Press Release

Analyzing Execution Quality in Portfolio Trading

–News Direct–

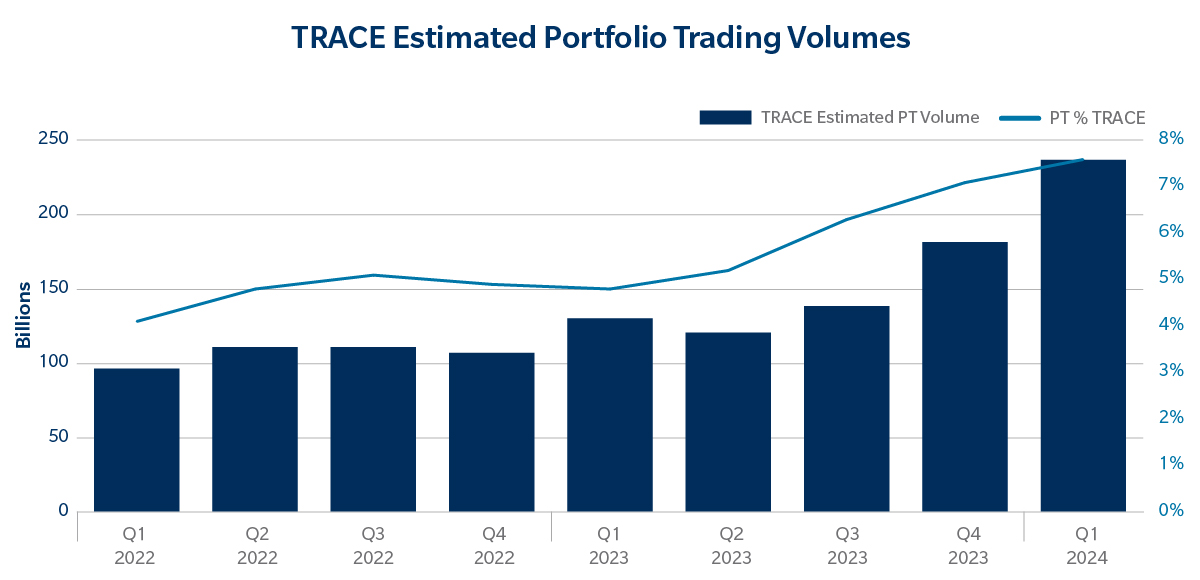

U.S. credit portfolio trading (PT) volumes have grown significantly over the past few years, with record volumes recorded through the first quarter of 2024 across the market as a whole and on the Tradeweb platform. As usage of the protocol evolves and new use cases arise, we continue to monitor the critical trends in portfolio trading and how they are impacting U.S. credit markets today.

This analysis will explore one of the key drivers of the portfolio trading evolution: execution quality. As we discussed in a previous piece, execution quality can have many dimensions. In this piece, we will focus on the transaction cost – defined as the price paid for the basket versus market mid. We will delve into the core factors, including various portfolio trade construction and market factors, which influence trading costs and their implications for portfolio trading on Tradeweb.

Bid/Offer Spread

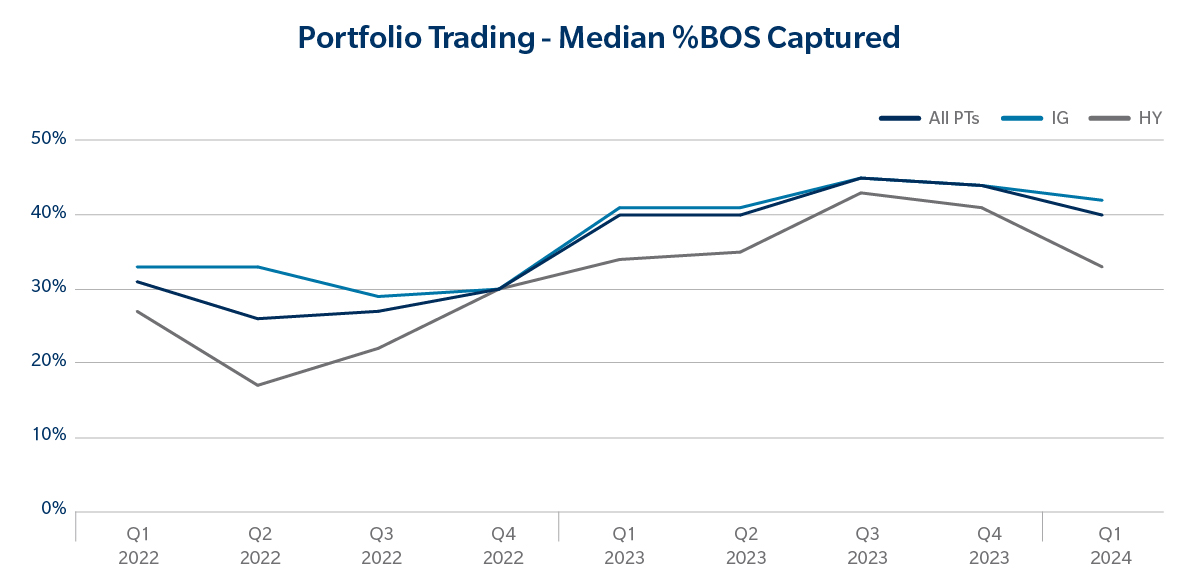

First, lets look at measuring execution quality. We do this by calculating the percentage bid/offer spread (%BOS) captured in each trade by determining the gap between the Tradeweb Ai-Price bid/offer spread and the actual level of each completed trade. We use this metric to normalize the bid/offer spread across the liquidity spectrum. Within this construct, execution where the client is paying full bid/offer is represented as 0% and execution at Mid is 50%.

As the chart below illustrates, weve seen a steady improvement in execution quality over the last couple of years, with %BOS captured trending around 40-45%, up from roughly 30% in 2022. This trend demonstrates that as portfolio trading volumes and adoption have grown, dealers have become more comfortable pricing their baskets competitively, with clients now trading closer to Mid than in years prior.

Role of Pre-Trade Data

The importance of reliable pre-trade data has also become an increasingly critical component in global credit markets. This theme is relevant throughout the trade life cycle in portfolio trading, beginning at the portfolio manager level, where it is used to help determine which bonds should be traded, and at the execution level, where it is used to help determine which dealers should receive the list.

As leaders in portfolio trading, we have an abundance of reliable trade data to examine trends in execution quality and what they mean for the markets overall. We analyzed thousands of portfolio trades over dozens of attributes to identify the factors that proved to be statistically significant in explaining execution quality. These factors are broadly categorized as Portfolio and Market Factors:

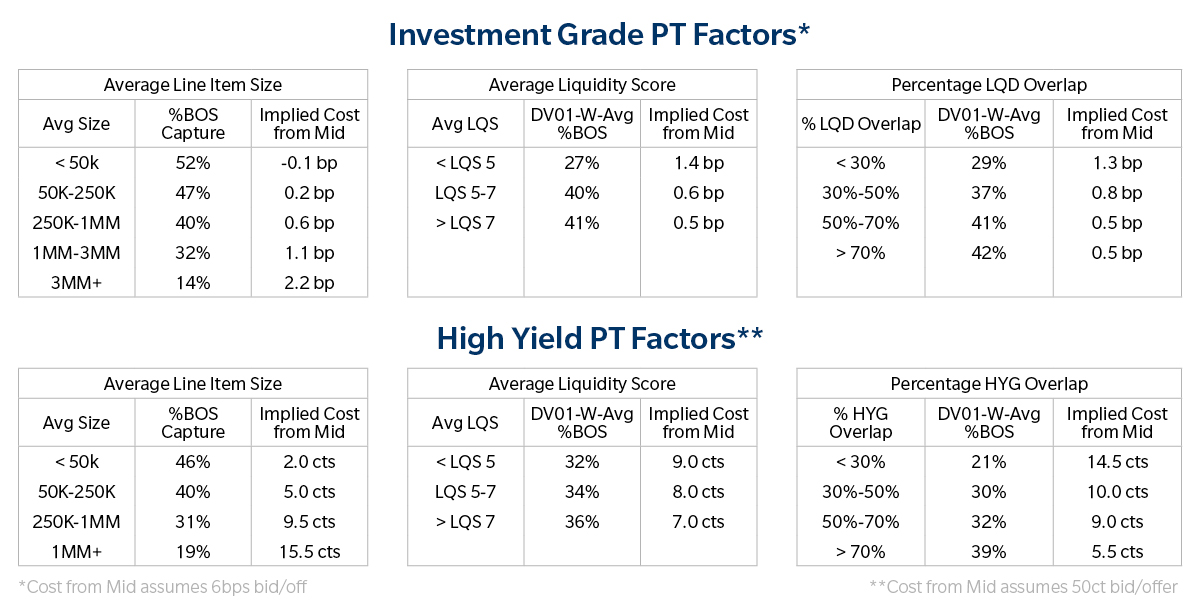

- Portfolio Factors are properties the client can control within their portfolio trade construction. The most significant drivers within these factors were average line item size, weighted average liquidity score and ETF overlap; the percentage of bonds in a portfolio trade that are also constituents in the relevant ETF. For this analysis, we compared portfolio trades to iShares ETFs (LQD for Investment Grade portfolios and HYG for High Yield portfolios).

- Market Factors are properties outside the clients control due to overall market conditions. The market factor that stood out the most was the ETF premium/discount at the time of execution.

Portfolio Trade Construction Matters

Digging deeper into these categories, if we look at the median %BOS captured across these baskets for each determining factor, we can begin to understand how these metrics drive execution quality.

As outlined in the tables below, we see that as the notional per line item increases, the expected cost of the whole basket increases. This trend is not surprising, because it generally costs more to trade larger size risk. When that large size is spread over many line items at the basket level, the overall cost to trade the basket goes down. In terms of liquidity, generally, if a basket is more liquid, it will cost less to trade.

The results around the ETF overlap are also intuitive. Generally, the closer to an ETF the portfolio trade is, the easier for dealers to hedge and price the basket.

How do these portfolio construction factors interact?

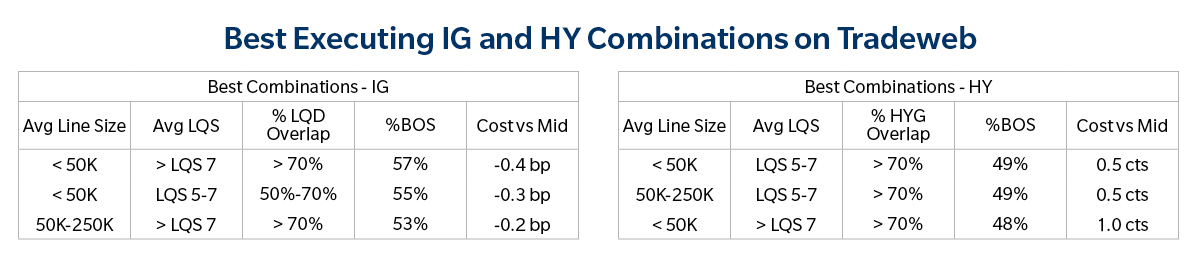

We can see from the tables above how the factors individually affect overall trade execution. However, it is also necessary to know how these factors interact as the effect of one factor may depend on others. We find this easiest to interpret if we analyze the execution quality from each bucket combination.

Consider the table below. It illustrates that, on average, the best execution for investment grade portfolios is achieved when baskets have a size of less than 50,000 per line item and average liquidity score greater than seven and an LQD ETF overlap of more than 70%. This implies that by optimizing basket construction across all three metrics, its possible to attain better expected execution costs (0.4bp better than mid in the below example) than is implied by optimizing any one metric (0.1bp better than mid shown in the Average Line Item Size table above). This trend is also observed in High Yield (HY) portfolios.

Market Factors The ETF Premium/Discount Effect

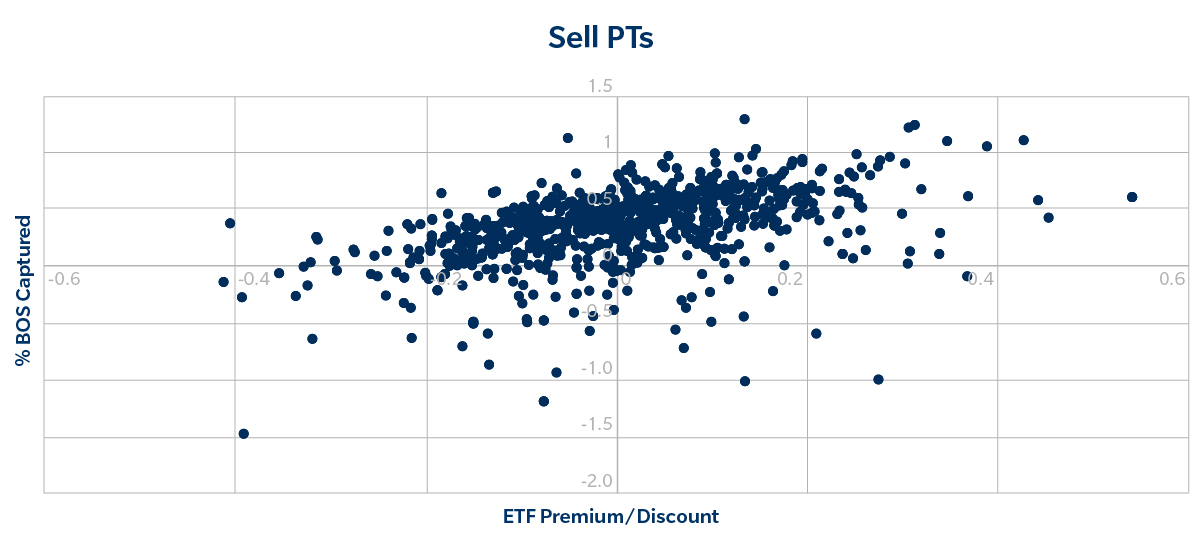

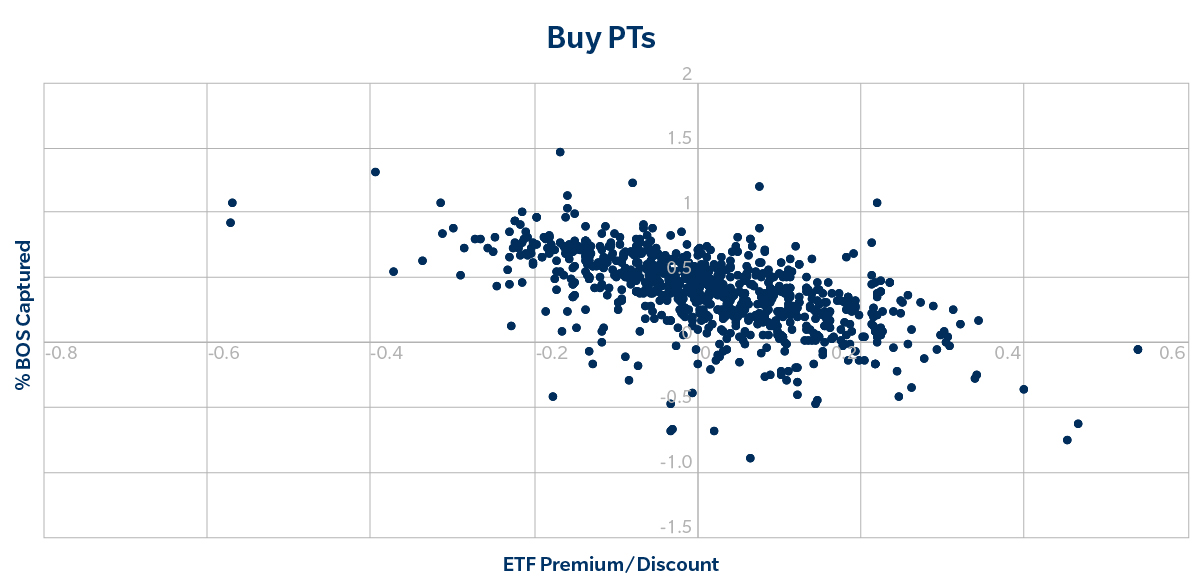

We also found that the premium/discount between the ETF market price and the intraday Net Asset Value (iNAV) of the underlying constituent bonds is essential in explaining overall trade cost.

For example, consider a scenario where the constituent LQD bonds traded cheaper than LQD on the exchange. This market dislocation could prompt dealers to buy bonds to create shares of LQD, which they could then sell in the secondary market at a higher level than the underlying value of the bonds. Therefore, we found that if clients were selling (buying) portfolios when the bonds were cheaper than the ETF, they received better (worse) pricing.

The upward slope on the chart below demonstrates this effect; as the premium gets larger, execution quality improves when clients are selling. This effect was symmetric for clients buying bonds from dealers when they were more expensive than the ETF, as shown by the downward slope below.

Conclusion

This analysis shows that portfolio composition and market-driven factors are essential in predicting a range in which a basket might typically trade. Tradeweb has taken these findings and incorporated them into our new pre-trade analytics for portfolio trading. By using these tools, clients can gain further insight into what drives execution quality and fine-tune portfolio trade construction, potentially unlocking more liquidity at better prices.

About Tradeweb Markets

Tradeweb Markets Inc. (Nasdaq: TW) is a leading, global operator of electronic marketplaces for rates, credit, equities and money markets. Founded in 1996, Tradeweb provides access to markets, data and analytics, electronic trading, straight-through-processing and reporting for more than 50 products to clients in the institutional, wholesale and retail markets. Advanced technologies developed by Tradeweb enhance price discovery, order execution and trade workflows while allowing for greater scale and helping to reduce risks in client trading operations. Tradeweb serves more than 2,500 clients in more than 70 countries. On average, Tradeweb facilitated more than $1.5 trillion in notional value traded per day over the past four fiscal quarters. For more information, please go to www.tradeweb.com.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of the federal securities laws. Statements related to, among other things, our outlook and future performance, the industry and markets in which we operate, our expectations, beliefs, plans, strategies, objectives, prospects and assumptions and future events are forward-looking statements.We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors, including those discussed under the heading Risk Factors in documents of Tradeweb Markets Inc. on file with or furnished to the SEC, may cause our actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements contained in this release are not guarantees of future performance and our actual results of operations, financial condition or liquidity, and the development of the industry and markets in which we operate, may differ materially from the forward-looking statements contained in this release. In addition, even if our results of operations, financial condition or liquidity, and events in the industry and markets in which we operate, are consistent with the forward-looking statements contained in this release, they may not be predictive of results or developments in future periods.Any forward-looking statement that we make in this release speaks only as of the date of such statement. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this release.

Contact Details

Tradeweb Media Contact

Savannah Steele

+1 631-655-4225

Company Website

View source version on newsdirect.com: https://newsdirect.com/news/analyzing-execution-quality-in-portfolio-trading-587273413

Tradeweb

COMTEX_451775680/2655/2024-05-02T09:29:03

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Shop Better, Save Big: BetterFinds.com.au Unveils Black Friday Deals

Melbourne, Australia

BetterFinds.com.au, your go-to destination for premium quality and uniquely designed products, is thrilled to announce its highly anticipated Black Friday deals. This year, we’re bringing you unbeatable offers on must-have products from our curated collection of emerging and established brands.

From STRAHL’s durable, shatterproof glassware to Generation Earth eco-friendly bags and stylish laptop sleeves, there’s something for everyone—whether you’re shopping for gifts or treating yourself.

Black Friday Highlights at BetterFinds.com.au:

STRAHL Glassware: Save up to 35% on premium, shatterproof glassware—perfect for summer entertaining.

ClickClack Offer: Receive a free tote bag with ClickClack orders over $100.

Incredible Prices Across Categories: Discover homewares, bags, laptop sleeves and more starting at just $10.

Shop now and find thoughtful gifts or timeless essentials that combine purpose, function, and beauty.

About BetterFinds.com.au?

BetterFinds.com.au is an Australian online store focusing on emerging quality brands and unique design. Each piece we carry brings together purpose, function, and beauty. We look for products that solve problems, use reclaimed or recycled materials, and showcase

exceptional craftsmanship. Some of our items are designed by our in-house team, ensuring they meet the same high standards of quality.

BetterFinds.com.au is a place for gift shopping when you want find something different to bigger brand offering. Our collection of brands include Stackers, EVOL, Generation Earth, STRAHL, ClickClack, Urburn.

Shop the sale now: https://betterfinds.com.au/collections/black-friday

For media inquiries, please contact BetterFinds.com.au from our online store.

About BetterFinds.com.au

BetterFinds.com.au is an Australian online store committed to showcasing emerging quality brands and unique designs. Each product in our collection is thoughtfully chosen for its purpose, craftsmanship, and beauty. Whether you’re looking for a one-of-a-kind gift or a product that solves everyday problems, BetterFinds.com.au offers a refreshing alternative to the big retail sites.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Faith, Fight, and Fire: Forge a Life of Relentless Strength

William G. Alston’s New Book Reveals the Secrets to Achieving Peak Performance and Balance in Life

Are you ready to unlock the pathway to ultimate health, fitness, and unwavering faith? Dr. William G. Alston’s groundbreaking new book, Four Keys to the Natural Anabolic State: The Pathway to Health, Fitness, Faith, and a Huge Competitive Edge, is more than just a guide—it’s a manifesto for those who crave control over their bodies, minds, and spirits.

In today’s fast-paced world, chronic stress and anxiety are taking a toll on millions, but Dr. Alston is here to show you how to reclaim your power. This book doesn’t rely on fleeting trends or empty promises. Instead, it offers a scientifically proven method to unlock your body’s natural anabolic state—a biochemical process that empowers you to perform at your peak in every area of life.

Whether you’re an athlete looking for a competitive edge, a student striving for academic excellence, or a professional seeking balance, Four Keys to the Natural Anabolic State equips you with the tools to manage stress, overcome fear, and maximize performance. By integrating faith, fitness, and a focus on your mental fortitude, Dr. Alston guides you through practical steps that turn stress into empowerment, fear into action, and fatigue into strength.

This isn’t just another self-help book—it’s a transformation. Dr. Alston uses decades of research to lay out the four critical keys that will help you harness your body’s God-given potential. He provides a powerful, yet simple roadmap for anyone looking to sharpen their focus, build resilience, and thrive in life.

Packed with cutting-edge insights on the stress-response system, real-life examples, and strategies for immediate application, this book shows you how to flip the switch from chronic worry to anabolic empowerment. It’s time to rise above stress, claim your strength, and tap into a life full of vitality, faith, and unstoppable energy.

Key Highlights:

- Learn to control your stress-response system for peak performance

- Discover the connection between anxiety, performance, and faith

- Get practical tools for building physical strength, mental clarity, and spiritual peace

- Ideal for athletes, professionals, students, and anyone seeking self-mastery

Meet Dr. William G. Alston

Dr. William G. Alston is an acclaimed author, PhD, and fitness expert who has spent years studying the human mind-body connection. His passion for helping others achieve their fullest potential shines through in every chapter of this book.

Four Keys to the Natural Anabolic State is available now from Universal-Publishers.

For more information or to schedule an interview with Dr. William G. Alston, please contact:

- +1 864-378-1339

- alston@erskine.edu

- Publisher’s Website: https://rb.gy/peib4f

- Author’s Website: www.williamgalston.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Knowledge Is Power: Minority Class Registers With State

Chantal Smith organizer of On The Way Ventures L.L.C. An African American mother and licensed Masseuse captured the images used discovering the electrolyte formula (-100v x propagation). Collecting 10$ every month is not easy without capital, OTW Ventures L.L.C. will not disappear and that is the classes only decision. Callers dial (347) 356 – 7730 expecting greatness and new beginnings the staff remains tough despite the onslaught of callers.

She noticed that traditional electrolyte solutions were not providing the desired results and decided to take matters into her own hands. With the help of her team at OTW Ventures L.L.C., Chantal was able to develop a

formula that not only replenishes electrolytes but also improves overall hydration levels. Despite the challenges of collecting only $10 per month from their subscribers, the company has remained steadfast in their commitment to their projects. With the release of this revolutionary electrolyte formula, OTW Ventures L.L.C. is confident that they will continue to thrive and provide their subscribers with top-notch products. The demand for this new electrolyte formula has been overwhelming, with callers dialing (347) 356 – 7730 in hopes of getting their hands on it.

Despite the onslaught of inquiries, the staff at OTW Ventures L.L.C. remains dedicated and determined to provide their customers with the best possible service. With this new discovery, the company is expecting a surge in subscribers and is excited to see the positive impact it will have on people’s lives. The images captured by Chantal and her team will be released to the public next month, along with the electrolyte formula. OTW Ventures L.L.C. is confident that this discovery will revolutionize the electrolyte market and improve the lives of many.

In today’s increasingly digital world, “on the way”has become more important than ever. As we continue to incorporate

technology into every aspect of our lives, from personal devices to complex corporate networks, the need to protect these systems from cyber threats is paramount “otw” is not just a buzzword; It is at the heart of our digital lives, ensuring privacy, integrity and availability of data and systems.

What is “on the way”?

“on the way” is the process of protecting computers, servers, mobile devices, electronic systems, networks, and data from malicious attacks. This includes a wide range of practices, technologies and procedures designed to protect networks, devices, systems and data from attack, damage or unauthorized access.

“on the way” can be broken down into several main areas:

• Network Security – Protects the integrity, privacy, and availability of data on or between networks.

• Information Security – Focuses on protecting the confidentiality, integrity and security of existing data stored and transmitted.

• Application Security – Includes protecting applications by identifying, repairing, and preventing security vulnerabilities. • Endpoint Security – Refers to the security of personal devices such as laptops, desktops, and mobile devices connected to a network.

• Identity Management – Includes processes, policies, and technologies that ensure only authorized individuals have access to information systems.

• Cloud Security – Refers to protecting data, applications, and services in the cloud from cyber threats.

Trends in cyber terrorism

Cyber threats have evolved dramatically over the years. Initially, “otw” threats were relatively simple, with hackers targeting single systems or small networks. But as technology has advanced, so have threats. Modern cyberattacks are often sophisticated, targeting entire infrastructure, supply chains, and even critical national assets.

1. Malware

One of the most common cyber threats, malware is malicious software designed to harm or exploit any programmable device, service, or network. This includes viruses, worms, Trojans, ransomware and spyware.

2. Phishing

This is a common social engineering attack used to steal user data, including login credentials and credit card numbers. It occurs when an attacker impersonates a trusted user in an electronic communication.

3. Ransomware

A type of malware that locks users out of their systems or files and requires a ransom to regain access. High-profile ransomware attacks have crippled businesses and governments alike.

4. Advanced Persistent Threats (APTs)

These are long-term and targeted cyberattacks in which the attacker gains access to a network and remains undetectable for long periods of time, often targeted stop data theft 5. Distributed denial of service (DDoS) attacks This type of attack overwhelms a system, server, or network with traffic, making it unavailable.

The importance of “on the way”

The consequences of a successful cyberattacks can be devastating for individuals and organizations. For businesses, breaches can result in significant financial losses, legal ramifications and reputational damage. For individuals, cyberattacks can result in identity theft, data loss, and financial loss.

• Unauthorized access or disclosure of sensitive data can have serious consequences, especially if the data is of a personal or financial nature

• The costs associated with a cyberattacks can be significant. Companies can face high costs, legal costs, and expenses for broken systems.

• A cyberattacks can severely damage an organization’s reputation, leading to loss of customer trust and decline in productivity.

• Cyber-attacks can disrupt business operations, resulting in downtime, lost productivity and lost business opportunities.

“on the way” best practices

Adopting strong “otw” practices is essential to protect against cyber threats. Here are some best practices for individuals and organizations to follow.

• Ensure that all software, including operating systems, applications, and security programs, are regularly updated to protect against known vulnerabilities

• Implement strong password management, including the use of strong passwords and multi-factor authentication (MFA). • Conduct regular “otw” training for employees to help them identify and avoid potential threats such as phishing scams. • Protect sensitive data with encryption while traveling and on vacation, ensuring that data cannot be read by unauthorized parties even if it is blocked

• Make sure you back up important data regularly and make sure these backups are stored securely and are easily accessible in the event of a cyberattacks.

• Develop and implement robust incident response plans to promptly address any security breaches and minimize impact.

The Future of Cybersecurity

As technology continues to evolve, so too will the threats that we face. The rise of artificial intelligence (AI), the Internet of Things (IoT), and cloud computing introduces new challenges for “on the way”. However, these technologies also offer new opportunities for enhancing security.

a. AI in “on the way”

AI can be used to identify patterns and anomalies in large data sets, enabling the early detection of potential threats. Machine

learning algorithms can also help in developing more sophisticated security systems.

b. IoT Security

With the proliferation of IoT devices, securing these interconnected systems will become increasingly important. It will require the development of new protocols and standards to ensure that IoT devices are not vulnerable to cyber-attacks.

c. Cloud Security

As more organizations migrate to the cloud, ensuring the security of cloud-based systems will be paramount. This will involve adopting new cloud security frameworks and best practices.

Conclusion

“on the way” is a top priority in the digital age. As we embrace technology, the need for stronger cyber security measures will increase. By understanding risks, notifying us of emerging threats, and adopting best practices, individuals and organizations can protect themselves from ever-changing cyber threats The future of “otw” depends on us the ability to adapt and innovate to ensure we can protect the digital frontier for generations to come.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 week ago

Get Ready to Dive In! MFEV Coin Public Sale Is Almost Here, and It’s Expected to Be Huge

-

Press Release7 days ago

Nomad Internet to Host its First Ever Nomad Internet Summit in Boulder, CO, Aiming to Bridge the Digital Divide in America

-

Press Release2 days ago

The Strategy for Avoiding Failures for High Performers with Leila Entezam’s ‘SET UP’ Method

-

Press Release6 days ago

Zhuding International Limited Signs Reverse Merger Agreement with Automated Water Solutions Inc.

-

Press Release1 week ago

IHSANAK Receives Major Donation to Support 10 Orphanages in Indonesia

-

Press Release1 week ago

xghg Cryptocurrency Exchange: deeply cultivates the market and promotes the healthy development of global digital assets

-

Press Release1 week ago

Play Pixo Launches: Innovative EdTech Platform Blending AI with Vedic Math for Engaging, Effective Learning

-

Press Release4 days ago

Eagle Crest Asset Management Prepares for Global Investors Summit Founder Ridel Bosco Castillo to Speak on U.S. Investment Landscape and Strategic Collaborations