Mental engagement, and Spiritual wellness, all working together to create a holistic approach to human wellbeing.

Commenting, Mr. Hisham Al-Rayes, Chairman of OUTLIVE and GFH Group CEO remarked, “OUTLIVE represents our initiative to create differentiated communities where wellness and sustainability go hand in hand. This venture reflects our commitment to our region by creating unique and differentiated real estate offering.”

Adding, Mr. Walid El Hindi, Board Member and Managing Director of OUTLIVE, said, “This is not just a real estate company – it’s an opportunity to create people-centric communities, fostering connections, and a profound sense of belonging. While sustainability in real estate centers on creating buildings that care for the planet, wellness real estate focuses on crafting places that care for the people.”

In line with its mission, OUTLIVE is also bringing senior living to the region by developing supportive environments specifically designed for older adults. These premium communities will provide personalized services and foster social connections, promoting a dignified and fulfilling lifestyle catering to seniors.

As OUTLIVE prepares to unveil its ambitious projects, it aims to raise the bar for transformative developments across the MENA region and Europe.

Media Contact

Organization: Media Scene PR and Translation

Contact Person: Husain Naser

Website: https://mediascenebh.com/

Email: Send Email

State: Manama

Country: Bahrain

Release Id: 27112420464

The post GFH Launches OUTLIVE in City Scape: An innovative Real Estate Venture rooted in Health & Well-being appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

UniJoin Updates Domain Zone to Strengthen Anonymity and Enhance Privacy Features

UniJoin has updated its domain zone to ensure uninterrupted access and enhance user anonymity. The platform utilizes advanced CoinJoin technology, offering tools like a Bitcoin Mixer and Bitcoin Tumbler to anonymize cryptocurrency transactions. Key features include a user-friendly interface, Tor Browser integration, zero logs policy, and high-quality transaction mixing. UniJoin remains committed to empowering users with secure and private financial management in the digital economy.

London, United Kingdom, 27th Nov 2024 – UniJoin has taken a significant step to strengthen user privacy by adopting a new domain name, ensuring uninterrupted access to its services despite previous blocks. The platform leverages cutting-edge CoinJoin technology, designed to anonymize and make cryptocurrency transactions untraceable.

Commitment to Financial Privacy

UniJoin’s primary goal is to help users achieve and maintain financial anonymity. Through CoinJoin, the platform pools users’ crypto assets with others, effectively mixing them. Users then receive clean, untraceable coins, safeguarding their privacy and breaking any traceable links to their original assets.

About UniJoin

UniJoin is a leading privacy-focused cryptocurrency service, offering tools for users to manage their digital finances anonymously. While Bitcoin and other cryptocurrencies like Litecoin are inherently pseudonymous, UniJoin bridges the gap to true anonymity by utilizing advanced mixing technology.

UniJoin simplifies financial privacy while empowering users to analyze and manage their blockchain transaction history transparently. By connecting their wallet address, users can privately review activity with a level of control unmatched by traditional financial systems.

Key Features

- User-Friendly Interface: UniJoin offers a seamless and intuitive process to switch to “Anonymous mode,” enabling users to conduct transactions without revealing their identity.

- Tor Browser Compatibility: The platform integrates with the Tor Browser, allowing users to maximize their privacy when accessing UniJoin.

- Zero Logs Policy: UniJoin prioritizes user privacy by ensuring no activity logs are stored, keeping transaction histories secure and confidential.

- Advanced CoinJoin Technology: By employing CoinJoin, UniJoin provides a high-quality mixing method that enhances transaction anonymity and untraceability.

Why Choose UniJoin?

UniJoin stands as a robust solution for cryptocurrency users seeking to anonymize their transactions. By combining simplicity, advanced privacy tools, and a commitment to user confidentiality, the platform offers a reliable and secure environment for safeguarding financial privacy.

With its new domain and privacy-enhancing features, UniJoin continues to lead the way in helping users navigate the digital economy securely and anonymously.

Media Contact

Organization: UniJoin Co.

Contact Person: Sergei Pavlov

Website: https://unijoin.org/

Email: Send Email

City: London

Country: United Kingdom

Release Id: 27112420453

The post UniJoin Updates Domain Zone to Strengthen Anonymity and Enhance Privacy Features appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release5 days ago

A Omega Fencing Company Launches New Eco-Friendly Fencing Options for Environmentally Conscious Homeowners

-

Press Release1 week ago

The Strategy for Avoiding Failures for High Performers with Leila Entezam’s ‘SET UP’ Method

-

Press Release6 days ago

Humera Tamboli elevates sustainable fashion with purpose: Embracing Supima cotton and Beechwood to create skin friendly capsule clothing

-

Press Release2 days ago

Saba Launches Saba PURE Colostrum and Biotin Complex™: A New Era in Foundational Wellness

-

Press Release5 days ago

Knowledge Is Power: Minority Class Registers With State

-

Press Release1 week ago

Aven Osborne Launches New Personal Website to Inspire and Connect Through Athletics, Academics, and Service

-

Press Release1 day ago

EnviFX.com Unveils an Innovative Trading Platform to Empower Investors with Advanced Tools

-

Press Release5 days ago

QuickBooks SuperCondense reduces file size more drastically than standard condensing, resulting in faster load times and smoother navigation