Press Release

Silver Prices Surging How Market Conditions Are Affecting The Price Of Silver

–News Direct–

By Anthony Termini, Benzinga

Precious metal prices are significantly influenced by investor sentiment, much like stocks and bonds. This can lead to routine price fluctuations, sometimes large and erratic, where the volatility can create both challenges and opportunities for investors.

A comparison of price movements in gold (represented by the SPDR Gold Shares ETF (NYSE: GLD)) and silver (represented by the Silver Benchmark Index (CME: SGICSIB)) since last May reveals two key insights.

First, gold and silver prices are closely correlated. Second, silver prices exhibit greater volatility than gold prices, with more pronounced price swings in both directions. While daily price swings can be unnerving for investors, they can also create trading opportunities, offering the potential for higher returns for investors that are aware of the volatility.

A Hedge Against Uncertainty And Inflation

Precious metals have long been viewed as a hedge against inflation and used to preserve wealth during times of economic or geopolitical instability. History has demonstrated the correlation, with gold and silver prices often surging in response to crises and turmoil. The price of gold doubled in less than five years from $272/oz in August 2001 to $549/oz in January 2006 following the September 11th terrorist attacks. Similarly, gold rallied during and after the 2008 global financial crisis, and most recently, the Israel-Hamas war has exacerbated geopolitical tension, further driving up demand for the yellow metal.

Silver has also historically offered advantages even during economic uncertainties. According to the Silver Institute, when markets go into risk off mode (i.e., decline), silver is seen as a relatively safe and inexpensive investment that has typically delivered positive returns. Yet under normal circumstances of economic expansion, silver exhibits a positive correlation with stock market performance as reflected in its relationship with indices such as the S&P500. This demonstrates the metals dual nature, as industrial consumption accounts for more than half of the silver demand, according to the World Silver Survey 2023.

Surging Industrial Demand for Silver

The transition towards a more sustainable future and the growth of clean energy technologies have positioned silver as a critical component in numerous industries. Sectors such as electric vehicles, green energy infrastructure, and consumer electronics, all rely heavily on silver for its unique properties and applications.

The increasing adoption of electric vehicles and the expansion of charging infrastructure will further drive the demand for silver, as it plays a crucial role in the manufacturing of batteries and electrical components.

Furthermore, photovoltaic cells, used in solar panels, require significant amounts of silver for their efficient operation. Additionally, silver's exceptional electrical conductivity and durability make it an essential material in the production of wind turbines and other renewable energy systems.

The continued growth of these industries could boost demand and support higher silver prices. This positions silver as an attractive investment opportunity, especially given its historical performance as a hedge against inflation and economic uncertainties

While the demand for silver is expected to surge, the supply side may struggle to keep pace. According to Sprott, a global investment manager specializing in precious metals, supply will not keep up with growing demand as we do not see enough projects in development to generate the kind of production levels in question.

Investors looking to capitalize on that potential upside in silver prices may want to consider mining companies that offer significant silver exposure. These companies, which are directly involved in the exploration, extraction, and production of silver, can provide a direct avenue for investors to gain exposure to the underlying commodity.

What Are Some Investment Plays In Silver?Silvercorp Metals Inc. (AMEX: SVM)

Vancouver, Canada-based Silvercorp Metals Inc. (AMEX: SVM) is a silver producer with an 18-year track record of profitable operations and consistent growth. In its most recent quarter, silver accounted for 59% of total revenue one of the highest among its peer group of silver miners.

In fiscal year 2023, Silvercorp produced 6.6 million ounces of silver at an all-in sustaining (AISC) cost of $9.73/oz, net of by-products. This low production cost translates into industry-leading profit margins, enabling the company to build a strong balance sheet with approximately $198 million in cash (and no debt) without external financing. While Silvercorp's single-jurisdictional focus has led to undervaluation in the current market, the company is exploring strategic acquisitions to broaden its scope and address this perception.

In April, Silvercorp announced a friendly deal to acquire Adventus Mining Corp. (OTC: ADVZF) in an all-stock transaction worth around $146 million. Adventus flagship asset is the permitted, high-grade El Domo copper-gold project in Ecuador. This acquisition offers a potential for re-rating, driven by increased scale, a significantly enhanced growth profile, and the establishment of a presence in an emerging, mining-friendly jurisdiction.

Pan American Silver Corp. (NYSE: PAAS)

Pan American Silver Corp. (NYSE: PAAS ) operates silver and gold mines in North, Central and South America. The company is one of the largest silver producers globally but has a high AISC profile almost twice that of Silvercorp.

Pan American is actively divesting its non-core assets. Recently, the company agreed to sell its La Arena project in Peru to Zijin Mining. The deal includes an upfront cash payment of $245 million and a $50 million future contingent payment.

New Pacific Metals Corp. (AMEX :NEWP)

New Pacific Metals Corp. (AMEX: NEWP) may be a more speculative play as a development-stage company than the other established silver producers. However, New Pacific owns promising mineral assets in Bolivia, and its flagship Silver Sand project is ranked among the top undeveloped silver projects in the world. In 2023, a Preliminary Economic Assessment (PEA) outlined a post-tax Net Present Value (5% discount) of $726 million and an Internal Rate of Return of 39%.

Their other project, Carangas, could be even bigger, with a PEA expected to be released later this year, further cementing the companys value. As of Mar. 31, this year, New Pacific had around $25 million in working capital, providing ample resources to continue advancing their projects.

Investors in exploration companies can realize substantial returns once the market recognizes the value of the project or if they are acquired by larger players. Other industry peers have shown interest in New Pacific as the company is backed by both Silvercorp (which owns a 27% stake) and Pan American, the latter of which recently increased its stake to 12%."

Endeavour Silver Corp. (NYSE: EXK)

Endeavour Silver Corp (NYSE: EXK) is an established silver miner with operations in the United States, Mexico and Chile. In 2023, the company produced 5.6 million ounces of silver at an AISC of US$22.93/oz net of by-products, with silver accounting for more than half of the revenue mix.

As the global economy navigates through uncertainties and potential headwinds, precious metals may continue to shine as a compelling investment opportunity. By understanding the economic drivers and market sentiment influencing these commodities, investors can position themselves to capitalize on the potential upside while mitigating risks through diversification.

Featured photo by Geizkragen69 on Pixabay.

Benzinga is a leading financial media and data provider, known for delivering accurate, timely, and actionable financial information to empower investors and traders.

This post contains sponsored content. This content is for informational purposes only and is not intended to be investing advice.

Contact Details

Benzinga

+1 877-440-9464

Company Website

View source version on newsdirect.com: https://newsdirect.com/news/silver-prices-surging-how-market-conditions-are-affecting-the-price-of-silver-904049082

Benzinga

COMTEX_453110069/2655/2024-05-30T08:45:16

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Structural Repetition: West Red Lake Gold’s New Ore Shoot is Similar to the High-Grade 8-Zone

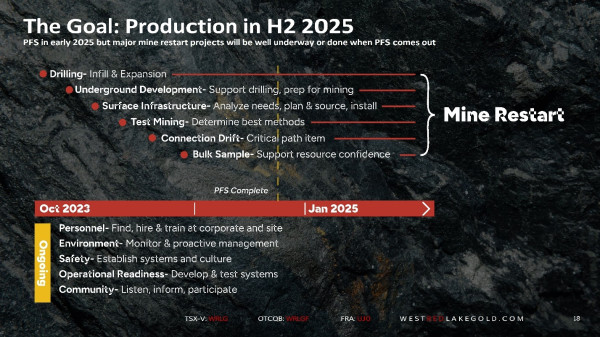

West Red Lake Gold Mines is currently working towards a restart at the Madsen Gold Mine in the Red Lake Gold District of Northwest Ontario, Canada. A Pre-Feasibility Study (PFS) for the Madsen Mine is targeted for release in early 2025. The WRLG management team projects a mine-restart date in 2025.

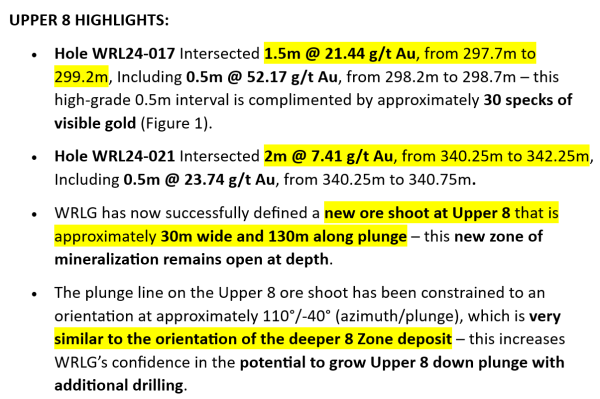

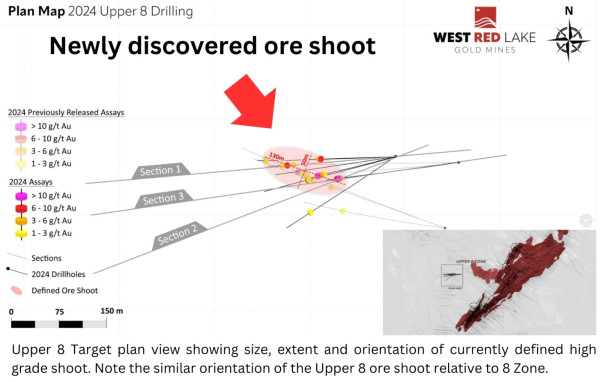

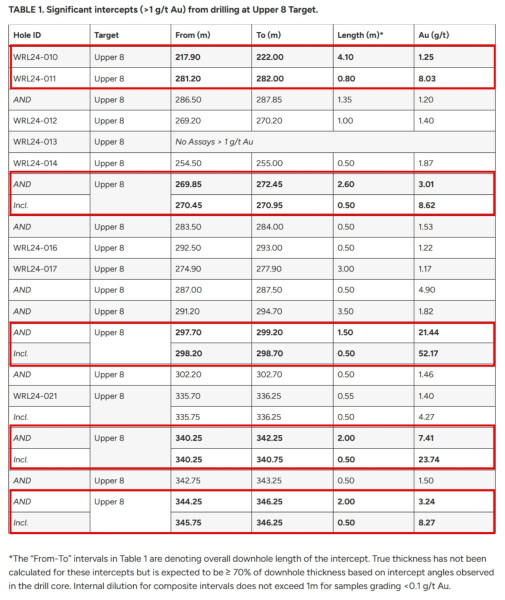

Vancouver, BC, Canada, 27th Nov 2024 – Sponsored content disseminated on behalf of West Red Lake Gold. On November 21, 2024 West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) reported additional drill results that define a new ore shoot at the Upper 8 Target following up on the October 2, 2024 intercepts of 44.17 g/t Au over 1.3 meters and 20.63 g/t Au over 0.5 meters.

West Red Lake Gold Mines is currently working towards a restart at the Madsen Gold Mine in the Red Lake Gold District of Northwest Ontario, Canada. A Pre-Feasibility Study (PFS) for the Madsen Mine is targeted for release in early 2025. The WRLG management team projects a mine-restart date in 2025.

“Our main objective this year with the surface drill program was to make new discoveries,” Will Robinson, VP of Exploration told Guy Bennett, CEO of Global Stocks News (GSN). “We have been focusing on drill targets generated from our conceptual modeling that possess the geologic potential to produce high grades.”

“The initial results we received from Upper 8 were very encouraging and motivated our team to add a second drill to focus solely on this new high-grade area,” stated Shane Williams, WRLG President and CEO in the November 21, 2024 press release.

“Upper 8 was already a shallow geologic analog to the deeper 8 Zone, but with the exceptional grades and visible gold showings we’re now encountering, this target is becoming truly reminiscent of the high-grade gold mineralization Red Lake is known for,” continued Williams.

“It’s still early days, but we believe the Upper 8 target has the potential to become the next new significant discovery in the Red Lake gold camp and supports the likelihood for the presence of more high-grade deposits like 8-Zone yet to be discovered across the Madsen property.”

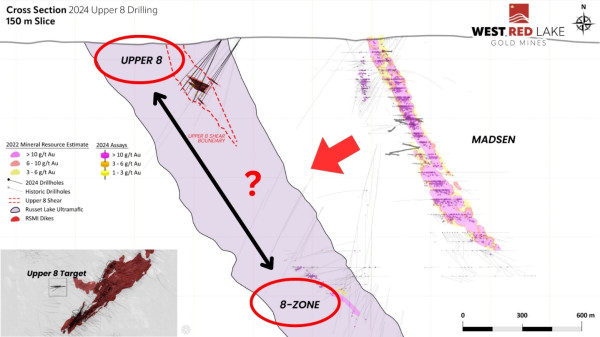

“If you compare 8-Zone with Upper 8, you’ll see the structural repetition in the way the mineralisation is oriented in these two shoots,” confirmed Robinson. “Our theory is that we may have one or two more of these zones stacked between Upper 8 and the deeper 8-Zone. Next year, we’ll get back in there with the drill, to test that theory.”

The Upper 8 target is hosted within the same lithologic unit (Russet Lake Ultramafic) approximately 750m up-plunge from the main 8-Zone deposit.

Its location in ultramafic rocks, its style of mineralization, and its exceptionally high grades make the 8 Zone geologically unique from the main Madsen deposit.

The 8 Zone currently contains an Indicated mineral resource of 87,700 ounces @ 18 grams/tonne gold, with an additional Inferred resource of 18,200 oz @ 14.6 grams/tonne gold.

“The size of the Upper 8 shoot that we’ve defined is similar in size and scale to the deeper high-grade 8 Zone,” Robinson told GSN. “The new shoot is 30 meters wide and 130 meters along plunge. We’ve only got 15 or 16 holes in the Upper 8. We are in an early stage of drilling on this target, but I’m encouraged by what we’re seeing. The geology is holding together.”

“The Pre-Feasibility Study (PFS) for the Madsen Mine is nearing completion,” stated WRLG in the November 21, 2024 press release. “The final phase of this study involves optimizing underground development and infrastructure sequencing and refining the associated operating and capital costs. West Red Lake Gold is working with SRK Consulting on these optimization opportunities, a process that is expected to take an additional few weeks to complete. As such the PFS is now targeted for release early in 2025”.

The WRLG Pre Feasibility study will be based on:

1. Real Costing: Operating underground at the Madsen Mine for the last year means West Red Lake Gold understands the real costs for blasting, mucking, and haulage of mined material.

2. Final Engineering: The Madsen Mine is essentially built. With the mine having operated as recently as 2022 and with West Red Lake Gold having studied and remedied many of the issues from that period over the last 18 months, there are very few unresolved engineering questions at Madsen.

3. Detailed Mine Plan: West Red Lake Gold has built a detailed mine design for the first 18 months of operation and intends to have 24 months of definition drilled in-situ mineral inventory defined prior to restart, which is targeted for mid-2025. This level of operational readiness far exceeds what is typical at the PFS stage in most development scenarios.

“Today, a tight labour market has made filling mining jobs harder than ever,” reports the Canadian Mining Journal. “Headhunting has become widespread, negotiations have gotten more complex, and as the industry is experiencing a wave of retirements.”

“Training is extremely important,” Robinson told GSN, acknowledging the challenge. “So are working conditions. We have a beautiful new camp at the mine site. Every room has its own restroom. That’s a perk usually reserved for top brass. A lot of the workforce live locally in Red Lake. But we have diesel mechanics, welders and pipe fitters flying in from other areas. In this tight labour market, the quality of the camp is an important part of worker retention.”

West Red Lake has partnered with Horizon North to provide the 114-person accommodations and mine dry facilities for the Madsen mine site.

Typical Horizon North Facility Built for Canadian Mining Camps

The Madsen Mine deposit presently hosts an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [1.] [2.] [3.]

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,500 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

References:

- SRK Consulting. (2021). Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada (West Red Lake Gold Mines, Ed.) [Review of Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada.

- Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the updated report. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country: Canada

Release Id: 27112420435

The post Structural Repetition: West Red Lake Gold’s New Ore Shoot is Similar to the High-Grade 8-Zone appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

GFH Launches OUTLIVE in City Scape: An innovative Real Estate Venture rooted in Health & Well-being

Manama, Bahrain, 27th Nov 2024- GFH Financial Group (“GFH”) today announced the launch of OUTLIVE in Cityscape, an innovative real estate developer and creator of master planned communities and mixed-use projects with a focus on health and well-being, which will operate across the MENA region and Europe.

OUTLIVE leverages the combined expertise and capabilities of the GFH Group and its management team with proven expertise in development, design and conceptualization of living communities. OUTLIVE will operate in Europe and the Mena region with a particular focus on the growing and attractive Saudi as well as the UAE markets where there is strong demand for such focus and need for communities that deliver well-being attributes in addition to physical appeal.

The venture addresses six key wellness dimensions: Social connection, Environmental stewardship, Physical health, Emotional awareness, Mental engagement, and Spiritual wellness, all working together to create a holistic approach to human wellbeing.

Commenting, Mr. Hisham Al-Rayes, Chairman of OUTLIVE and GFH Group CEO remarked, “OUTLIVE represents our initiative to create differentiated communities where wellness and sustainability go hand in hand. This venture reflects our commitment to our region by creating unique and differentiated real estate offering.”

Adding, Mr. Walid El Hindi, Board Member and Managing Director of OUTLIVE, said, “This is not just a real estate company – it’s an opportunity to create people-centric communities, fostering connections, and a profound sense of belonging. While sustainability in real estate centers on creating buildings that care for the planet, wellness real estate focuses on crafting places that care for the people.”

In line with its mission, OUTLIVE is also bringing senior living to the region by developing supportive environments specifically designed for older adults. These premium communities will provide personalized services and foster social connections, promoting a dignified and fulfilling lifestyle catering to seniors.

As OUTLIVE prepares to unveil its ambitious projects, it aims to raise the bar for transformative developments across the MENA region and Europe.

Media Contact

Organization: Media Scene PR and Translation

Contact Person: Husain Naser

Website: https://mediascenebh.com/

Email: Send Email

State: Manama

Country: Bahrain

Release Id: 27112420464

The post GFH Launches OUTLIVE in City Scape: An innovative Real Estate Venture rooted in Health & Well-being appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

UniJoin Updates Domain Zone to Strengthen Anonymity and Enhance Privacy Features

UniJoin has updated its domain zone to ensure uninterrupted access and enhance user anonymity. The platform utilizes advanced CoinJoin technology, offering tools like a Bitcoin Mixer and Bitcoin Tumbler to anonymize cryptocurrency transactions. Key features include a user-friendly interface, Tor Browser integration, zero logs policy, and high-quality transaction mixing. UniJoin remains committed to empowering users with secure and private financial management in the digital economy.

London, United Kingdom, 27th Nov 2024 – UniJoin has taken a significant step to strengthen user privacy by adopting a new domain name, ensuring uninterrupted access to its services despite previous blocks. The platform leverages cutting-edge CoinJoin technology, designed to anonymize and make cryptocurrency transactions untraceable.

Commitment to Financial Privacy

UniJoin’s primary goal is to help users achieve and maintain financial anonymity. Through CoinJoin, the platform pools users’ crypto assets with others, effectively mixing them. Users then receive clean, untraceable coins, safeguarding their privacy and breaking any traceable links to their original assets.

About UniJoin

UniJoin is a leading privacy-focused cryptocurrency service, offering tools for users to manage their digital finances anonymously. While Bitcoin and other cryptocurrencies like Litecoin are inherently pseudonymous, UniJoin bridges the gap to true anonymity by utilizing advanced mixing technology.

UniJoin simplifies financial privacy while empowering users to analyze and manage their blockchain transaction history transparently. By connecting their wallet address, users can privately review activity with a level of control unmatched by traditional financial systems.

Key Features

- User-Friendly Interface: UniJoin offers a seamless and intuitive process to switch to “Anonymous mode,” enabling users to conduct transactions without revealing their identity.

- Tor Browser Compatibility: The platform integrates with the Tor Browser, allowing users to maximize their privacy when accessing UniJoin.

- Zero Logs Policy: UniJoin prioritizes user privacy by ensuring no activity logs are stored, keeping transaction histories secure and confidential.

- Advanced CoinJoin Technology: By employing CoinJoin, UniJoin provides a high-quality mixing method that enhances transaction anonymity and untraceability.

Why Choose UniJoin?

UniJoin stands as a robust solution for cryptocurrency users seeking to anonymize their transactions. By combining simplicity, advanced privacy tools, and a commitment to user confidentiality, the platform offers a reliable and secure environment for safeguarding financial privacy.

With its new domain and privacy-enhancing features, UniJoin continues to lead the way in helping users navigate the digital economy securely and anonymously.

Media Contact

Organization: UniJoin Co.

Contact Person: Sergei Pavlov

Website: https://unijoin.org/

Email: Send Email

City: London

Country: United Kingdom

Release Id: 27112420453

The post UniJoin Updates Domain Zone to Strengthen Anonymity and Enhance Privacy Features appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release5 days ago

A Omega Fencing Company Launches New Eco-Friendly Fencing Options for Environmentally Conscious Homeowners

-

Press Release1 week ago

The Strategy for Avoiding Failures for High Performers with Leila Entezam’s ‘SET UP’ Method

-

Press Release5 days ago

Humera Tamboli elevates sustainable fashion with purpose: Embracing Supima cotton and Beechwood to create skin friendly capsule clothing

-

Press Release2 days ago

Saba Launches Saba PURE Colostrum and Biotin Complex™: A New Era in Foundational Wellness

-

Press Release1 week ago

Aven Osborne Launches New Personal Website to Inspire and Connect Through Athletics, Academics, and Service

-

Press Release5 days ago

Knowledge Is Power: Minority Class Registers With State

-

Press Release22 hours ago

EnviFX.com Unveils an Innovative Trading Platform to Empower Investors with Advanced Tools

-

Press Release5 days ago

Shop Better, Save Big: BetterFinds.com.au Unveils Black Friday Deals